- United States

- /

- Packaging

- /

- NYSE:CCK

Investors Appear Satisfied With Crown Holdings, Inc.'s (NYSE:CCK) Prospects

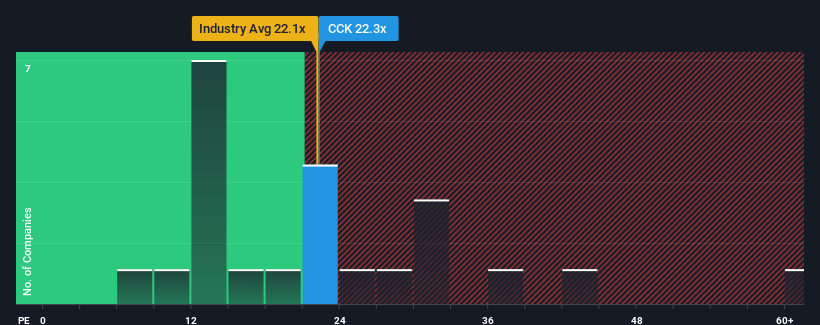

With a price-to-earnings (or "P/E") ratio of 22.3x Crown Holdings, Inc. (NYSE:CCK) may be sending bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Crown Holdings has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Crown Holdings

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Crown Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 32% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 11% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 25% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 10.0% per annum, which is noticeably less attractive.

With this information, we can see why Crown Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Crown Holdings maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Crown Holdings is showing 2 warning signs in our investment analysis, you should know about.

If you're unsure about the strength of Crown Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCK

Crown Holdings

Engages in the packaging business in the United States and internationally.

Good value with limited growth.

Similar Companies

Market Insights

Community Narratives