- United States

- /

- Chemicals

- /

- NYSE:ASH

Could Temporary Downtime at Ashland’s (ASH) Kentucky Plant Reveal More About Its Cost Structure?

Reviewed by Sasha Jovanovic

- Earlier this month, Ashland Inc. announced that a production unit at its Calvert City, Kentucky plant was taken offline due to an equipment-related incident, with repairs expected to extend into fiscal First Quarter 2026.

- Although the affected operations are limited to upstream manufacturing, Ashland does not anticipate disruptions to customer deliveries or sales, citing adequate inventory and ongoing production from other units.

- We’ll now explore how this temporary operational disruption feeds into Ashland’s broader investment narrative and future cost structure.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Ashland Investment Narrative Recap

To be a shareholder in Ashland, you need to believe in the strength of its specialty chemicals portfolio, especially its focus on high-value, sustainable solutions for noncyclical end-markets like personal care and life sciences. The recent Calvert City outage appears immaterial to immediate sales and earnings catalysts, with management maintaining there is no impact to customer deliveries and only a modest projected Adjusted EBITDA effect in fiscal 2026. The company’s primary short-term risk, prolonged demand softness and pricing pressure in key segments, remains unchanged by this event.

Among recent announcements, the $60 million manufacturing network optimization plan, including the closure of the Parlin, New Jersey site, stands out in this context. This initiative ties closely to Ashland’s ongoing cost-reduction catalyst, which underpins its margin targets, but places additional scrutiny on operational execution especially as the company manages repair costs and efficiency challenges from unforeseen disruptions. Despite the apparent resilience shown here, investors should not overlook that…

Read the full narrative on Ashland (it's free!)

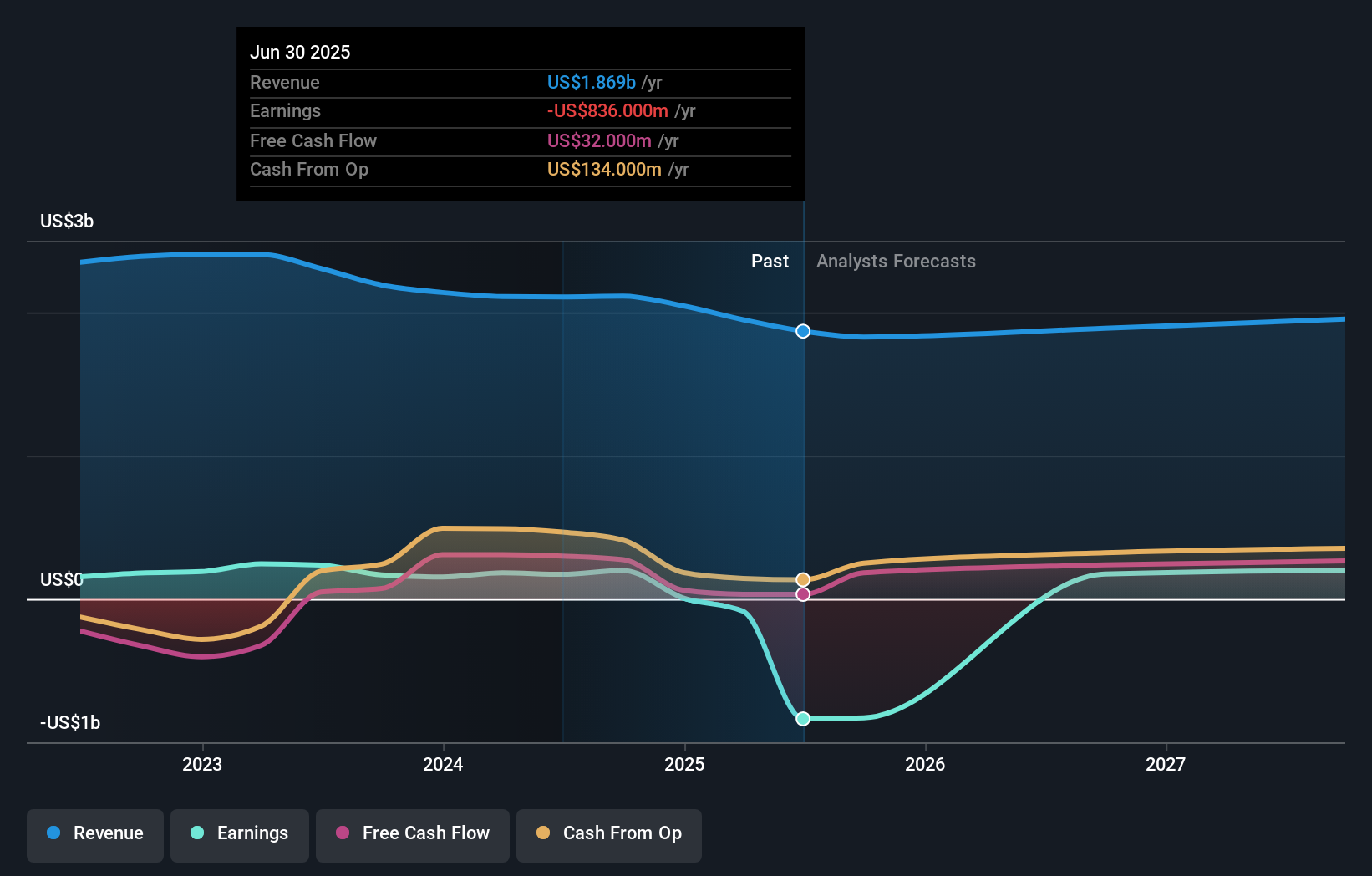

Ashland's narrative projects $2.0 billion revenue and $347.1 million earnings by 2028. This requires 1.9% yearly revenue growth and a $1,183.1 million earnings increase from the current $-836.0 million.

Uncover how Ashland's forecasts yield a $64.70 fair value, a 36% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community sets Ashland’s fair value estimates between US$64.70 and US$113.18, spanning two independent perspectives. With operational weaknesses and ongoing demand pressure still in focus, make sure you weigh the full range of views before forming your outlook.

Explore 2 other fair value estimates on Ashland - why the stock might be worth over 2x more than the current price!

Build Your Own Ashland Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ashland research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ashland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ashland's overall financial health at a glance.

No Opportunity In Ashland?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASH

Ashland

Provides additives and specialty ingredients in the North and Latin America, Europe, Asia Pacific, and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives