- United States

- /

- Metals and Mining

- /

- NYSE:BVN

Assessing Buenaventura (NYSE:BVN) Valuation After Earnings Upgrades and Strong Institutional Support

Reviewed by Kshitija Bhandaru

Compañía de Minas BuenaventuraA (NYSE:BVN) has attracted fresh attention after a leading financial research firm boosted its sector ranking to #1. The change was attributed to a meaningful upgrade in earnings estimates and strong institutional ownership. Investors appear to be taking notice in light of these shifts.

See our latest analysis for Compañía de Minas BuenaventuraA.

Investor confidence in Compañía de Minas BuenaventuraA has ticked up, powered by its sector-leading upgrade and stronger earnings outlook. That momentum is reflected in a modest but steady one-year total shareholder return, which suggests optimism is building around the company’s growth potential following recent upgrades and increased institutional exposure.

If you’re curious about what other companies institutional investors are eyeing, it’s a great moment to broaden your horizons and discover fast growing stocks with high insider ownership

With institutional ownership high and earnings estimates on the rise, the stock's sharp run this year has raised new questions. Is Buenaventura still undervalued, or has the market fully priced in its growth prospects?

Most Popular Narrative: 37.5% Overvalued

Compañía de Minas BuenaventuraA’s last close of $24.49 sits well above the narrative’s fair value estimate of $17.82. With this gap, the narrative frames the current price as significantly overextended. Now, let’s look at what’s driving this call.

The imminent start-up and ramp-up of the San Gabriel project, with first gold production targeted for Q4 2025 and stabilization by mid-2026, is set to meaningfully boost gold output and diversify the company's revenue streams at a time when ongoing macroeconomic uncertainty may increase gold's appeal as a safe-haven asset, supporting both revenue and margins.

Eager to find out why the narrative is so bullish on future gold and copper production, yet still sees the stock as overvalued? The key lies in the projections for how new projects, margins, and growth are expected to pivot by 2028. What is the story behind the high expectations, and do the numbers really justify today’s price? Unpack the hidden details inside the full breakdown.

Result: Fair Value of $17.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharp declines in silver or gold production, combined with operational disruptions, could quickly undermine both revenue and margin projections for Buenaventura.

Find out about the key risks to this Compañía de Minas BuenaventuraA narrative.

Another View: What Do Multiples Say?

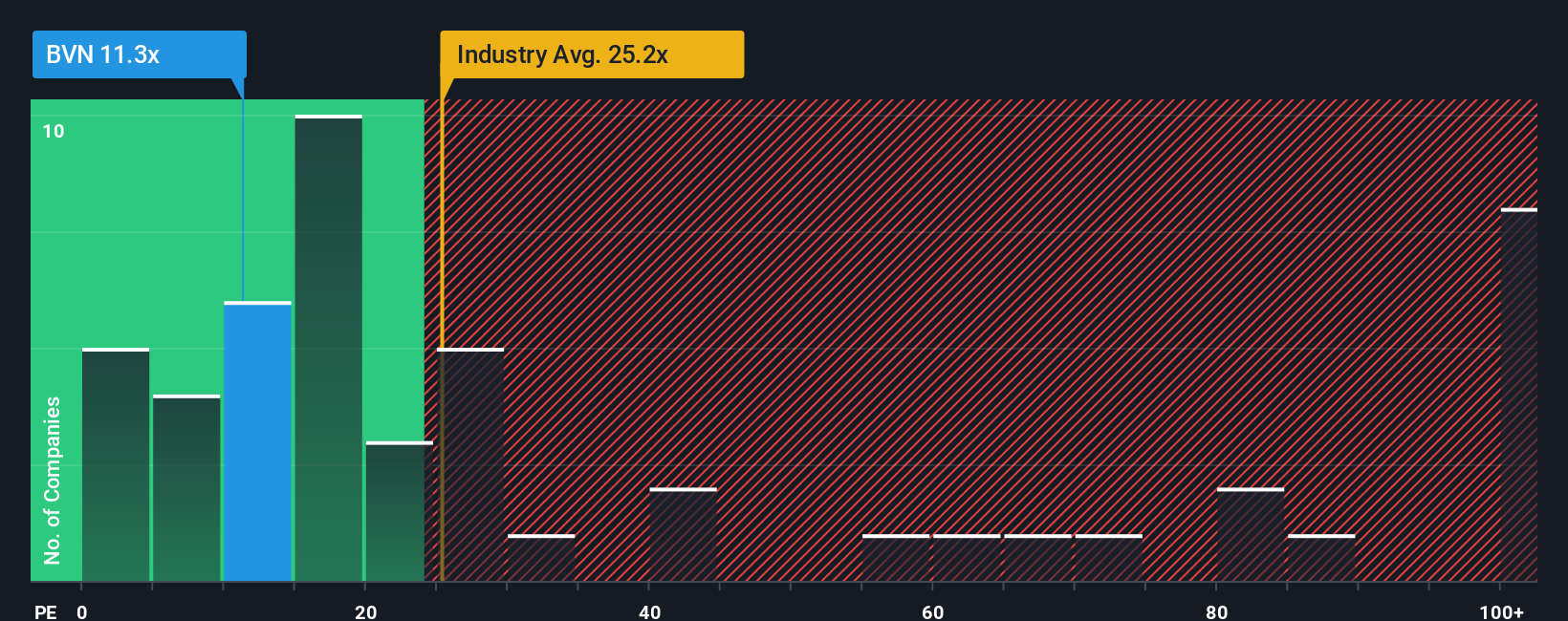

There is another way to approach valuation. Compared to industry peers, the company’s price-to-earnings ratio of 12.3x looks much cheaper than the peer average of 33x and is also below the industry’s 24.6x mark. The fair ratio, based on historical trends, stands at 17.8x, so the stock still trades at a discount using this method. Do these cheaper multiples hint at long-term opportunity or signal something investors are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Compañía de Minas BuenaventuraA Narrative

If you see the numbers differently or want to investigate your own angle, it only takes a few minutes to craft a personal narrative using all the available data. Do it your way

A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by. Use the Simply Wall Street Screener to spot companies with unique growth, value, and innovation potential right now.

- Tap into tomorrow’s leaders in digital assets by evaluating these 78 cryptocurrency and blockchain stocks, which are shaping new trends in secure payments and decentralized tech.

- Secure stronger yields for your portfolio with these 19 dividend stocks with yields > 3%, which consistently reward shareholders with attractive income streams.

- Catch the wave of healthtech transformation by searching these 32 healthcare AI stocks, which are making major breakthroughs in medical AI and smart diagnostics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BVN

Compañía de Minas BuenaventuraA

Engages in the exploration, mining, concentration, smelting, and marketing of polymetallic ores and metals in Peru.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives