- United States

- /

- Packaging

- /

- NYSE:AMCR

Amcor (AMCR) Reports Transition To Net Loss Of US$39 Million In Q4 2025 Earnings

Reviewed by Simply Wall St

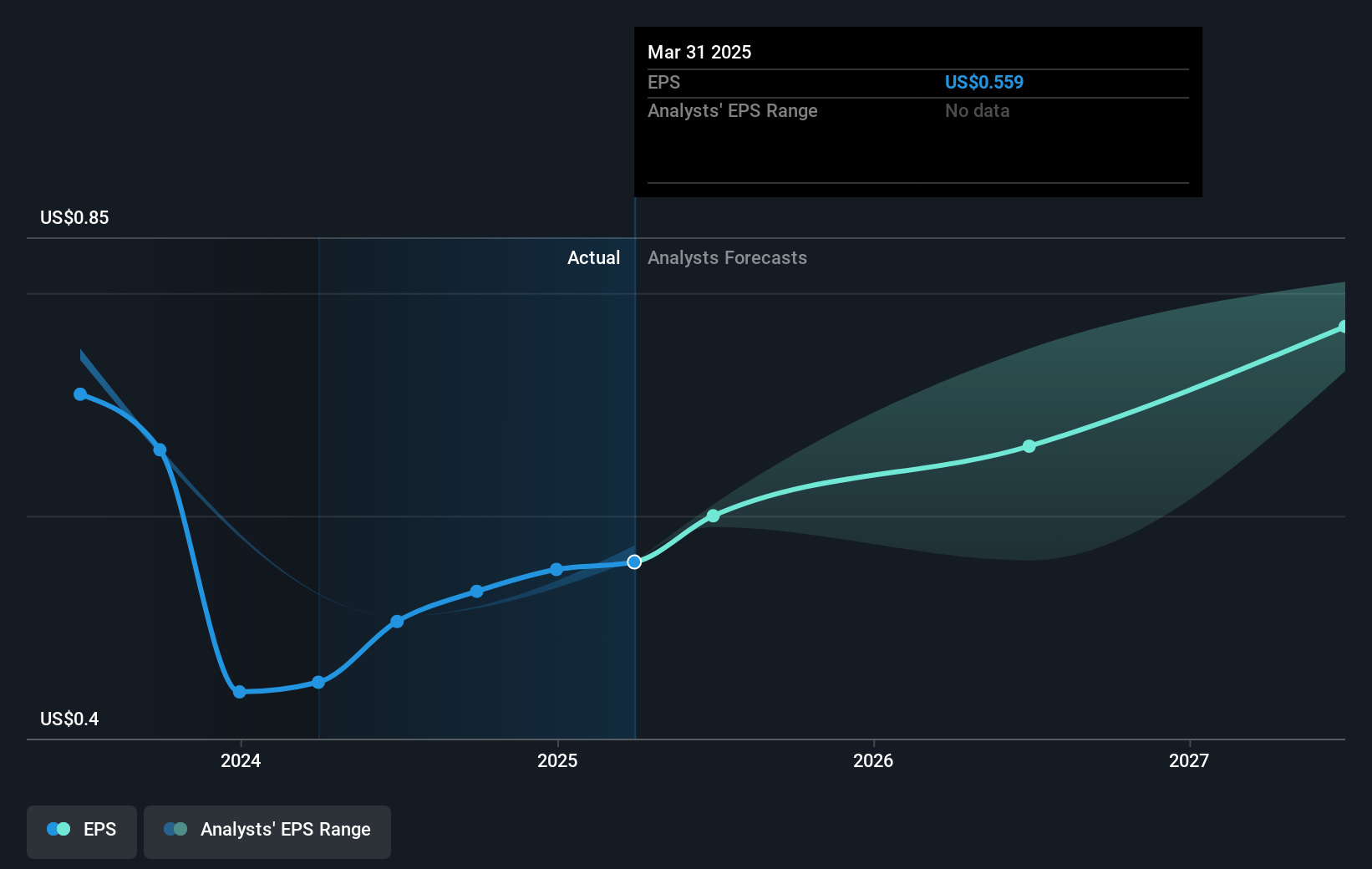

Amcor (AMCR) recently announced a quarterly dividend of USD 0.13 per share and reported its Q4 2025 earnings results, showing substantial sales growth to USD 5,082 million, up from USD 3,535 million a year ago, but a transition from net income to a net loss of USD 39 million. Despite these earnings figures and steady dividend announcements, Amcor's share price recorded an 8.82% decline over the last quarter, which contrasts with the broader market's positive trend. Market uncertainties, such as fluctuating inflation data influencing Federal Reserve rate decisions, may have amplified investor caution, contributing to the share's downward movement.

Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

The recent news of Amcor's quarterly dividend announcement and its transition to a net loss highlights ongoing challenges and opportunities as the company navigates its merger integration with Berry Global. The company's shares recorded an 8.82% decline in the last quarter despite robust Q4 sales growth. Over a five-year period, Amcor's total shareholder return stood at a 2.28% decline, indicating underperformance compared to market gains over the same duration. In the past year, Amcor also underperformed the broader US market, which returned 15.8%.

The announced earnings results, despite substantial sales growth to US$5.08 billion, show a transition from net income to a US$39 million loss. This could affect future revenue and earnings forecasts, with analysts projecting improvements through merger synergies and enhanced R&D capabilities. However, market conditions such as fluctuating inflation could further impact these forecasts. As of now, Amcor's shares are trading at US$8.48, presenting a considerable discount to the analyst price target of US$11.04, suggesting significant upside potential in meeting projected earnings and revenue growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AMCR

Amcor

Engages in the production and sale of packaging products in Europe, North America, Latin America, and the Asia Pacific.

Moderate risk with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives