- United States

- /

- Packaging

- /

- NYSE:ATR

Should AptarGroup’s (ATR) Nasus Pharma Partnership Shift Investor Expectations for Pharma Segment Innovation?

Reviewed by Sasha Jovanovic

- Nasus Pharma Ltd. recently announced comprehensive agreements with Aptar France S.A.S. and AptarGroup Inc. to support the clinical development and planned commercialization of NS002, an intranasal powder epinephrine product candidate, providing access to Aptar’s proven drug delivery technology and manufacturing capabilities.

- This partnership highlights AptarGroup’s growing role as a technology and regulatory solutions provider for innovative pharmaceutical products advancing toward market approval.

- We'll explore how AptarGroup's involvement in the NS002 program could influence its outlook for pharmaceutical innovation and segment growth.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

AptarGroup Investment Narrative Recap

To believe in AptarGroup as a shareholder today, you need confidence in its ability to drive consistent growth by expanding proprietary pharmaceutical delivery systems and leveraging partnerships like the recent Nasus Pharma agreement, which aligns closely with key innovation catalysts. While this collaboration boosts AptarGroup’s role in high-value pharma device development and underscores its expertise, it does not materially change the current short-term risk, persistent uncertainty in emergency medicine delivery system demand and unpredictable pharma segment sales remain pressing near-term challenges.

Among recent announcements, AptarGroup’s Q2 2025 earnings report showing rising sales and improved net income stands out, reinforcing the company’s resilience and providing important context for evaluating how new pharmaceutical collaborations fit into overall growth. These results, combined with successful product rollouts in drug delivery systems, highlight the company’s focus on scaling innovation to offset softer trends in certain pharma sub-segments.

By contrast, even as new collaborations offer promise, investors should be aware that ongoing volatility in demand for emergency medicine and regulatory shifts could…

Read the full narrative on AptarGroup (it's free!)

AptarGroup's outlook anticipates $4.3 billion in revenue and $450.9 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 6.1% and reflects a $59.4 million increase in earnings from the current $391.5 million.

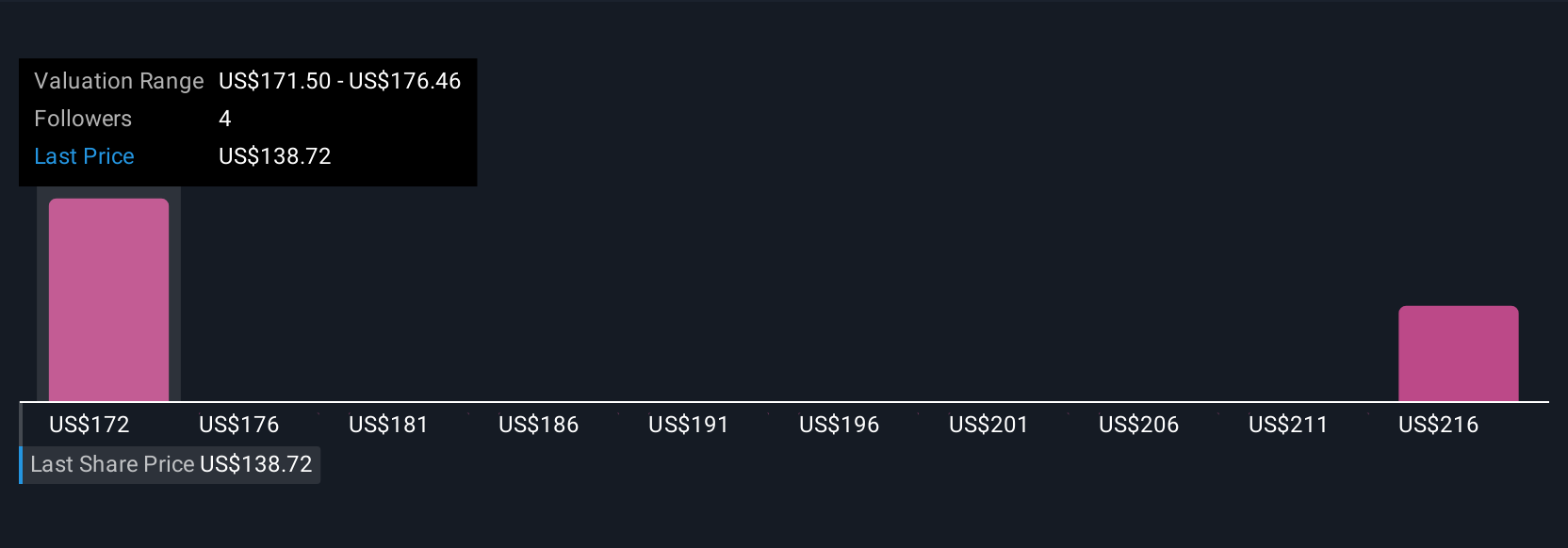

Uncover how AptarGroup's forecasts yield a $177.00 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community member fair value estimates for AptarGroup range widely from US$153 to US$206, with differing growth forecasts. Weigh these varied views alongside near-term risks around emergency medicine segment uncertainty when considering potential future performance.

Explore 3 other fair value estimates on AptarGroup - why the stock might be worth just $153.00!

Build Your Own AptarGroup Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AptarGroup research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free AptarGroup research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AptarGroup's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ATR

AptarGroup

Designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives