- United States

- /

- Chemicals

- /

- NYSE:APD

Air Products and Chemicals (NYSE:APD) Declares Quarterly Dividend of US$1.79 Per Share

Reviewed by Simply Wall St

Air Products and Chemicals (NYSE:APD) announced a quarterly dividend of $1.79 per share, reinforcing its commitment to returning value to shareholders. Despite the broader market's 1% decline over the last seven days, APD saw a 5% uptick in its stock price over the past month. This contrast can partly be attributed to the dividend announcement. Meanwhile, market movements have been volatile, with slight rebounds amidst concerns over federal spending and bond yields. In light of this, Air Products’ financial results, showing a notable net loss, appear countered by the broader upward trend in the tech sector and cryptocurrency surge.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

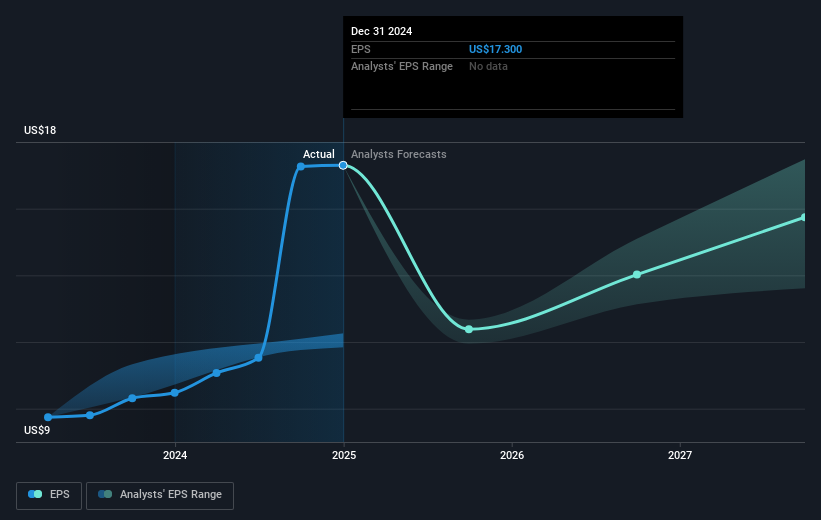

The recent dividend announcement by Air Products and Chemicals (NYSE:APD) underscores its commitment to shareholder value despite a challenging financial environment. The company's stock price rose 5% over the past month, contrasting with the market's 1% decline, and demonstrates investor confidence. Over five years, APD's total return, including share price and dividends, was 29.15%, indicating long-term value creation. However, the underwhelming recent fiscal results, highlighted by a net loss, suggest potential hurdles as the company seeks to capitalize on the favorable conditions in the tech and crypto sectors.

The dividend news could instill further investor confidence, potentially impacting future revenue and earnings forecasts positively. It's essential to evaluate how this aligns with the company's refocus on core industrial gases and ambitious projects in Saudi Arabia and Louisiana. These initiatives are projected to deliver substantial gains, contingent on successful execution. Yet, the share price of US$267.62 remains below the consensus price target of US$320.2, presenting an opportunity for growth if expectations are met. Despite the higher valuation compared to peers, analysts are optimistic about APD's ability to generate substantial revenue and earnings growth in the coming years. Over the past year, APD outperformed the US Chemicals industry, which saw an 8.7% decline, though it lagged behind the broader US market's 9.1% gain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:APD

Air Products and Chemicals

Provides atmospheric gases, process and specialty gases, equipment, and related services in the Americas, Asia, Europe, the Middle East, India, and internationally.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives