- United States

- /

- Chemicals

- /

- NYSE:CF

CF Industries (CF) Valuation Check After Q3 2025 Beat and Ongoing Nitrogen and Carbon Policy Uncertainty

Reviewed by Simply Wall St

CF Industries Holdings (CF) just delivered Q3 2025 earnings and revenue ahead of expectations, but the stock reaction has been muted as investors weigh supply demand risks, gas costs, and EU carbon policy uncertainty.

See our latest analysis for CF Industries Holdings.

Despite the post earnings dip, with a 30 day share price return of minus 3.63 percent and a 90 day share price return of minus 8.11 percent, CF still boasts a 5 year total shareholder return of 136.87 percent. This suggests that long term momentum has been strong even as near term sentiment cools around CEO transition, decarbonisation spending, and nitrogen market uncertainty.

If CF’s recent wobble has you rethinking cyclical names, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

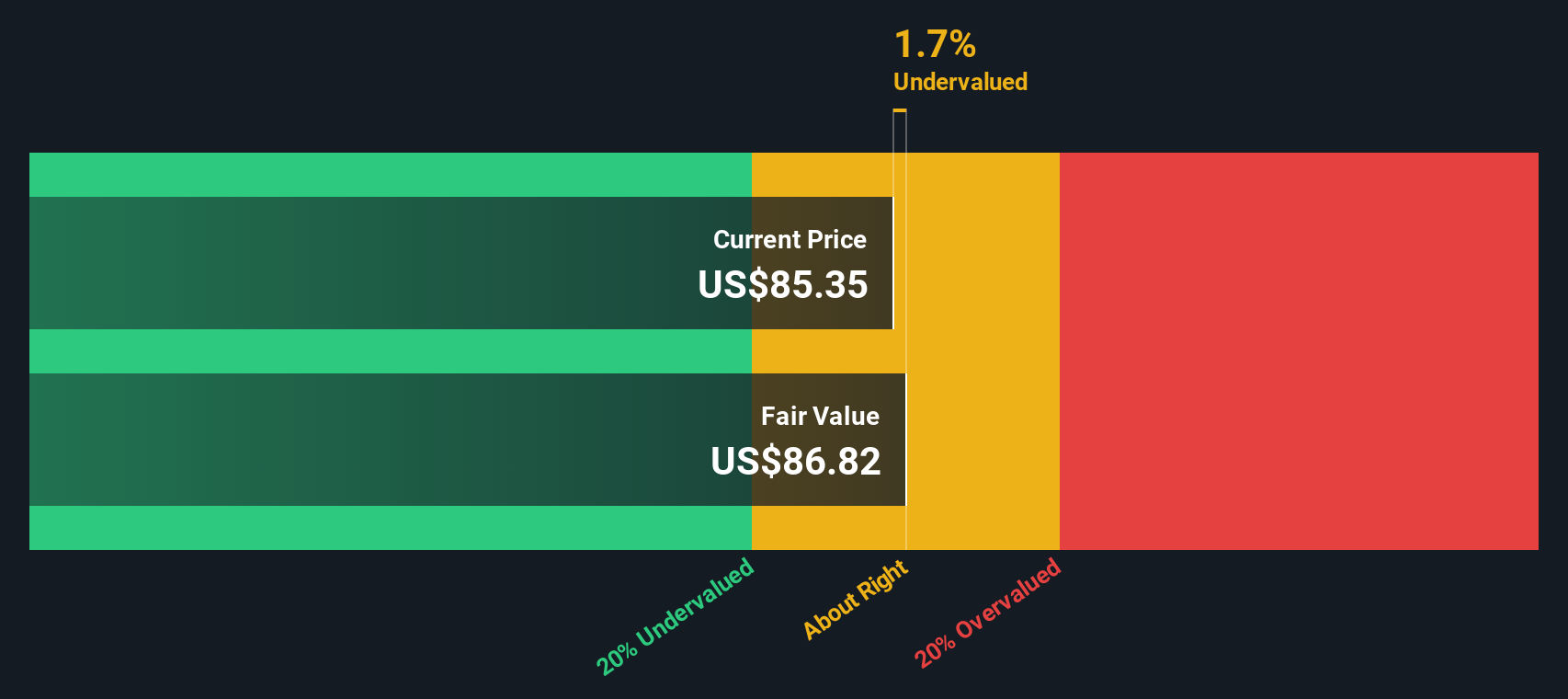

With earnings still beating forecasts and the share price lagging both peers and analyst targets, the key debate now is simple: is CF quietly undervalued or is the market already pricing in every ounce of future growth?

Most Popular Narrative: 15.2% Undervalued

With CF Industries Holdings last closing at $78.19 against a narrative fair value near $92, the story leans toward a meaningful valuation gap built on specific long range assumptions.

While carbon capture and blue/green ammonia projects are expected to deliver incremental EBITDA from tax credits and product premiums, heavy reliance on government incentives and early-stage clean ammonia markets introduces long-term regulatory and adoption risks, threatening the stability of projected future cash flows and margins.

Curious how flat revenues, thinner margins, and shrinking share count can still justify a richer earnings multiple than today? See which precise profit path underpins that fair value.

Result: Fair Value of $92.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if nitrogen markets soften faster than expected or if clean ammonia incentives fade, undermining margins and long term growth.

Find out about the key risks to this CF Industries Holdings narrative.

Another View: DCF Flags Mild Overvaluation

While the narrative model sees CF about 15 percent undervalued, our DCF model points the other way, with a fair value near $70.55 versus the current $78.19 share price. If cash flows are the anchor, today’s price could already be leaning a little ahead of itself.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CF Industries Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CF Industries Holdings Narrative

If the above perspectives do not fully align with your own view and you prefer hands on analysis, you can build a complete narrative in under three minutes: Do it your way.

A great starting point for your CF Industries Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

CF might be on your radar, but the market will not wait. Lock in your edge now by scanning fresh opportunities tailored to your strategy.

- Capture early-stage potential in markets others overlook by targeting these 3629 penny stocks with strong financials that already show strong balance sheets and resilient fundamentals.

- Ride the structural shift toward automation and smarter software by focusing on these 24 AI penny stocks poised to benefit from real world AI adoption.

- Explore potential value by zeroing in on these 918 undervalued stocks based on cash flows where current prices appear misaligned with long term cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CF

CF Industries Holdings

Engages in the manufacture and sale of hydrogen and nitrogen products for energy, fertilizer, emissions abatement, and other industrial activities in North America, Europe, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion