- United States

- /

- Chemicals

- /

- NYSE:AXTA

Axalta (AXTA) Margin Growth Reinforces Value Narrative After 39% Earnings Jump

Reviewed by Simply Wall St

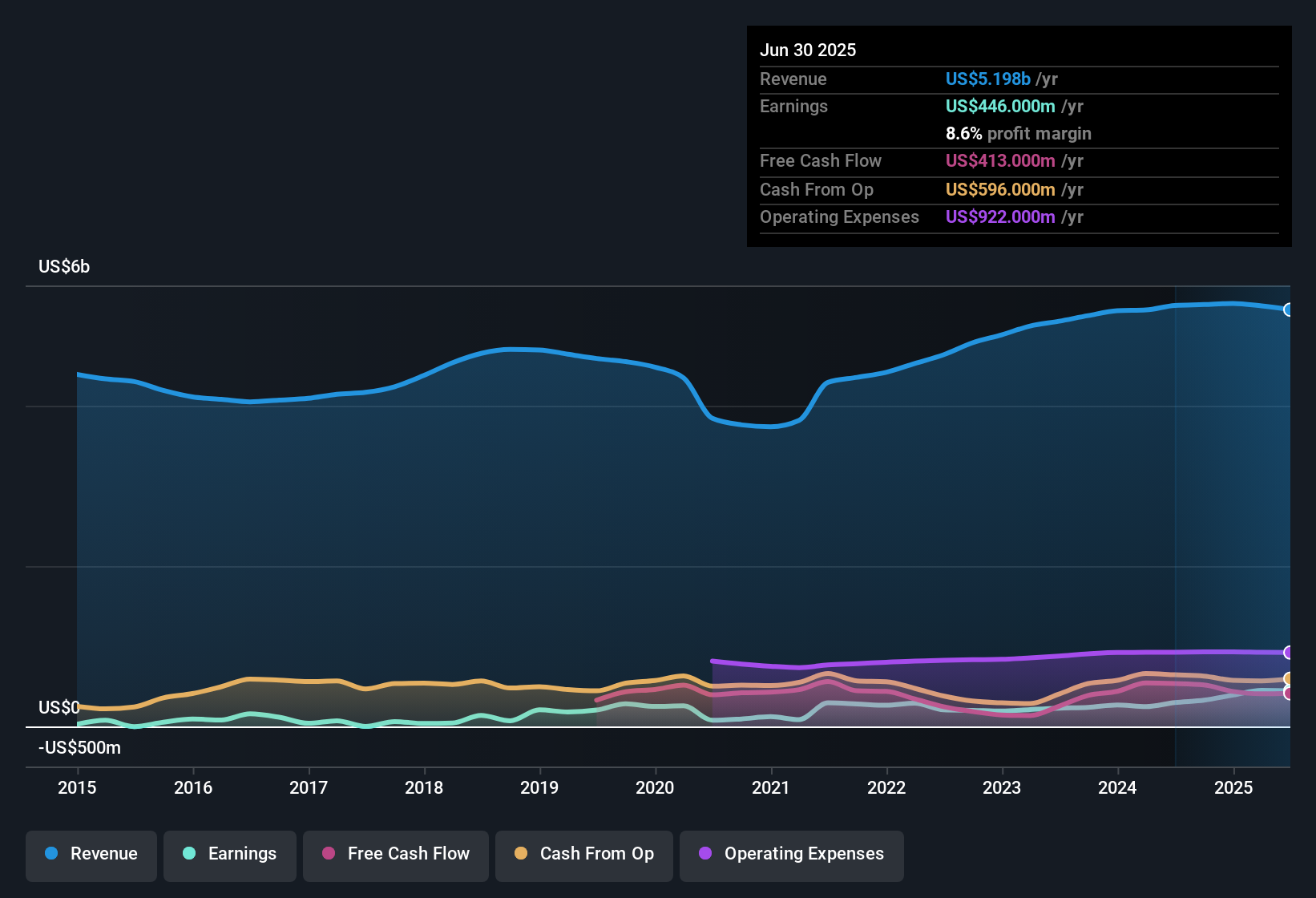

Axalta Coating Systems (AXTA) delivered earnings growth of 39.1% over the past year, outpacing its five-year average growth of 20.9% per year. Net profit margins climbed to 8.8%, up from last year’s 6.2%. Investors are taking note of a Price-To-Earnings ratio of 13.8x, which stands well below industry averages. With forecasts projecting annual earnings growth of 10.1% and revenue growth of 2.6%, the latest results highlight a favorable mix of profitability and valuation momentum.

See our full analysis for Axalta Coating Systems.Next, we will weigh these headline numbers against the market’s key narratives to see which views are reinforced and where surprises might emerge.

See what the community is saying about Axalta Coating Systems

DCF Fair Value Nearly Doubles Share Price

- Axalta’s current share price of $29.48 trades at a 56% discount to its DCF fair value of $66.88, a gap that stands out even among value-focused stocks in the US Chemicals sector.

- Under the analysts' consensus view, this wide discount heavily supports the idea that Axalta offers a rare mix of upside potential and downside protection.

- Compared to industry peers, Axalta’s Price-To-Earnings ratio of 13.8x sits far below the industry average of 26.4x and peer average of 22.5x, sharpening the case for value-driven buyers.

- The consensus analyst price target is $36.39, roughly 23% above the current price. This reinforces a balanced outlook that blends market skepticism with growth expectations.

See how analysts’ balanced outlook stacks up to new guidance and margin trends in the full consensus narrative. 📊 Read the full Axalta Coating Systems Consensus Narrative.

Margin Momentum Beats Peer Group

- Net profit margins have risen to 8.8% this year, up from 6.2% previously, outstripping many direct competitors who have struggled with cost inflation and supply chain pressures.

- Referencing the analysts' consensus view, the pace of Axalta’s margin expansion stands out.

- Sustained gross margin improvement appears tied to a long-term push on operational efficiency and innovation, with expectations for profit margins to reach 10.9% within three years. This tempo is notable among leading sector names.

- Consensus narrative notes the company’s focus on digital platforms and premium products is supporting both pricing power and earnings quality, despite tension from slower North America volumes.

Revenue Growth Outpaced by Margin Gains

- Revenue growth forecasts call for a 2.6% annual increase, notably slower than the projected margin improvement and trailing Axalta’s own historical growth rate of 20.9% per year.

- Within analysts’ consensus view, this divergence in top-line versus bottom-line strength prompts debate.

- Forecasts tie most of the earnings upside to expanding margins rather than rapid revenue acceleration. This suggests operational execution, not sales volume, will drive future gains.

- Consensus narrative adds that while regional expansion and product launches may diversify revenue, persistent “volume weakness” and mixed demand could temper the top-line story if not offset by continued cost discipline.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Axalta Coating Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a distinct take on the figures? Share your unique perspective and shape your own narrative in just a few minutes: Do it your way

A great starting point for your Axalta Coating Systems research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Axalta’s margin gains impress, its sluggish revenue growth raises concerns about long-term consistency compared to sector leaders.

For investors who want steadier progress and fewer surprises, take advantage of stable growth stocks screener (2122 results) and discover companies with a reliable record of growth and resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AXTA

Axalta Coating Systems

Through its subsidiaries, manufactures, markets, and distributes high-performance coatings systems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)