- United States

- /

- Chemicals

- /

- NYSE:APD

Can Air Products (APD) Use Yara Partnership Talks to Reframe Its Clean-Energy Capital Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, Air Products and Chemicals and Yara International announced they are in advanced negotiations to partner on low-emission ammonia projects in Louisiana and Saudi Arabia, linking Air Products’ hydrogen assets with Yara’s global ammonia production, storage, and distribution network.

- The proposed structure, including Yara’s plan to acquire roughly one-quarter of the Louisiana ammonia assets’ estimated US$8–9 billion cost and enter long-term offtake and marketing agreements, could materially reshape how Air Products funds and monetizes its large clean-energy projects.

- We’ll now examine how this potential long-term partnership with Yara on low-emission ammonia supply and marketing could influence Air Products’ investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Air Products and Chemicals Investment Narrative Recap

To own Air Products and Chemicals today, you need to believe its heavy investment in clean hydrogen and low emission ammonia eventually converts large capital projects into sustainable earnings and cash flow. The Yara talks do not alter that core thesis, but they could influence the near term catalyst of bringing capital in process onto the income statement, while also touching the key risk that long duration, multi billion dollar projects strain free cash flow if timelines slip.

The most relevant recent announcement here is the update that the NEOM Green Hydrogen Project is over 90% complete, with commercial production targeted for 2027 and a Yara marketing agreement aimed for early 2026. Together with the Louisiana Clean Energy Complex, this ties the current share price reaction directly to whether Air Products can turn these large projects into productive assets without further delays or cost pressure.

Yet while the ammonia partnership could ease future funding needs, investors should still be aware that...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals' narrative projects $14.9 billion revenue and $3.8 billion earnings by 2028. This requires 7.4% yearly revenue growth and a roughly $2.2 billion earnings increase from $1.6 billion today.

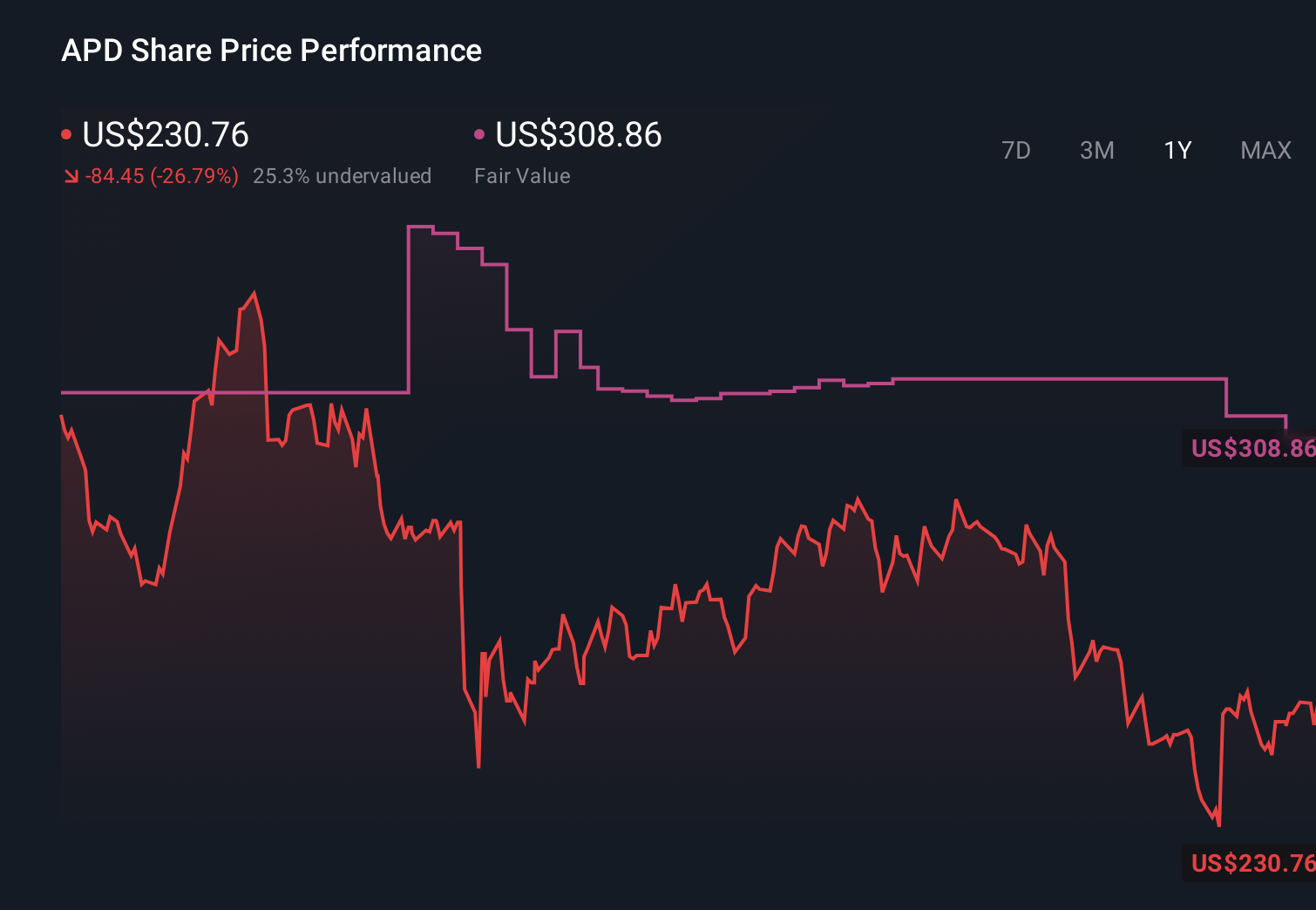

Uncover how Air Products and Chemicals' forecasts yield a $308.86 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates cluster between US$262 and US$309 per share, showing a fairly tight spread of opinions. Readers should weigh this against the risk that large, long duration hydrogen and ammonia projects could restrict free cash flow for years, which may influence how quickly the business performance catches up with any valuation view.

Explore 3 other fair value estimates on Air Products and Chemicals - why the stock might be worth just $262.40!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>