The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that CF Industries Holdings, Inc. (NYSE:CF) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for CF Industries Holdings

How Much Debt Does CF Industries Holdings Carry?

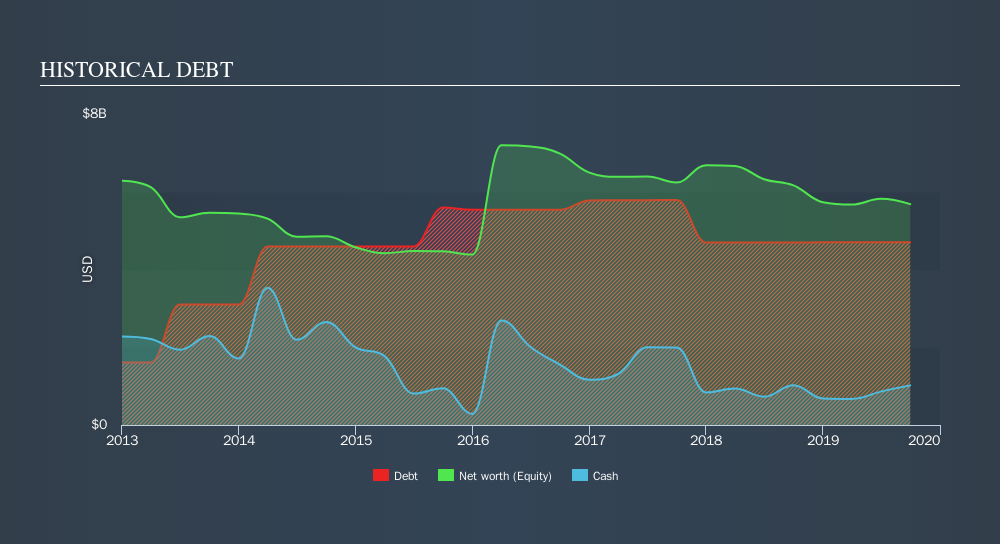

As you can see below, CF Industries Holdings had US$4.70b of debt, at September 2019, which is about the same the year before. You can click the chart for greater detail. However, because it has a cash reserve of US$1.02b, its net debt is less, at about US$3.68b.

How Strong Is CF Industries Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that CF Industries Holdings had liabilities of US$1.25b due within 12 months and liabilities of US$5.98b due beyond that. Offsetting these obligations, it had cash of US$1.02b as well as receivables valued at US$311.0m due within 12 months. So it has liabilities totalling US$5.89b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of US$9.81b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

CF Industries Holdings has net debt worth 2.0 times EBITDA, which isn't too much, but its interest cover looks a bit on the low side, with EBIT at only 4.2 times the interest expense. While these numbers do not alarm us, it's worth noting that the cost of the company's debt is having a real impact. Importantly, CF Industries Holdings grew its EBIT by 53% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine CF Industries Holdings's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, CF Industries Holdings actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

The good news is that CF Industries Holdings's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But, on a more sombre note, we are a little concerned by its level of total liabilities. All these things considered, it appears that CF Industries Holdings can comfortably handle its current debt levels. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. Of course, we wouldn't say no to the extra confidence that we'd gain if we knew that CF Industries Holdings insiders have been buying shares: if you're on the same wavelength, you can find out if insiders are buying by clicking this link.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:CF

CF Industries Holdings

Engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives