- United States

- /

- Metals and Mining

- /

- NYSE:CDE

Coeur Mining (CDE) Is Down 14.8% After Gold and Silver Price Drop Ahead of Q3 Earnings – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Coeur Mining, Inc. experienced a steep share price drop after gold and silver prices fell sharply, reflecting a broad downturn in precious metals markets earlier this week.

- The company's upcoming third quarter earnings release on October 29 has drawn heightened attention amid market volatility and questions about the impact of these commodity price swings.

- We’ll assess how the recent fall in metal prices could influence expectations for Coeur Mining’s pending financial results and strategic outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Coeur Mining Investment Narrative Recap

To be a Coeur Mining shareholder, you need to believe in the long-term value of gold and silver and the company's ability to maintain operational efficiency, despite commodity volatility. While the recent sharp sell-off in precious metals has cast a shadow on sentiment and become the most important short-term risk, the upcoming third quarter earnings on October 29 remain the near-term catalyst. Unless metals prices continue to weaken, this event will likely determine the next direction for the stock.

Of particular relevance, Coeur Mining completed a US$2 million tranche of share buybacks in August as part of a broader US$75 million program. This move followed positive Q2 earnings momentum and underscores management’s confidence, though it also means there will be questions heading into earnings about capital priorities and preserving flexibility as metals prices fluctuate.

By contrast, keep in mind that prolonged commodity price drops could significantly impact the company’s ability to meet production guidance and cash flow targets...

Read the full narrative on Coeur Mining (it's free!)

Coeur Mining's outlook points to $2.1 billion in revenue and $676.1 million in earnings by 2028. Achieving these targets relies on an annual revenue growth rate of 12.8% and an increase in earnings of $485.4 million from the current $190.7 million.

Uncover how Coeur Mining's forecasts yield a $20.08 fair value, a 6% upside to its current price.

Exploring Other Perspectives

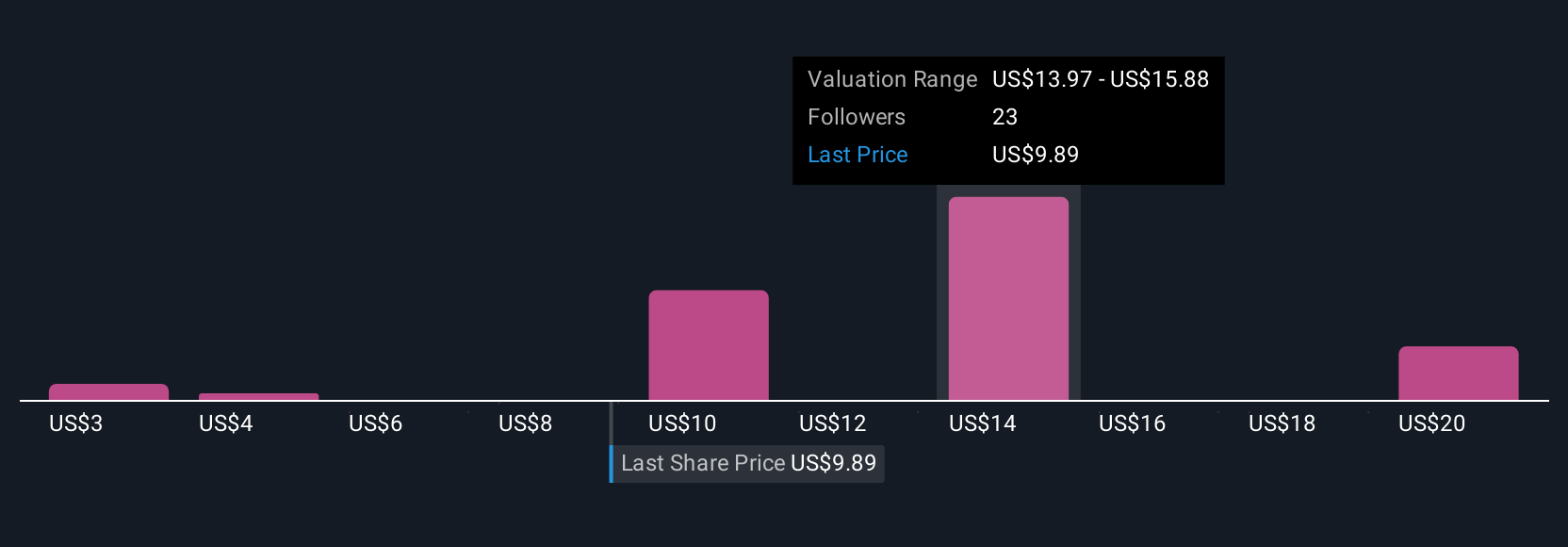

Simply Wall St Community members’ fair value estimates for Coeur Mining range from US$2.52 to US$21.60, based on 9 different analyses. With such a spread and given how closely results track gold and silver prices, it’s clear your outlook on commodity cycles is likely to strongly shape your own expectations.

Explore 9 other fair value estimates on Coeur Mining - why the stock might be worth as much as 14% more than the current price!

Build Your Own Coeur Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coeur Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coeur Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coeur Mining's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDE

Coeur Mining

Operates as a gold and silver producer in the United States, Canada, and Mexico.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives