- United States

- /

- Chemicals

- /

- NYSE:CE

Will Celanese’s (CE) Digital Push Reinforce Its Edge in Specialty Materials Innovation?

Reviewed by Sasha Jovanovic

- Celanese Corporation recently showcased a lineup of new digital solutions and sustainable advanced materials at the K Show in Dusseldorf, unveiling the enhanced Chemille® Digital Assistant and expanded services for sectors including automotive, electronics, and consumer products.

- This emphasis on customer-centric digital platforms and eco-friendly product offerings underlines Celanese's ongoing pivot toward innovation and sustainability across its global portfolio.

- We'll examine how the launch of AI-powered Chemille® Digital Assistant could influence Celanese's long-term outlook in the specialty materials sector.

We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Celanese Investment Narrative Recap

To be a shareholder in Celanese today means believing in the company’s ability to drive earnings improvement via innovation, cost discipline, and recovery in specialty materials demand, especially as industry pressures weigh on both volumes and margins. The latest product and digital solution launches showcase a commitment to long-term growth rather than immediate relief for persistent overcapacity and weak demand, these remain the most important near-term challenges, while operational execution is the central catalyst to watch.

The recent unveiling of the Chemille® Digital Assistant, an AI-powered material selection tool, is particularly relevant amid ongoing cost optimization efforts. By accelerating customer decision-making and potentially lowering development costs, this platform adds a differentiated service that could support recovery as end markets stabilize and enhance Celanese's positioning against core risks tied to weak demand and margin pressure.

However, in contrast to innovation headlines, investors should be aware of lingering margin risks due to prolonged overcapacity and input cost volatility in critical markets like China…

Read the full narrative on Celanese (it's free!)

Celanese's outlook forecasts $10.2 billion in revenue and $799.9 million in earnings by 2028. This reflects a 1.0% annual revenue decline and a $2.4 billion earnings improvement from the current loss of $-1.6 billion.

Uncover how Celanese's forecasts yield a $54.69 fair value, a 37% upside to its current price.

Exploring Other Perspectives

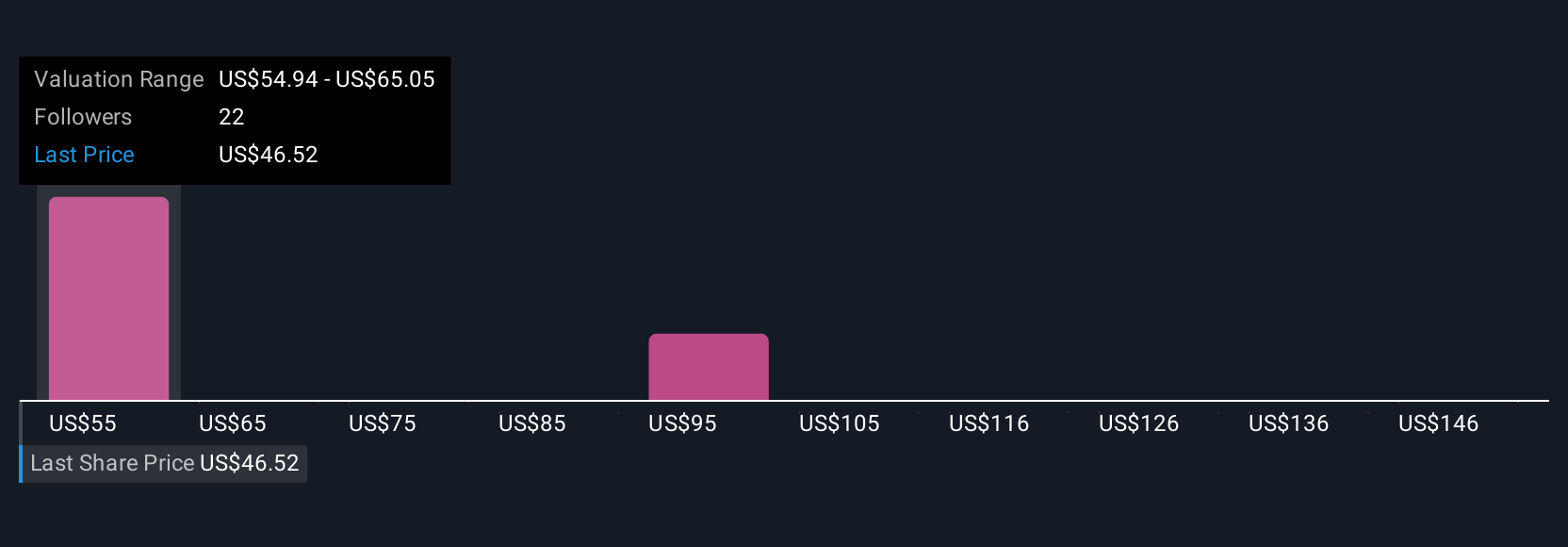

Eight members of the Simply Wall St Community see Celanese’s fair value spanning from US$50 to over US$107. With opinions this broad, keep in mind that ongoing margin compression and unpredictable revenues remain central risks for anyone analyzing where the stock goes next.

Explore 8 other fair value estimates on Celanese - why the stock might be worth just $50.00!

Build Your Own Celanese Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Celanese research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Celanese research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Celanese's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CE

Celanese

A chemical and specialty materials company, manufactures and sells engineered polymers worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives