- United States

- /

- Chemicals

- /

- NYSE:AXTA

Axalta’s New EV Battery Coatings Could Be a Game Changer for Axalta Coating Systems (AXTA)

Reviewed by Sasha Jovanovic

- In early October 2025, Axalta Coating Systems unveiled its Alesta e-PRO FG Black and Alesta e-PRO Dielectric Gray battery coatings at The Battery Show North America, targeting safety and performance advancements for electric vehicle and stationary energy storage solutions.

- This launch directly addresses thermal stability and electrical insulation challenges in EV batteries, reflecting Axalta's continued focus on product innovation tailored to the expanding electric vehicle market.

- We'll explore how Axalta's advanced EV battery coatings could influence its investment narrative given the company's focus on innovation-led growth.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Axalta Coating Systems Investment Narrative Recap

To own Axalta Coating Systems shares, investors must have confidence in Axalta’s ability to drive growth through coatings innovation, particularly in fast-evolving markets like electric vehicles. While the recent launch of advanced EV battery coatings highlights Axalta’s strengths in research and development, this does not significantly alter near-term catalysts; ongoing pressure in core Performance Coatings and Refinish volumes remains the key short-term driver, while margin risk from mix shift towards lower-priced segments is still the principal concern.

The introduction of Alesta e-PRO FG Black and Alesta e-PRO Dielectric Gray at The Battery Show North America stands out as the most relevant announcement, reinforcing Axalta’s focus on specialized solutions for the expanding EV industry. This innovation aligns with the company’s growth catalyst of tapping into new, high-value markets, even as headwinds in traditional segments continue.

However, even with innovation, investors should not overlook the continued risk from deteriorating price-mix trends in the core business, as...

Read the full narrative on Axalta Coating Systems (it's free!)

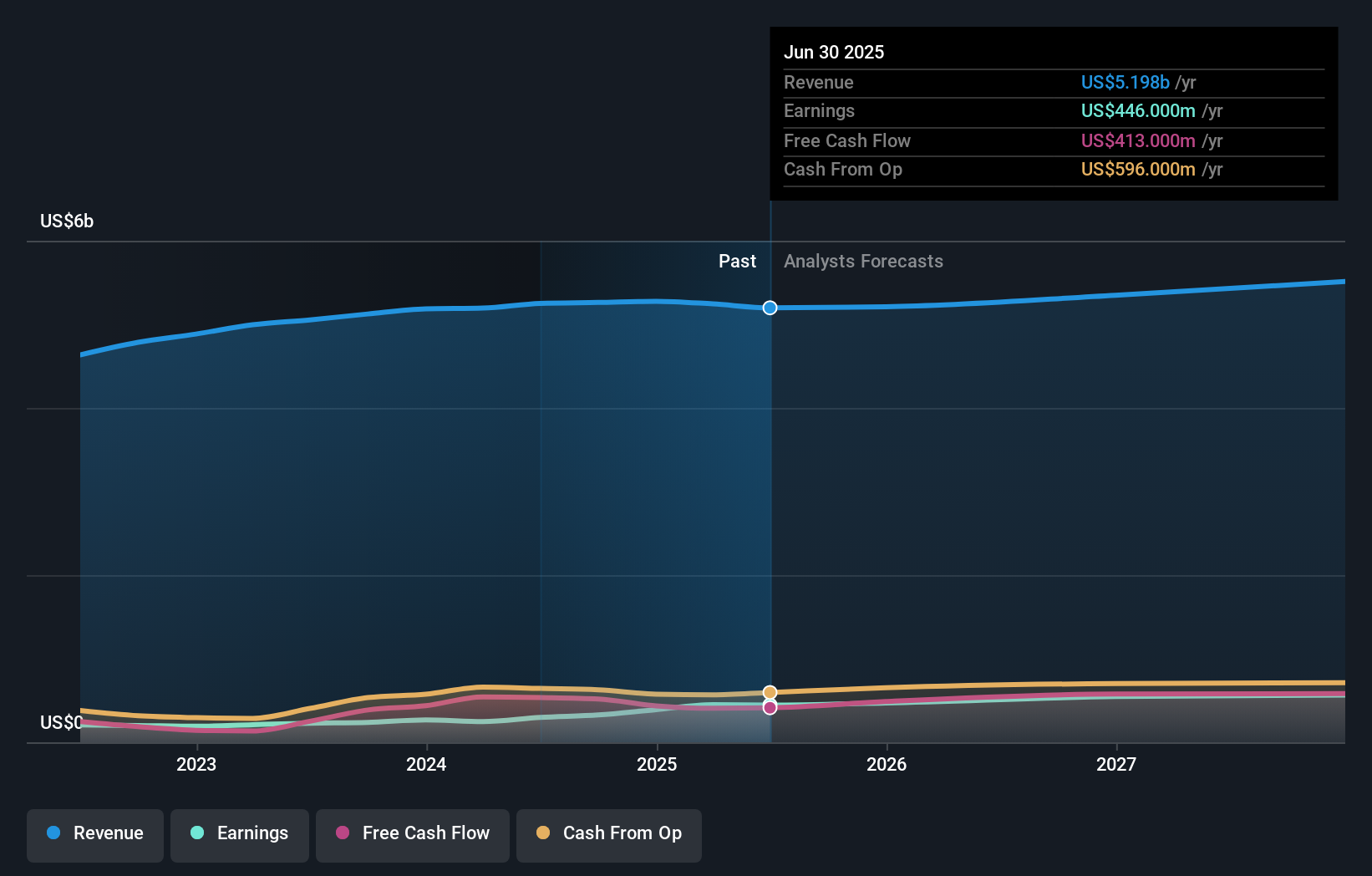

Axalta Coating Systems is projected to reach $5.6 billion in revenue and $604.8 million in earnings by 2028. This scenario assumes a 2.3% annual revenue growth rate and a $158.8 million increase in earnings from the current $446.0 million.

Uncover how Axalta Coating Systems' forecasts yield a $36.56 fair value, a 37% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Axalta’s fair value between US$36.56 and US$62.64, based on two distinct forecasts. While opinions widely differ, weak volume and margin trends in established product lines could be a deciding factor in the company's performance.

Explore 2 other fair value estimates on Axalta Coating Systems - why the stock might be worth over 2x more than the current price!

Build Your Own Axalta Coating Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axalta Coating Systems research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Axalta Coating Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axalta Coating Systems' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXTA

Axalta Coating Systems

Through its subsidiaries, manufactures, markets, and distributes high-performance coatings systems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives