- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Could Cleveland-Cliffs' (CLF) Supply Deal Reveal a Strategic Shift in Steel Industry Positioning?

Reviewed by Sasha Jovanovic

- Earlier this week, Cleveland-Cliffs announced a three-year extension with SunCoke Energy to supply 500,000 tons of metallurgical coke annually, while also appointing Edilson Camara to its Board of Directors for his global industrial strategy experience.

- This agreement ensures consistent raw material supply and signals a focus on operational continuity and strengthened leadership amid evolving market conditions.

- Next, we’ll examine how the recent supply agreement extension could influence Cleveland-Cliffs’ investment narrative and outlook for the steel industry.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Cleveland-Cliffs Investment Narrative Recap

To invest in Cleveland-Cliffs, one needs confidence in strong domestic steel demand and the firm’s ability to manage raw material supply and cost controls. While the new SunCoke Energy agreement supports operational continuity, this alone is unlikely to alter the most important near-term catalyst: continued enforcement of U.S. steel tariffs. The biggest risk remains potential regulatory shifts or easing of these tariffs, which could impact Cliffs’ revenue and pricing power; this risk is not affected by the latest supply deal.

Among recent announcements, the completed follow-on equity offering of nearly US$952 million stands out. This move provides Cleveland-Cliffs with additional flexibility to manage debt and liquidity, which ties directly to the company’s biggest risk, elevated leverage and the need for effective balance sheet management as market conditions fluctuate.

By contrast, investors should be aware of the ongoing uncertainties surrounding Section 232 steel tariffs and what any changes might mean for...

Read the full narrative on Cleveland-Cliffs (it's free!)

Cleveland-Cliffs' outlook anticipates $22.5 billion in revenue and $590 million in earnings by 2028. This projection relies on a 6.8% annual revenue growth rate and a $2.29 billion increase in earnings from the current level of -$1.7 billion.

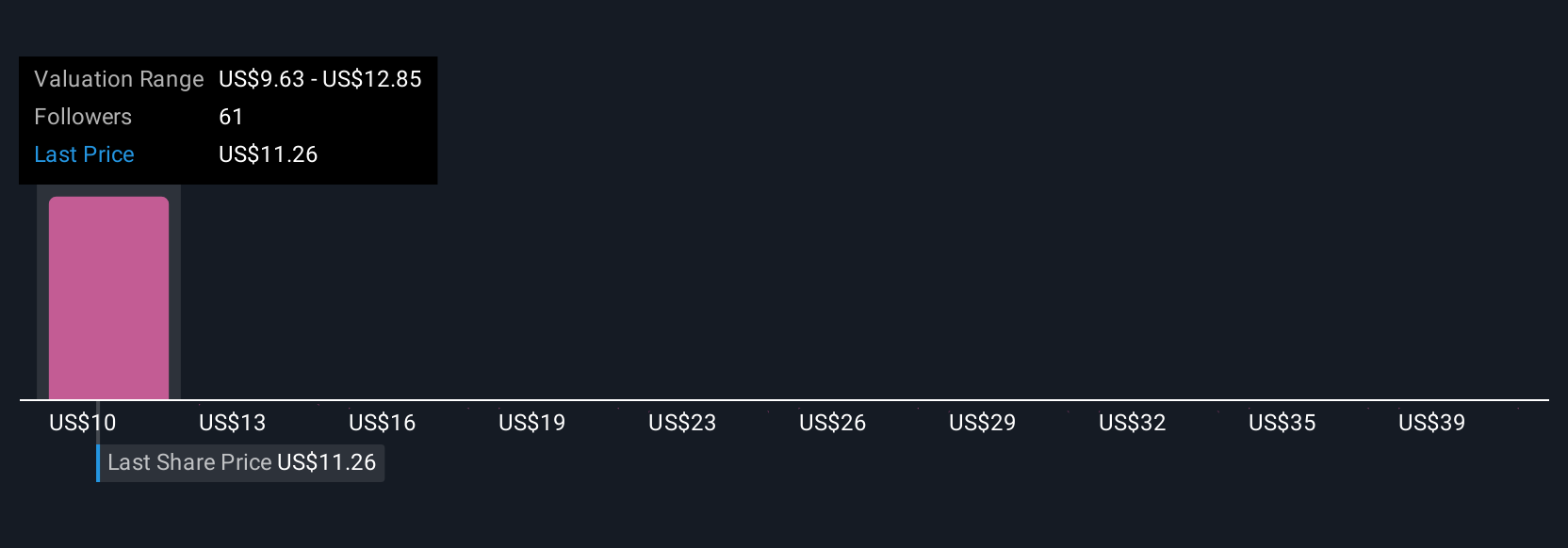

Uncover how Cleveland-Cliffs' forecasts yield a $12.58 fair value, in line with its current price.

Exploring Other Perspectives

Seven Simply Wall St Community members provide fair value estimates for Cleveland-Cliffs, ranging from US$7.79 to US$56.79. Differences in opinion highlight how ongoing U.S. steel tariff enforcement continues to play a key role in shaping expectations for the stock’s future performance.

Explore 7 other fair value estimates on Cleveland-Cliffs - why the stock might be worth over 4x more than the current price!

Build Your Own Cleveland-Cliffs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cleveland-Cliffs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cleveland-Cliffs' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.