- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (NYSE:CLF) Unveils $150 Million Stainless Steel Expansion In Ohio

Reviewed by Simply Wall St

Cleveland-Cliffs (NYSE:CLF) has recently inaugurated a new Vertical Stainless Bright Anneal Line at their Coshocton Works facility, marking a $150 million investment aimed at enhancing their premium stainless steel production. This recent expansion may have added weight to the stock's 5% advance over the past month amid an overall flat market trend. While broader markets dealt with geopolitical tensions and fluctuating oil prices, Cleveland-Cliffs' move aligns with their strategic growth in the automotive and appliance sectors, possibly providing resilience against other market pressures. This development highlights the company's commitment to innovation and sustainability.

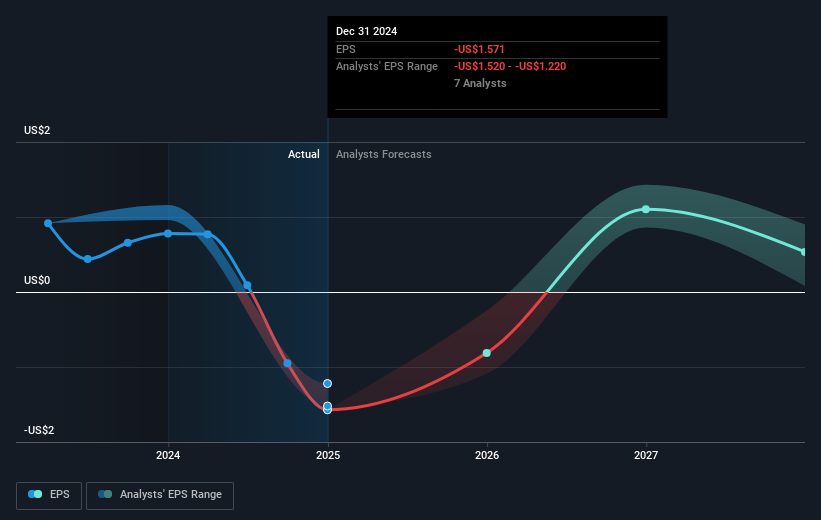

Cleveland-Cliffs' recent investment in its Coshocton Works facility could provide significant support to its efforts in enhancing production efficiency for premium stainless steel. This $150 million expansion aligns with projections of increased demand in the automotive and appliance sectors. By investing in state-of-the-art facilities, the company may not only bolster its revenue streams but also potentially improve earnings forecasts amid a fluctuating market, although these benefits would unfold longer term. Analyst projections suggest that despite current losses, the company could gain momentum if demand in key sectors revives as expected.

Over a longer-term horizon, Cleveland-Cliffs has seen a total shareholder return, including dividends, of 38.56% over the past five years. This return offers some context to the company's recent performance amidst more immediate market challenges. Nonetheless, over the past year, the company's shares have underperformed both the US Metals and Mining industry and the broader US market, which saw returns of 8.2% and 10.4%, respectively.

Share price movements, positioned against a consensus price target of US$10.91, reflect a potential undervaluation given its current trading at US$8.61. The stock is trading at a 21.1% discount to this target, indicating room for growth potential if the company successfully capitalizes on its strategic opportunities and overcomes current risks. However, given the expected annual share growth and other factors, investors should conduct their due diligence before aligning with this valuation outlook.

Dive into the specifics of Cleveland-Cliffs here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives