- United States

- /

- Chemicals

- /

- NYSE:ALB

Is Albemarle’s (ALB) Analyst-Led Rebound Signaling a Turning Point in Its Earnings Narrative?

Reviewed by Sasha Jovanovic

- Albemarle experienced a rebound following consecutive share price declines, as analyst earnings outlooks improved ahead of the company's November 2025 earnings report.

- This shift in investor sentiment comes despite ongoing financial challenges for Albemarle, highlighting how market optimism can build around anticipated near-term performance and analyst estimate revisions.

- We'll examine how the upward analyst earnings revisions ahead of Albemarle's upcoming earnings release reshape the company's investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Albemarle Investment Narrative Recap

Belief in Albemarle as an investment centers on the expectation that global lithium demand and EV adoption will eventually outpace near-term supply pressures and reset profitability higher, despite industry volatility. While recent analyst upgrades signal some optimism ahead of the November 2025 earnings report, the core risk, persistently low lithium prices from oversupply, remains unchanged for now, and these estimate revisions have yet to materially alter this key challenge facing the business.

Of recent corporate announcements, Albemarle's commitment to operational and structural efficiency stands out. The August 2025 changes aimed at enhancing agility and executive oversight could influence the company's ability to respond to uncertain pricing and demand conditions, but the biggest near-term catalyst will still be the upcoming earnings results and any forward guidance.

Yet, with continued spot price weakness and supply overhang, investors should be mindful that even with positive analyst sentiment, the risk of prolonged suppressed margins is...

Read the full narrative on Albemarle (it's free!)

Albemarle's outlook anticipates $6.9 billion in revenue and $1.1 billion in earnings by 2028. This is based on analysts forecasting an annual revenue growth rate of 11.5% and a turnaround in earnings of $2.2 billion, up from current earnings of -$1.1 billion.

Uncover how Albemarle's forecasts yield a $86.65 fair value, in line with its current price.

Exploring Other Perspectives

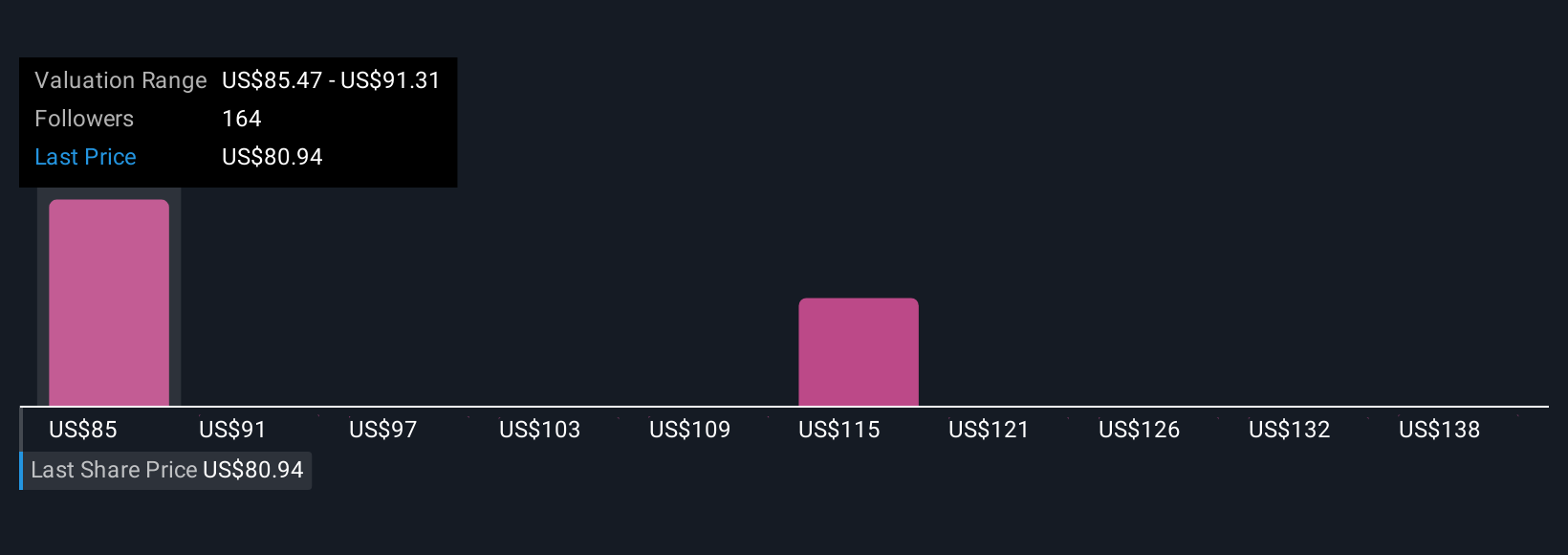

Fair value estimates from ten Simply Wall St Community members span from US$86.65 to US$143.88 per share, reflecting sometimes sharply contrasting expectations. While these views are wide-ranging, persistent lithium oversupply and ongoing price risk remain at the forefront for Albemarle's long-term financial performance, so keep an open mind and consider multiple perspectives before you decide.

Explore 10 other fair value estimates on Albemarle - why the stock might be worth just $86.65!

Build Your Own Albemarle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albemarle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Albemarle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albemarle's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives