- United States

- /

- Metals and Mining

- /

- NYSE:CLF

Cleveland-Cliffs (CLF) Reports US$483 Million Loss in Quarterly Earnings

Reviewed by Simply Wall St

Cleveland-Cliffs (CLF) recently announced second quarter earnings on July 21, 2025, reporting a sales decline to USD 4,934 million and a net loss of USD 483 million. Despite these financial setbacks, the stock saw an impressive 53% price increase over the past month. This rise in stock price comes amidst a period where the S&P 500 and Nasdaq rose to record highs and subsequently pulled back slightly due to mixed corporate earnings. The company's removal from various Russell indices and recent market trends may have counteracted these broader moves, adding complexity to the stock's price behavior.

The recent 53% increase in Cleveland-Cliffs' stock price, despite second quarter earnings showing a sales decline to US$4.93 billion and a net loss of US$483 million, introduces complexities regarding the company's projected competitive advantages from tariffs and the Stelco acquisition. Over the past five years, the total shareholder return was 80.98%, reflecting the broader strategic progress across that period. However, recent underperformance relative to the US market and the Metals and Mining industry, which posted respective 13.7% and 12.8% returns over the past year, highlights potential ongoing challenges.

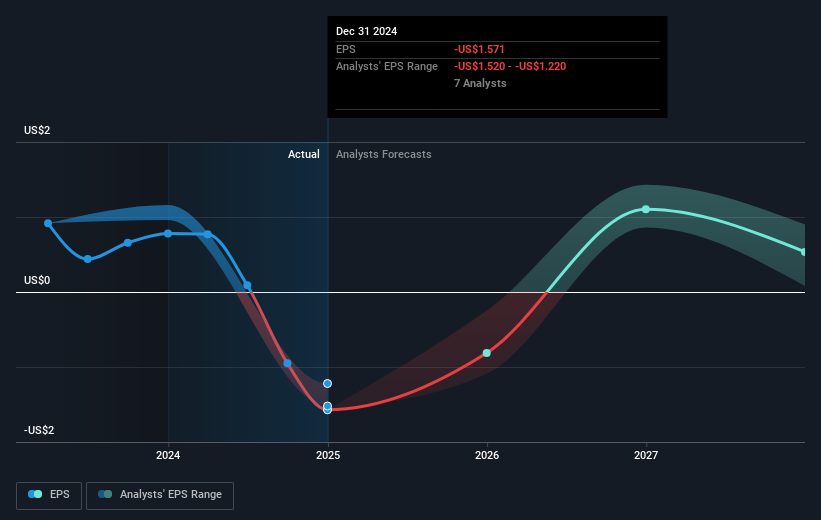

The stock's recent surge may influence analysts' revenue and earnings forecasts, as the market may be pricing in anticipated benefits from tariffs and operational improvements. Nonetheless, the 6.5% forecasted annual revenue growth is slower than the anticipated 9% growth of the broader US market. Analysts' consensus price target of US$10.91 indicates relatively stable market expectations, yet the current share price of US$10.66 suggests a minimal discount, indicating limited upside potential based on existing forecasts.

Jump into the full analysis health report here for a deeper understanding of Cleveland-Cliffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLF

Cleveland-Cliffs

Operates as a flat-rolled steel producer in the United States, Canada, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives