- United States

- /

- Metals and Mining

- /

- NYSE:AMR

Alpha Metallurgical Resources (AMR): Assessing Valuation Following Insider Buying, Buyback Restart, and Kingston Wildcat Progress

Reviewed by Kshitija Bhandaru

If you are weighing whether to buy, hold, or take profits on Alpha Metallurgical Resources (AMR), recent headlines might give you pause. The spotlight is back on this coal producer after a director scooped up 108,000 shares, building on a year-long pattern of insider accumulation. Add in strong second-quarter results, marked by improvements in operating efficiency and lower sales costs, plus news that the buyback program has restarted and that Kingston Wildcat is moving ahead, and you have several signals worth a closer look.

The stock’s ride over the past year has been anything but smooth. Shares have climbed nearly 60% over the past 3 months, reversing course after a year of underperformance. Despite long-term returns remaining impressive and management signaling optimism with their own money, the market continues to size up whether Alpha Metallurgical is primed for a comeback or simply volatile. Recent progress at Kingston Wildcat, with coal production on the horizon, only adds to the intrigue.

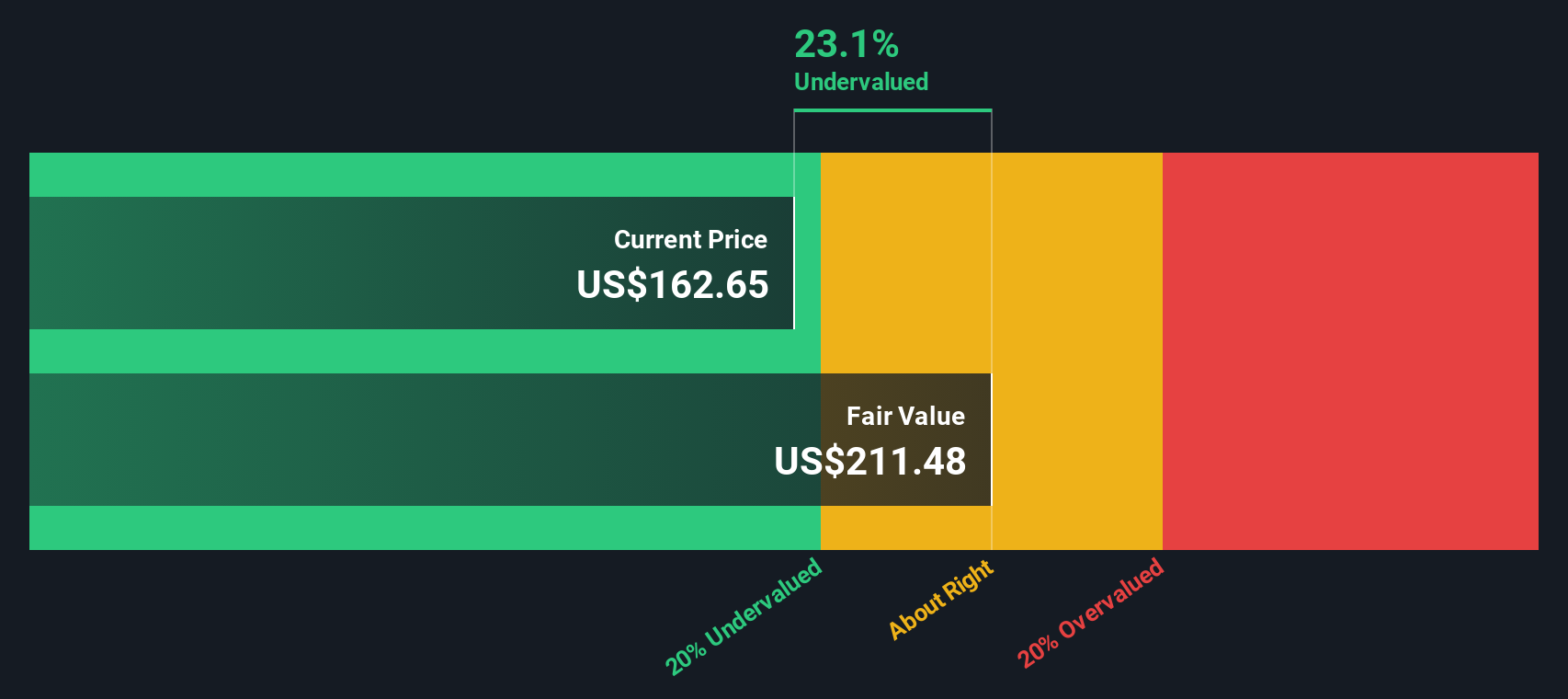

With so much positive movement in management and the share price, is Alpha Metallurgical Resources still undervalued, or is the market already baking future growth into its price?

Most Popular Narrative: 20% Undervalued

The prevailing narrative sees Alpha Metallurgical Resources as undervalued by about 20%, pegging its fair value well above the current market price. This view emerges from a sharp revision in analysts' expectations surrounding profit margins and revenue growth, set against the backdrop of new federal policy support.

"The addition of metallurgical coal to the U.S. critical minerals list under recent federal legislation (One Big Beautiful Bill Act) makes Alpha's products eligible for a new production tax credit between 2026 and 2029. This could potentially deliver $30 to $50 million in annual cash benefits and directly boost Alpha's free cash flow and net earnings during those years."

Curious how a shifting regulatory landscape and improved business fundamentals have changed the game for Alpha? There is one core assumption and a set of bold future projections driving analysts’ consensus. These are numbers that might surprise even longtime followers. Want to see what is fueling this valuation boost and how aggressive the expectations really are? Take a closer look at the blueprint behind the most-watched price target to uncover the financial moves baked into these predictions.

Result: Fair Value of $167.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing shifts in global steel demand and regulatory changes could challenge Alpha's bullish outlook. These factors could serve as potential catalysts that may disrupt future projections.

Find out about the key risks to this Alpha Metallurgical Resources narrative.Another View: Discounted Cash Flow Model

Stepping back from market price targets, our SWS DCF model approaches Alpha Metallurgical Resources from a different angle and also finds the company undervalued. But can both methods really tell the same story, or does one miss the mark?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alpha Metallurgical Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alpha Metallurgical Resources Narrative

If you see things differently or want to analyze the numbers on your own terms, you can build your own view in just a few minutes. Do it your way.

A great starting point for your Alpha Metallurgical Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for Your Next Opportunity?

If you want to stay ahead of the crowd, now is the time to look beyond Alpha. The Simply Wall Street Screener makes it easy to pinpoint standout investments tailored to your strategy, so you never miss a promising move.

- Capitalize on value by targeting stocks the market may have overlooked using our powerful tool for unearthed gems, including undervalued stocks based on cash flows.

- Catch the wave of innovation by tapping into emerging companies at the intersection of healthcare and AI. See which breakthrough firms are gaining traction with healthcare AI stocks.

- Grow your passive income stream by tracking businesses that consistently offer strong yields. Start building your future with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMR

Alpha Metallurgical Resources

A mining company, produces, processes, and sells met and thermal coal in Virginia and West Virginia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives