- United States

- /

- Metals and Mining

- /

- NYSE:AU

How AngloGold Ashanti’s Soaring 207% Rally Shapes the Outlook for 2025

Reviewed by Bailey Pemberton

Thinking about what’s next for AngloGold Ashanti? You are not alone. Whether you already hold a few shares or are considering your first investment, it is the stock’s remarkable run that likely has your attention. In just the past week, shares have climbed 7.8%, building on a red-hot 24.9% gain across the last month. Year to date, the stock is up an eye-popping 206.8%. That kind of performance naturally raises eyebrows, especially when you factor in the gold sector’s broader resurgence as investors respond to shifting market risks and renewed appetite for precious metals.

Impressively, AngloGold Ashanti’s long-term returns are just as striking, with a 199.3% gain over the past year and a massive 469.2% run in the last three years. Some of this momentum can be chalked up to rising gold prices globally, driven by market volatility and an ongoing search for “safe haven” assets. However, not all the gains are about external factors. Recent news points to improved operational efficiency and strategic moves by the company to optimize their global portfolio, quietly boosting investor sentiment.

Given those kinds of returns, the key question is obvious: does the stock still offer good value, or has it simply outpaced its fundamentals? According to a widely used valuation framework, AngloGold Ashanti scores a 3 out of 6 on key undervaluation checks. This suggests there may still be opportunities, but not without some caveats.

Let’s break down how the typical valuation methods stack up for AngloGold Ashanti, and then circle back to what I think is an even better way to understand what this stock could do next.

Approach 1: AngloGold Ashanti Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and then discounting them back to their present value. This approach helps analysts estimate what the business is really worth based on how much cash it is expected to generate for shareholders over the long run.

For AngloGold Ashanti, the current Free Cash Flow stands at $1.46 billion. According to analyst and model projections, Free Cash Flow is expected to rise in the coming years, peaking at $3.06 billion in 2026 before gradually declining over the next decade. By 2028, Free Cash Flow is projected at $2.54 billion, with further decreases anticipated in subsequent years. These future numbers combine both analyst estimates for the next five years and model-driven forecasts beyond that.

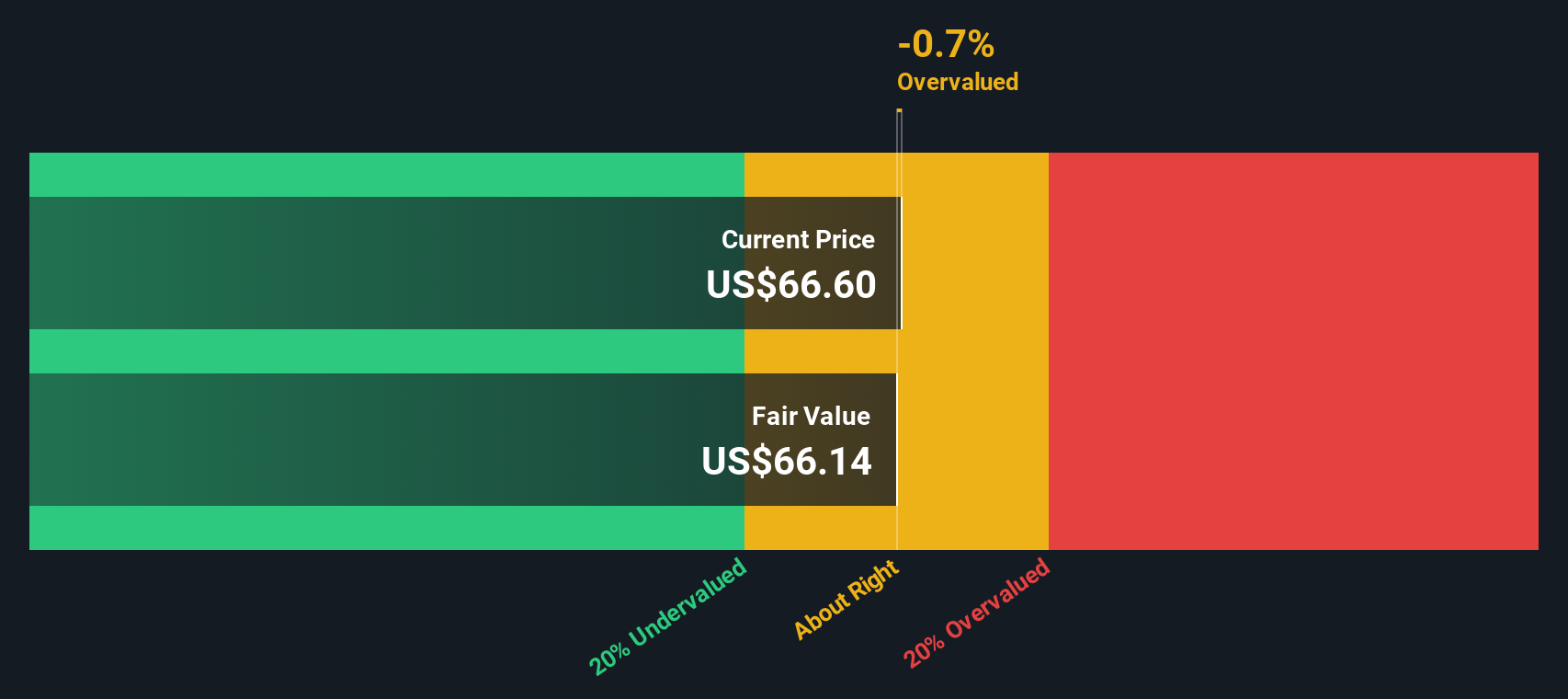

Based on this cash flow outlook and using the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $64.85. Comparing this to the current share price, the DCF valuation suggests that AngloGold Ashanti stock is about 15.1% overvalued at this time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AngloGold Ashanti may be overvalued by 15.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: AngloGold Ashanti Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used method for valuing profitable companies like AngloGold Ashanti because it compares the market’s valuation of a company to its actual earnings. For companies consistently generating profits, the PE ratio serves as a quick snapshot of how much investors are willing to pay for each dollar of earnings.

It’s important to remember that the ideal or “fair” PE ratio for a stock depends on several factors, including how quickly the company is expected to grow and how risky its future outlook appears. Higher growth prospects can justify a higher PE. In contrast, greater risks usually drag it down. That is why benchmarks like peer and industry averages, along with specially tailored metrics, can provide a more balanced view.

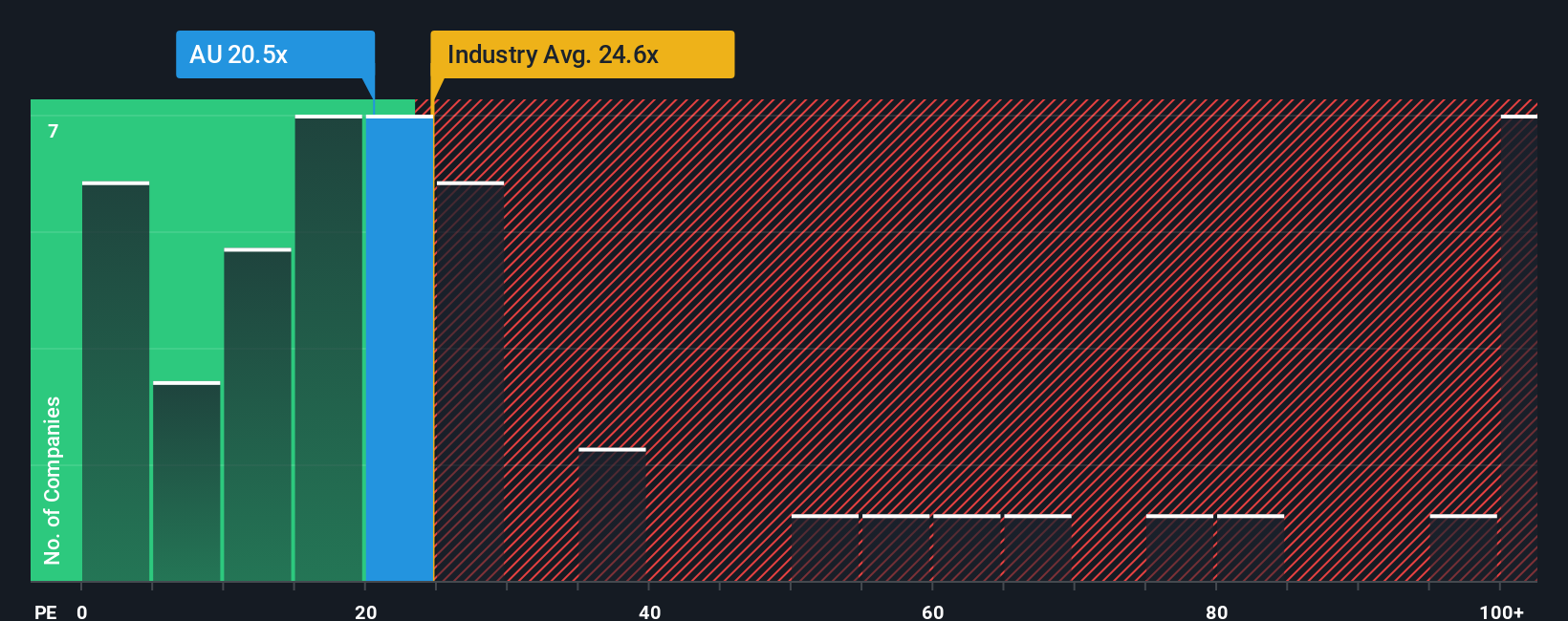

AngloGold Ashanti currently trades at a PE ratio of 20.88x. This is below both the Metals and Mining industry average of 24.13x and the peer group average of 34.87x. This indicates a more conservative valuation relative to its immediate sector. However, Simply Wall St’s proprietary Fair Ratio for AngloGold Ashanti stands at 28.96x. This represents the PE ratio a company with AngloGold Ashanti’s earnings growth profile, risk factors, margins, and industry position would warrant in a balanced market scenario. The Fair Ratio goes beyond simple averages by factoring in nuances like future growth expectations, profit margins, and company-specific risks, making it a more comprehensive benchmark.

Compared to its actual PE of 20.88x, which is significantly lower than the Fair Ratio of 28.96x, AngloGold Ashanti appears undervalued based on this metric alone. This suggests some room for upside if market participants start to price in its future earnings potential.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AngloGold Ashanti Narrative

Earlier we mentioned that there is an even better way to understand a stock’s value. Let’s introduce you to Narratives. A Narrative is simply your own perspective, or story, about where a company is headed, based on what you believe its fair value, future revenues, earnings, and margins could be. Narratives connect your view of a company to a concrete financial forecast and then directly to an estimated fair value. This helps to make sense of what is driving a stock’s price.

Narratives are easy to create and use on Simply Wall St’s Community page, where millions of investors share perspectives that go beyond standard valuation ratios. With Narratives, you can compare your estimated Fair Value to the current Price. This helps you decide not only what a business is worth, but also when it might be time to buy or sell.

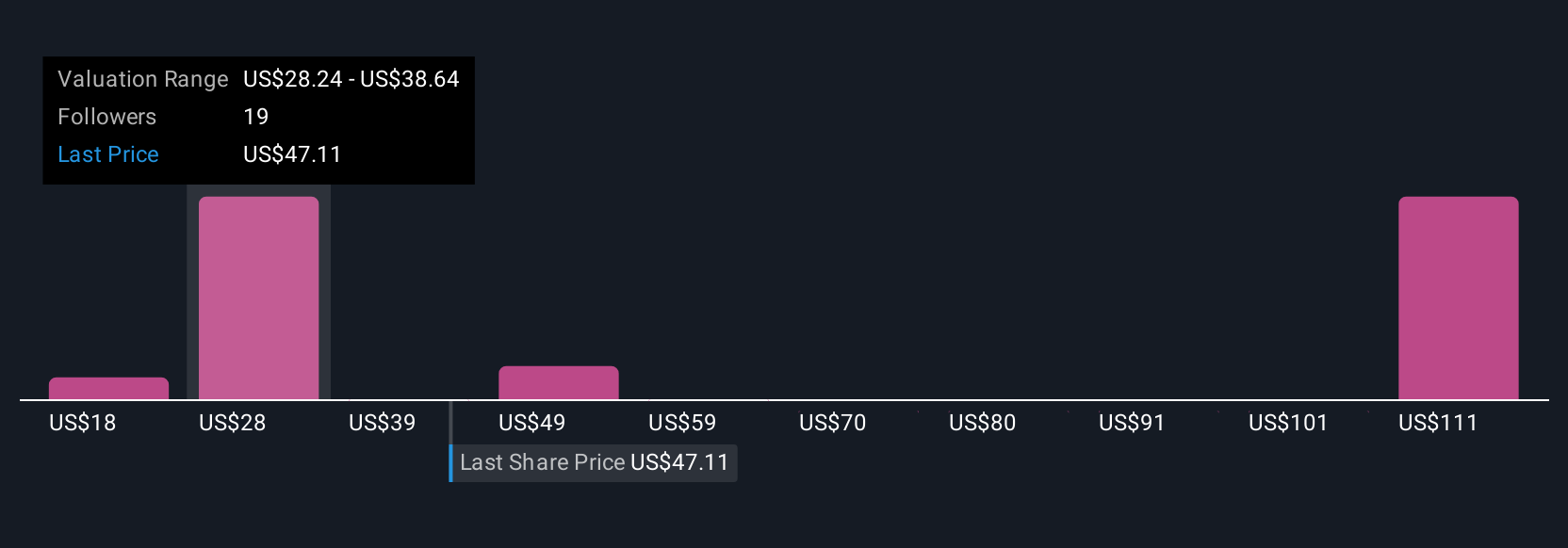

These Narratives dynamically update as new information emerges, whether it is a quarterly earnings report or fresh news from the sector, so your decisions stay relevant. For example, one investor’s Narrative might highlight strong demand, asset optimization, and rising margins. This could lead them to a higher fair value of $70.00 for AngloGold Ashanti. Another, more cautious perspective, might see risks in cost pressures or gold price volatility, resulting in a far lower valuation around $38.00.

Do you think there's more to the story for AngloGold Ashanti? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AU

AngloGold Ashanti

Operates as a gold mining company in Africa, Australia, and the Americas.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives