- United States

- /

- Metals and Mining

- /

- NYSE:AU

What Does AngloGold Ashanti’s 23% Surge Mean for Its True Value?

Reviewed by Bailey Pemberton

- Wondering if AngloGold Ashanti is actually good value after its recent run? Here’s a breakdown of what’s driving the story and whether there may be opportunity ahead.

- Despite a slight dip of 0.6% in the past week, AngloGold Ashanti has risen 23.3% over the past month, and its year-to-date return stands at 244.5%.

- News about strategic asset shifts and increased market interest in gold miners have contributed to AngloGold Ashanti’s recent momentum, while new demand forecasts from analysts have also influenced the trend. These updates provide important context to the recent price rally.

- On a quantitative front, the company currently scores a 3 out of 6 on our valuation checks, suggesting that while some aspects appear undervalued, others may require further inspection. Here is a closer look at different ways to value AngloGold Ashanti, as well as an upcoming method to help assess whether the stock merits attention.

Approach 1: AngloGold Ashanti Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model aims to estimate the fair value of a company by projecting its future free cash flows and then discounting those projections back to their value today. This approach captures the time value of money. The DCF model is widely used in equity valuation, especially for firms with sufficient free cash flow history and visibility into future performance.

For AngloGold Ashanti, the company’s current Free Cash Flow stands at $2.2 billion, highlighting significant operational strength. Analyst projections anticipate free cash flows rising to $2.5 billion by December 2028, with the next ten years extrapolated by Simply Wall St based on recent estimates and long-term trends. In this period, analyst data informs the first five years, while future projections rely on broader assumptions.

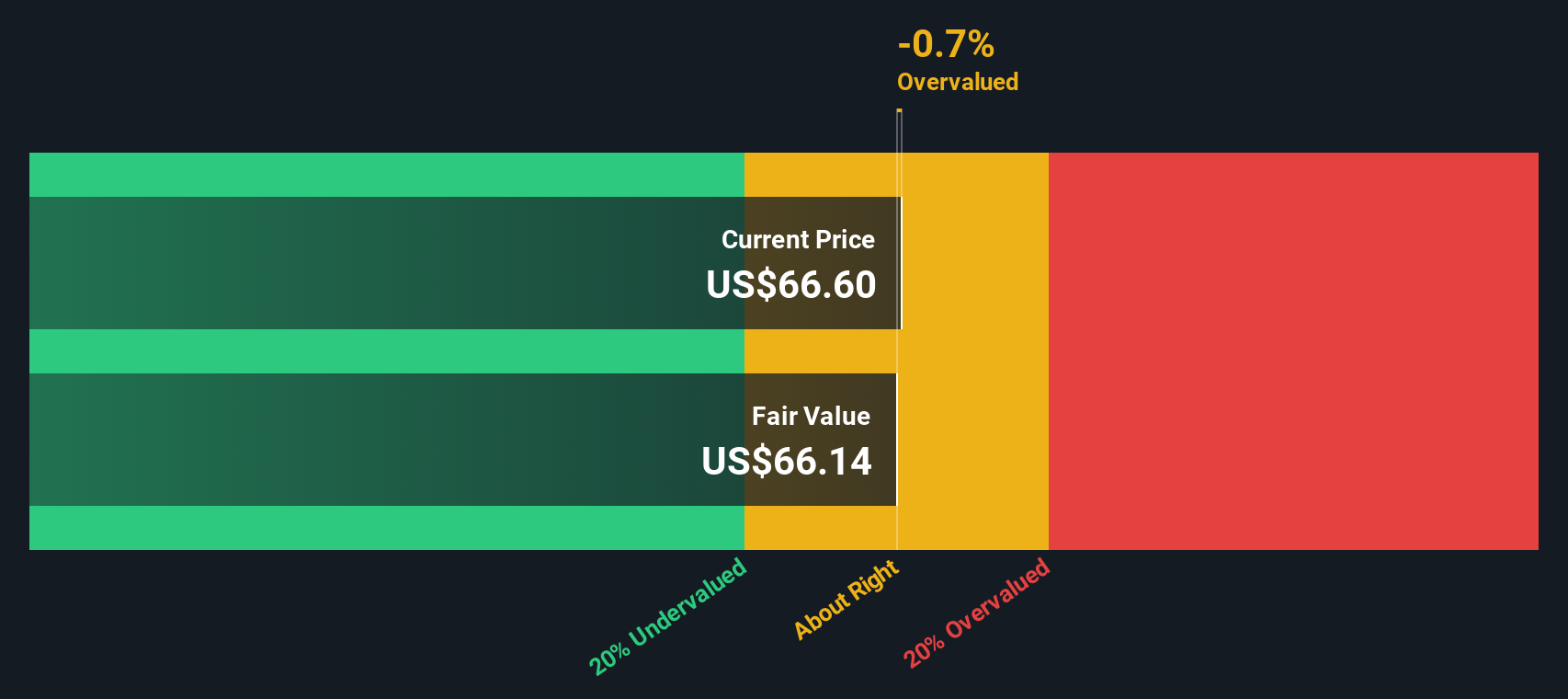

The DCF model calculates an intrinsic value of $68.94 per share for AngloGold Ashanti. Compared to the current share price, this indicates the stock is about 21.6% overvalued according to present cash flow projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AngloGold Ashanti may be overvalued by 21.6%. Discover 930 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: AngloGold Ashanti Price vs Earnings

For established, profitable companies like AngloGold Ashanti, the Price-to-Earnings (PE) ratio is often a useful metric because it compares a company's current share price to its earnings per share. This provides a snapshot of how the market is valuing its profits. The PE ratio is especially relevant when a company has strong and relatively stable earnings, making it easier to benchmark against peers.

A company's “normal” or “fair” PE ratio is shaped by multiple factors, including growth prospects and perceived risks. Businesses with higher expected earnings growth or lower risk profiles can often justify a higher PE, while those facing headwinds may trade at a discount.

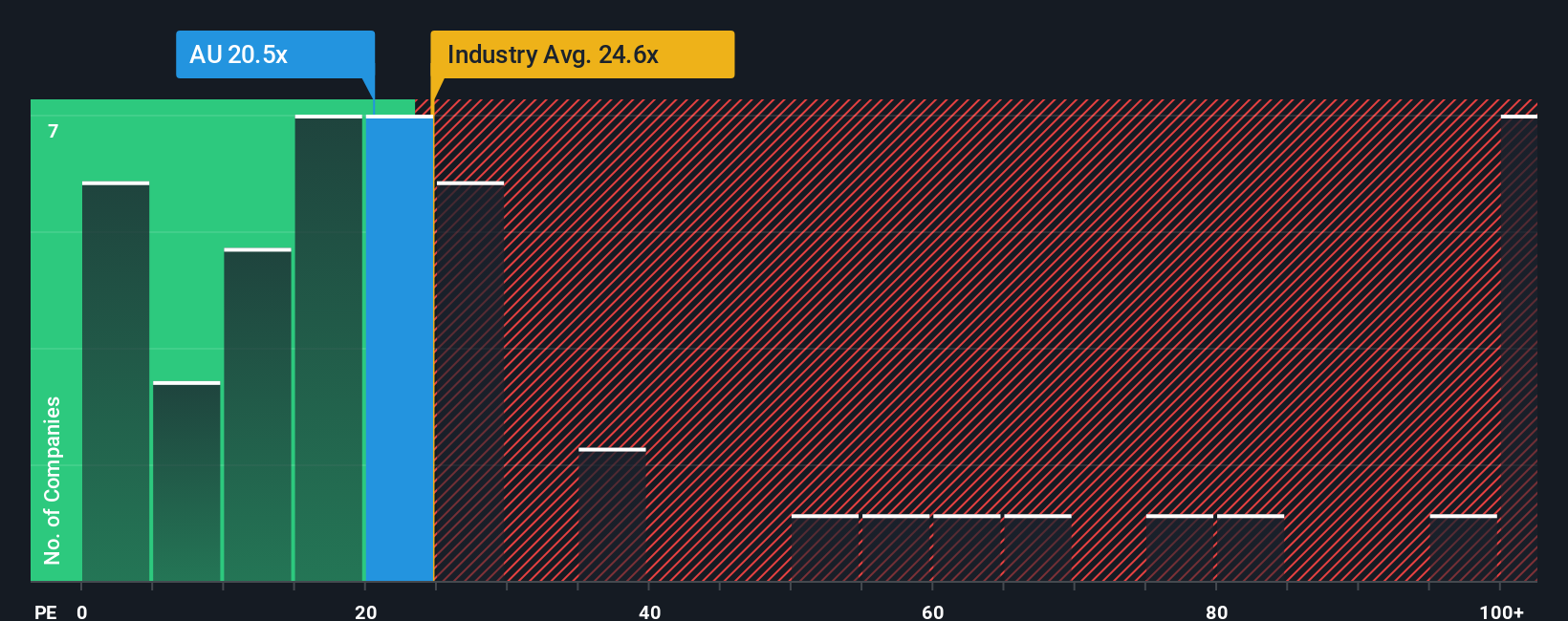

Currently, AngloGold Ashanti trades at a PE of 18.8x, compared to the Metals and Mining industry average of 22.3x and a peer average of 25x. This suggests investors are pricing the company below both the wider industry and similar players in the market.

Simply Wall St’s proprietary Fair Ratio for AngloGold Ashanti stands at 30.1x. This Fair Ratio reflects not just industry averages or peer comparisons but also factors in the company's unique earnings growth, profit margins, risk profile, and market cap. As a result, it offers a more tailored and forward-looking gauge of what the market “should” pay for the business.

Since AngloGold Ashanti’s actual PE of 18.8x is notably below its Fair Ratio of 30.1x, it implies that the shares could be undervalued relative to where they might trade if investors fully recognized its growth and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AngloGold Ashanti Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a clear, approachable story you build around a company like AngloGold Ashanti, connecting its recent performance, prospects, and risks to a financial forecast and a bottom-line fair value.

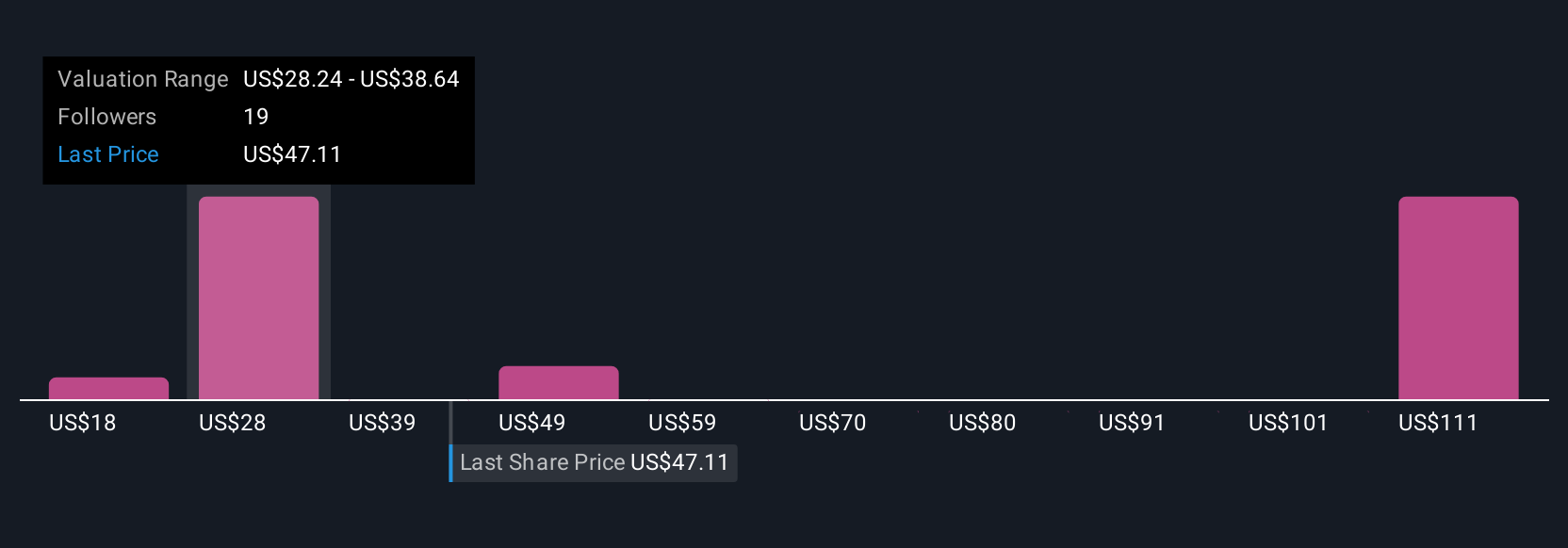

Rather than just focusing on numbers, Narratives help you blend your perspective by setting assumptions for future revenue, earnings, and margins into a story that explains “why” a company might be worth more (or less) than the market thinks. Narratives are more dynamic than static models, as they update automatically when new information, such as earnings or sector news, is released. This helps your conclusions stay relevant.

On Simply Wall St’s Community page, millions of investors use Narratives as an accessible tool to help decide when to buy or sell. You can instantly see if your Fair Value is above or below the latest market price. For example, in the case of AngloGold Ashanti, some investors are bullish and forecast a fair value as high as $90.57 per share based on strong growth and margin assumptions, while others see headwinds and set it closer to $38.00. This shows just how much different stories and expectations can drive investment decisions.

Do you think there's more to the story for AngloGold Ashanti? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026