- United States

- /

- Metals and Mining

- /

- NYSE:AMR

Alpha Metallurgical Resources (NYSE:AMR) Slides 12% in a Week Amid Trade War Fears

Reviewed by Simply Wall St

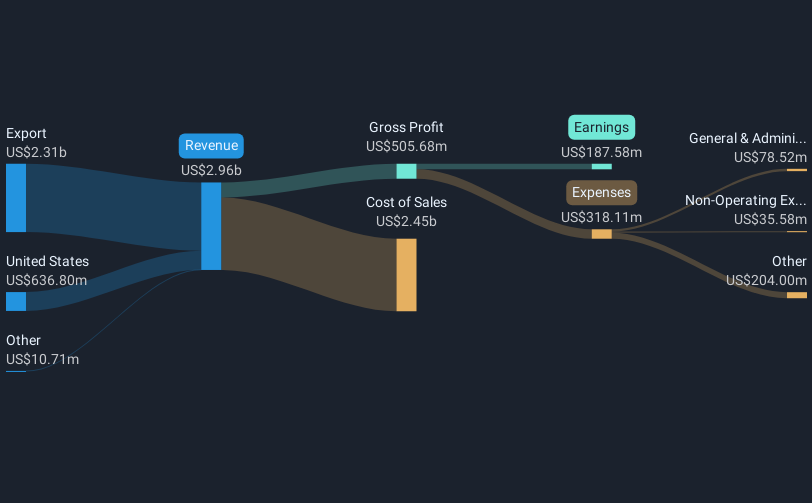

Alpha Metallurgical Resources (NYSE:AMR) saw a price decline of 12% over the last week, a movement possibly influenced by broader market dynamics. The global stock markets experienced sharp declines as fears related to a trade war accelerated, with major indices entering correction and bear market territories. This broader market volatility, exacerbated by escalating tariffs and economic uncertainty, may have impacted investor sentiment towards Alpha Metallurgical Resources. Although the company did not report specific news during this period, the sector it operates in might be particularly sensitive to economic disruptions, mirroring the broader market's 6% drop over the same timeframe.

The last five years have seen Alpha Metallurgical Resources achieve a very large total return of 2948.80%, reflecting significant growth despite recent challenges. The company's focused approach on strategic mergers and acquisitions, alongside the anticipated development of the Wildcat mine, has strengthened its position. This strategy, combined with maintaining a strong balance sheet, has helped mitigate the impacts of market volatility, allowing the company to capitalize on favorable steel demand projections.

Throughout this period, key actions like share buybacks have been a significant focus, with over 6.63 million shares repurchased for US$1.10 billion since March 2022. Despite experiencing revenue declines, reflected in decreasing earnings reports, Alpha consistently declared quarterly dividends, offering US$0.50 per share as of 2023. Additionally, leadership changes, including the appointment of Michael Gorzynski as chairman, and enhancements in corporate governance have been pivotal. The company's inclusion in the S&P 1000 and S&P 600 indices further underscores its growing market presence and investor confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMR

Alpha Metallurgical Resources

A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives