- United States

- /

- Chemicals

- /

- NYSE:CBT

Cabot (CBT): Evaluating Valuation After Recent Share Price Decline

Reviewed by Kshitija Bhandaru

Cabot (CBT) has seen its shares move recently, and investors may be wondering what is driving the action. Over the past month, the stock has slipped about 7%, which has sparked questions about underlying valuation and future outlook.

See our latest analysis for Cabot.

Cabot’s share price has drifted lower over recent months, with momentum clearly fading compared to earlier in the year. While the 1-year total shareholder return is essentially flat, longer-term investors have still seen solid gains. The 3-year and 5-year total shareholder returns both remain positive. These movements reflect shifting sentiment around growth prospects and potential valuation resets as market conditions evolve.

If you’re looking for more ideas beyond materials stocks, it could be a smart time to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading below analyst price targets and some long-term returns intact, it raises a key question: Is Cabot poised for a rebound, or has the market already accounted for all future growth in its price?

Price-to-Earnings of 9.6x: Is it justified?

With Cabot’s shares recently closing at $75.17, its price-to-earnings (P/E) ratio is just 9.6x, making it look sharply undervalued compared to its peers and the broader industry.

The price-to-earnings ratio tells investors how much they are paying for each dollar of the company’s earnings. In materials and chemicals, the P/E helps assess whether growth prospects, cyclical risks, or profit stability are being accurately captured in the share price.

On this front, Cabot stands out. Not only is its P/E significantly lower than the peer group average of 43.8x, but it is also well below the US Chemicals industry average of 26.3x. This discount suggests the market may be underestimating the quality or sustainability of Cabot’s earnings profile, especially considering its record of solid long-term growth and high returns on equity.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.6x (UNDERVALUED)

However, persistent one-year losses and cyclicality in chemicals could challenge a swift rebound if broader market sentiment or sector fundamentals remain weak.

Find out about the key risks to this Cabot narrative.

Another View: What Does the SWS DCF Model Say?

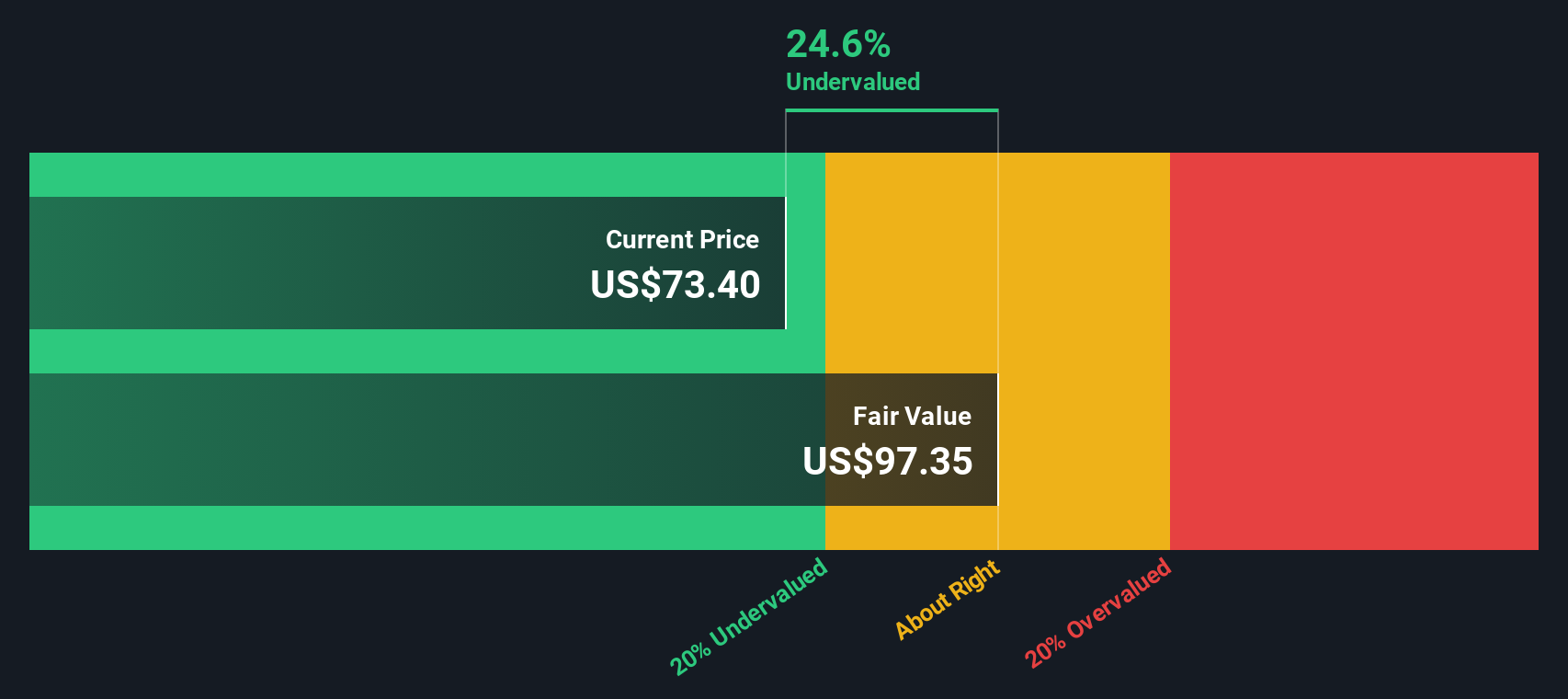

A different approach is to check what our DCF model suggests. According to this method, Cabot’s share price is around 22.8% below its estimated fair value of $97.34. This also points solidly toward undervaluation. But does this method tell the whole story, or are there risks hiding beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cabot for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cabot Narrative

If you have a different perspective or want to dig into the data yourself, you can assemble your own view in just a few minutes. Do it your way

A great starting point for your Cabot research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to get ahead of market trends and uncover unique opportunities, take charge by checking out specialist stock lists tailored to investors like you.

- Target high yields and unlock fresh income potential by reviewing these 19 dividend stocks with yields > 3% with market-beating track records.

- Spot tomorrow’s tech disruptors in artificial intelligence. Start with these 25 AI penny stocks making waves in automation, analytics, and smart innovation.

- Capitalize on true value by shortlisting these 886 undervalued stocks based on cash flows poised for a turnaround based on solid cash flows and attractive entry points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CBT

Cabot

Operates as a specialty chemicals and performance materials company.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026