- United States

- /

- Packaging

- /

- NYSE:CCK

Does the Recent 16% Rally Signal a New Opportunity in Crown Holdings for 2025?

Reviewed by Bailey Pemberton

If you are sizing up Crown Holdings and wondering whether it is the right time to buy, hold, or move on, you are not alone. Investors are eyeing this packaging giant after a stretch of muted short-term moves, punctuated by a healthy 16.1% gain so far this year. Sure, the stock cooled off a bit this week, slipping 2.4%, but over the past five years, Crown Holdings has still posted an impressive total return of 21.1%. That performance is getting noticed, especially with global demand for packaging shifting higher as consumer preferences and supply chain needs evolve.

What is grabbing even more attention lately is the company’s valuation. Using a standard checklist of six key valuation criteria, Crown Holdings comes in undervalued on five of them. This results in a value score of 5 out of 6. When stocks score this high, it typically means that the market is either overlooking something important or is being overly cautious on risks.

Of course, valuation can feel like a moving target, especially as news swirls about market developments affecting the sector. That is why, next, we will break down Crown’s standing across different valuation approaches and hint at a smarter, more holistic way to figure out a stock’s worth that goes beyond just checking boxes.

Approach 1: Crown Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by forecasting its future cash flows and discounting them back to their present value. This provides a holistic view based on real business performance rather than market sentiment alone.

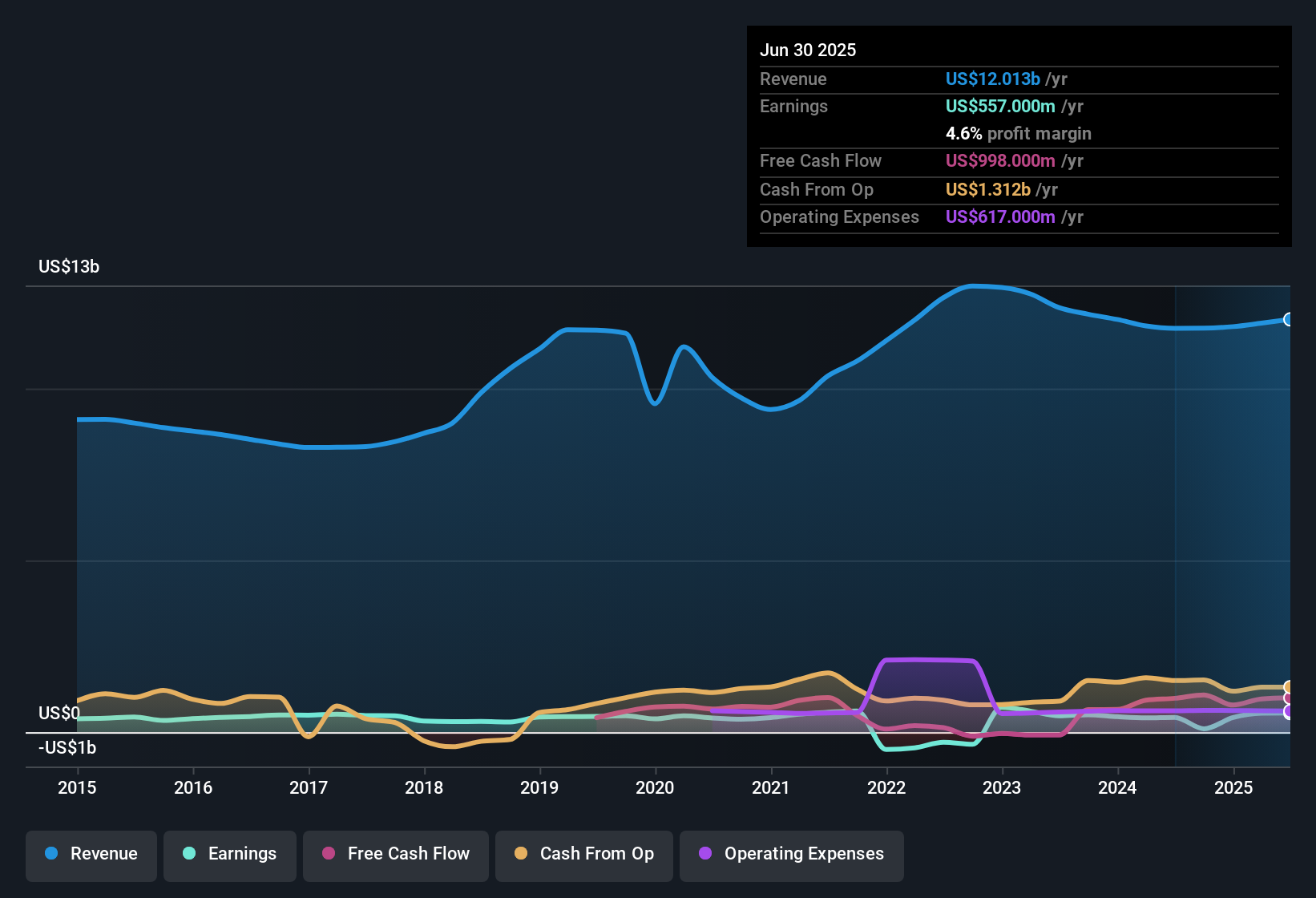

For Crown Holdings, the current trailing twelve months Free Cash Flow stands at $708.7 Million. Analysts project that annual free cash flow will continue to grow, reaching $1.01 Billion by 2027. Looking even further out, extrapolations suggest free cash flow could rise steadily over the next decade, with estimates climbing to more than $1.5 Billion by 2035. These projections are largely based on analyst estimates for the next five years and then extended using growth trends observed by Simply Wall St.

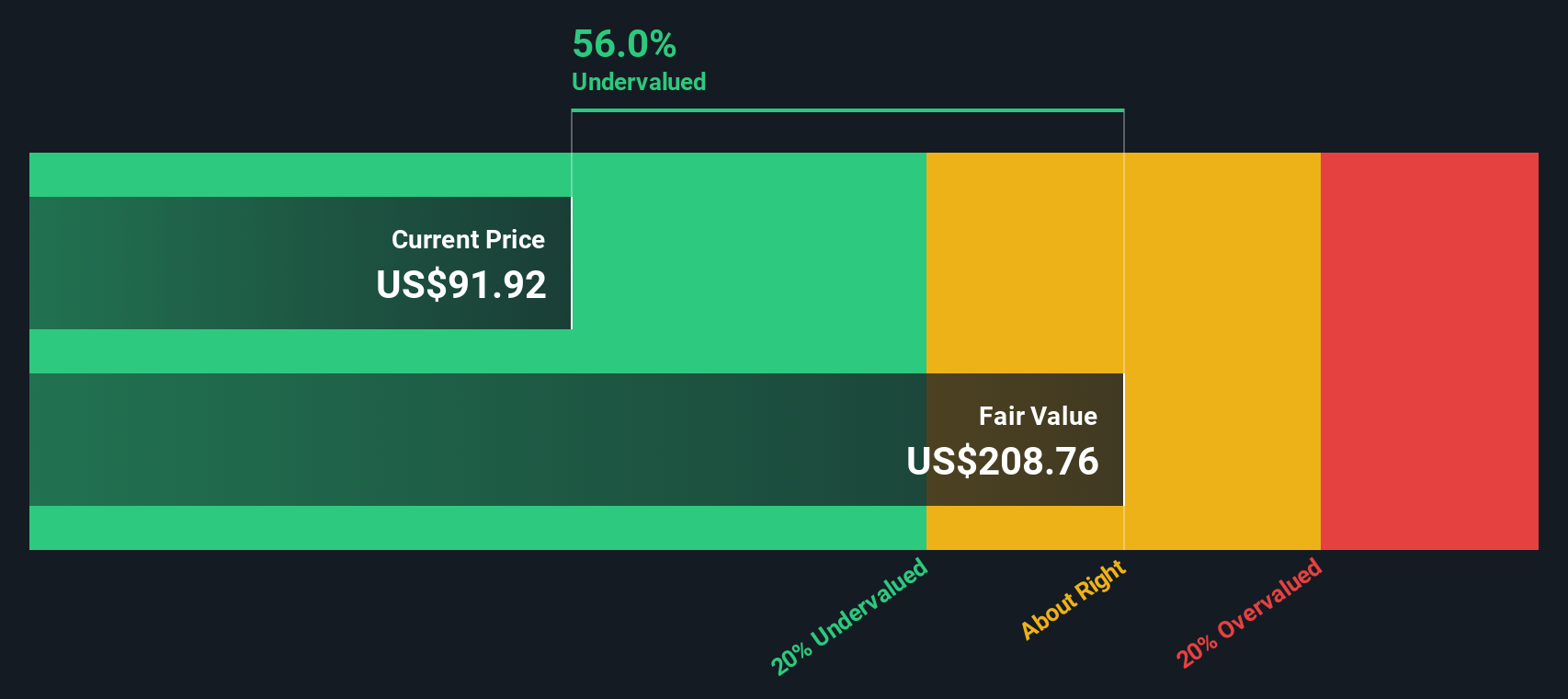

By applying the DCF model and discounting these cash flows to today's dollars, Crown Holdings’ intrinsic value is calculated at $212.30 per share. With the current market price standing about 55.6% below this level, the analysis signals the stock is significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Crown Holdings is undervalued by 55.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Crown Holdings Price vs Earnings

For profitable companies like Crown Holdings, the Price-to-Earnings (PE) ratio is widely favored as it directly reflects how much investors are willing to pay for each dollar of current earnings. It is a go-to metric because it offers a quick snapshot of market expectations, balancing both a company’s profit performance and what investors anticipate for future growth.

Growth outlook and risk profile play a big part in shaping what counts as a "normal" or "fair" PE ratio. Companies with higher growth potential and lower risk generally deserve a higher multiple, while sectors confronting headwinds or volatility often command lower ratios.

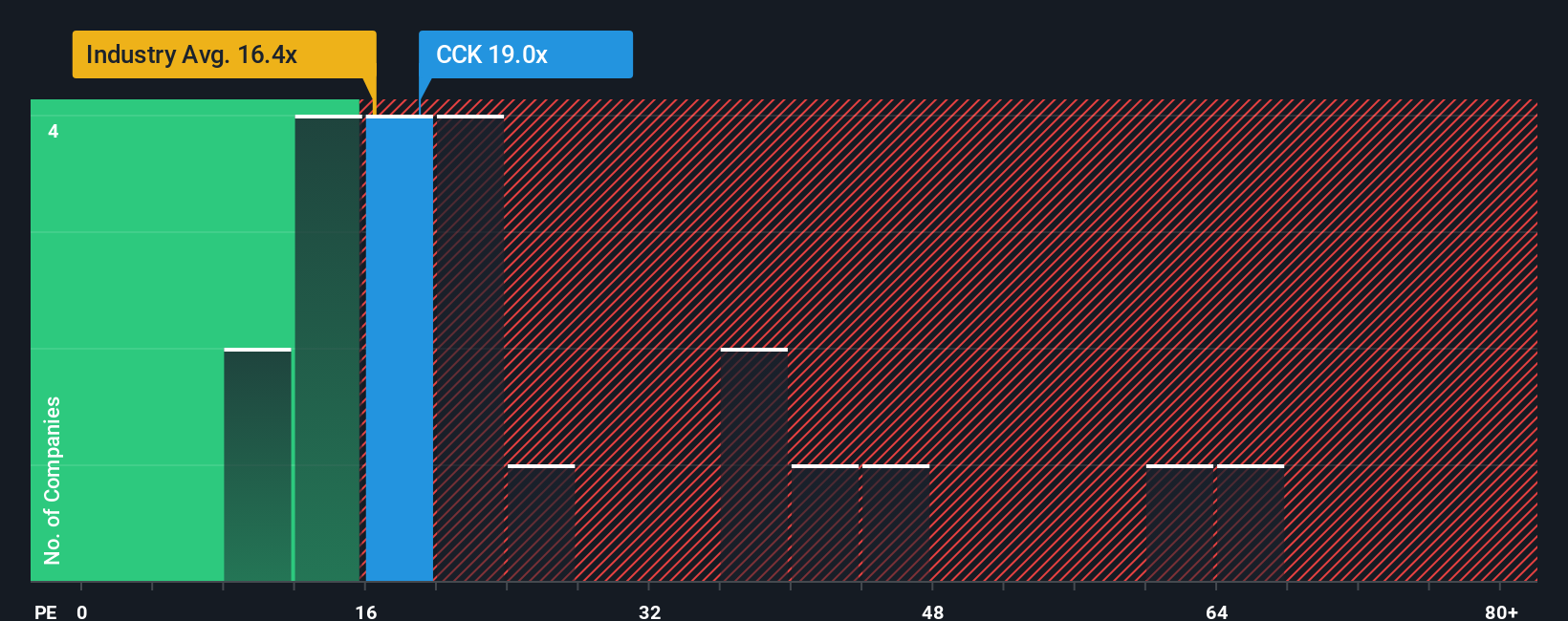

Right now, Crown Holdings trades at a PE ratio of 19.47x. For context, the packaging industry average sits at 16.02x, and its peer group comes in at 20.25x. At first glance, this puts Crown Holdings slightly above the industry but just below the peer average. This is a sign the market is pricing it based on its competitive position and performance.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike a basic industry or peer comparison, the Fair Ratio (19.58x) is designed to account for Crown’s unique mix of earnings growth, industry characteristics, profit margins, and size, along with any specific business risks. By weighing these extra layers, the Fair Ratio aims to offer a more relevant benchmark for today’s valuation climate.

Comparing Crown Holdings’ actual PE (19.47x) to its Fair Ratio (19.58x), the two match up almost exactly. This suggests the current share price is right in line with what would be considered fair value on this basis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Crown Holdings Narrative

Earlier, we hinted at a smarter way to understand valuation. Let's introduce you to Narratives, an innovative approach that helps you connect a company’s evolving story with a grounded financial view and make your investment decisions truly dynamic.

A Narrative is more than just numbers; it is your own perspective on a company’s future, from assumptions about revenue growth and earnings to expectations for margins and risks, all woven together to estimate what you think the stock is really worth.

By using Narratives, you create a personal story that links the business outlook for Crown Holdings, such as steady expansion in sustainable packaging or margin pressure from rising input costs, to a tailored financial forecast, which then calculates your Fair Value for the stock.

This powerful tool is available to everyone in the Simply Wall St Community, where millions of investors update and compare Narratives as new information emerges, such as breaking news or quarterly results. This ensures your view remains current and actionable.

With Narratives, you can quickly see if your calculated Fair Value is above or below the current share price, helping you decide when it might be time to buy, hold, or sell. You can also compare your view with other investors, who may be more optimistic or cautious. For instance, some see Crown Holdings reaching as high as $140 per share by 2028, while others estimate it could be as low as $110, all based on differing assumptions about market growth, earnings, and risks.

Do you think there's more to the story for Crown Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCK

Crown Holdings

Engages in the packaging business in the United States and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives