- United States

- /

- Metals and Mining

- /

- NYSE:CDE

Assessing Coeur Mining’s Valuation After Its 2024 Rally and Operational Progress

Reviewed by Simply Wall St

Coeur Mining (CDE) has quietly turned into one of this year’s more interesting precious metals trades, with the stock up sharply year to date as investors reconsider its leverage to gold and silver prices.

See our latest analysis for Coeur Mining.

That surge has been backed by improving sentiment toward precious metals and Coeur’s own operational progress, and with the share price now at $16.89 after a 172.42% year to date share price return and a 392.42% three year total shareholder return, momentum still looks more like a powerful rerating than a fleeting spike.

If this kind of turnaround story has your attention, it might be worth seeing what else is setting up for strong reratings via fast growing stocks with high insider ownership.

Yet with Coeur still trading at a notable discount to analyst targets and some estimates of intrinsic value, the key question now is whether this rally leaves meaningful upside on the table or already factors in the next leg of growth.

Most Popular Narrative Narrative: 19% Undervalued

With the most followed narrative setting fair value above Coeur Mining's last close, the valuation hinges on ambitious growth and profitability assumptions.

The successful ramp up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production, positioning Coeur for robust revenue and earnings growth in the near to medium term.

Strengthened operational efficiencies reflected in declining cost applicable to sales per ounce and process improvements at key mines are improving operating leverage and could further support margin expansion and cash generation.

Curious how faster revenue growth, surging earnings power and thicker margins all combine into that higher fair value estimate plus still moderate future multiple? The full narrative unpacks the exact growth runway, profitability shift and valuation reset that underpin this upside case, and shows how those projections could reshape Coeur's earnings profile if they play out.

Result: Fair Value of $20.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case depends on continued exploration success and timely permitting, with setbacks or delays likely to quickly pressure both earnings and valuation assumptions.

Find out about the key risks to this Coeur Mining narrative.

Another Take on Valuation

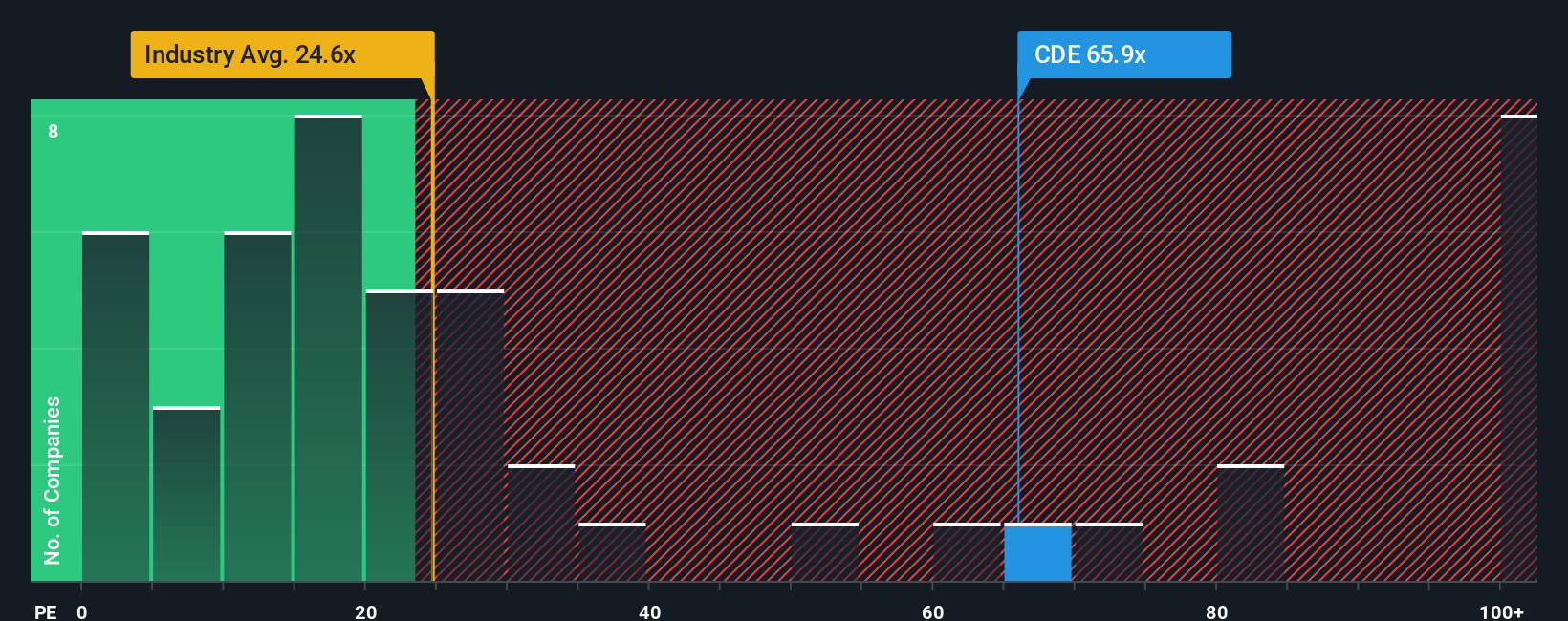

On earnings based metrics, Coeur looks far less forgiving. Its P E ratio of 26.5 times sits above both peers at 23.3 times and a fair ratio of 25.8 times, suggesting the market already bakes in a lot of good news and leaves less room for execution slips.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Coeur Mining Narrative

If you see things differently or simply prefer to dig into the numbers yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your Coeur Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, consider scanning hand picked opportunities across sectors with our powerful screener tools, tailored to very different strategies.

- Capture early stage growth potential by reviewing these 3636 penny stocks with strong financials that pair tiny market caps with solid fundamentals and room for meaningful re rating.

- Explore structural tech shifts by targeting these 26 AI penny stocks positioned at the intersection of artificial intelligence, innovation and evolving revenue models.

- Support an income focused approach by evaluating these 13 dividend stocks with yields > 3% that combine attractive yields with balance sheets designed to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CDE

Coeur Mining

Operates as a gold and silver producer in the United States, Canada, and Mexico.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)