- United States

- /

- Chemicals

- /

- NYSE:ALB

Assessing Albemarle’s Rally After Lithium Price Recovery in 2025

Reviewed by Bailey Pemberton

Thinking about what to do with Albemarle stock these days? You’re certainly not alone. After a tough stretch, Albemarle has staged an impressive near-term rally, posting a 7.1% jump over the past week and 21.1% over the last month. Even year-to-date, shares have rebounded by 15.2%. Still, if you zoom out, the five-year return is just 8.6% and the three-year performance shows a steep drop of 60.0%. Clearly, this is a stock that’s been through quite a roller coaster, which has investors wondering whether the ride is headed up or down from here.

Much of this recent recovery can be traced to shifting sentiment around lithium demand, especially as global markets watch electric vehicle adoption and government policy. Some analysts have highlighted how supply chain adjustments and hopeful signals from major automakers have helped renew interest. There’s also emerging debate over whether the market has overestimated the risks facing Albemarle, a company widely viewed as a lithium sector bellwether.

But with volatility comes questions: Is Albemarle actually undervalued at current prices, or is the latest bounce just noise? According to a valuation score across six key checks, Albemarle passes 2, meaning it scores a 2 out of 6 on the undervaluation front. That might sound mixed, but it only tells part of the story.

In the next section, I’ll break down the most common valuation methods pros use to size up Albemarle, and why some “standard” numbers may miss the mark. And if you stick around to the end, you’ll see an even smarter way to think about valuing this company, one most investors overlook.

Albemarle scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Albemarle Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model is designed to estimate a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. In Albemarle’s case, analysts use a two-stage model which factors in near-term estimates as well as more speculative, long-term growth.

Currently, Albemarle’s latest twelve-month Free Cash Flow (FCF) sits at a deficit of $330.5 million. Despite this negative starting point, analysts project a turnaround. By 2027, FCF is estimated to reach $357.3 million. Using these and broader 10-year projections, Albemarle’s FCF is expected to grow past the $1 billion mark by 2030, with projections indicating it could continue to climb through 2035. This reflects significant optimism about its cash generation power in the coming years.

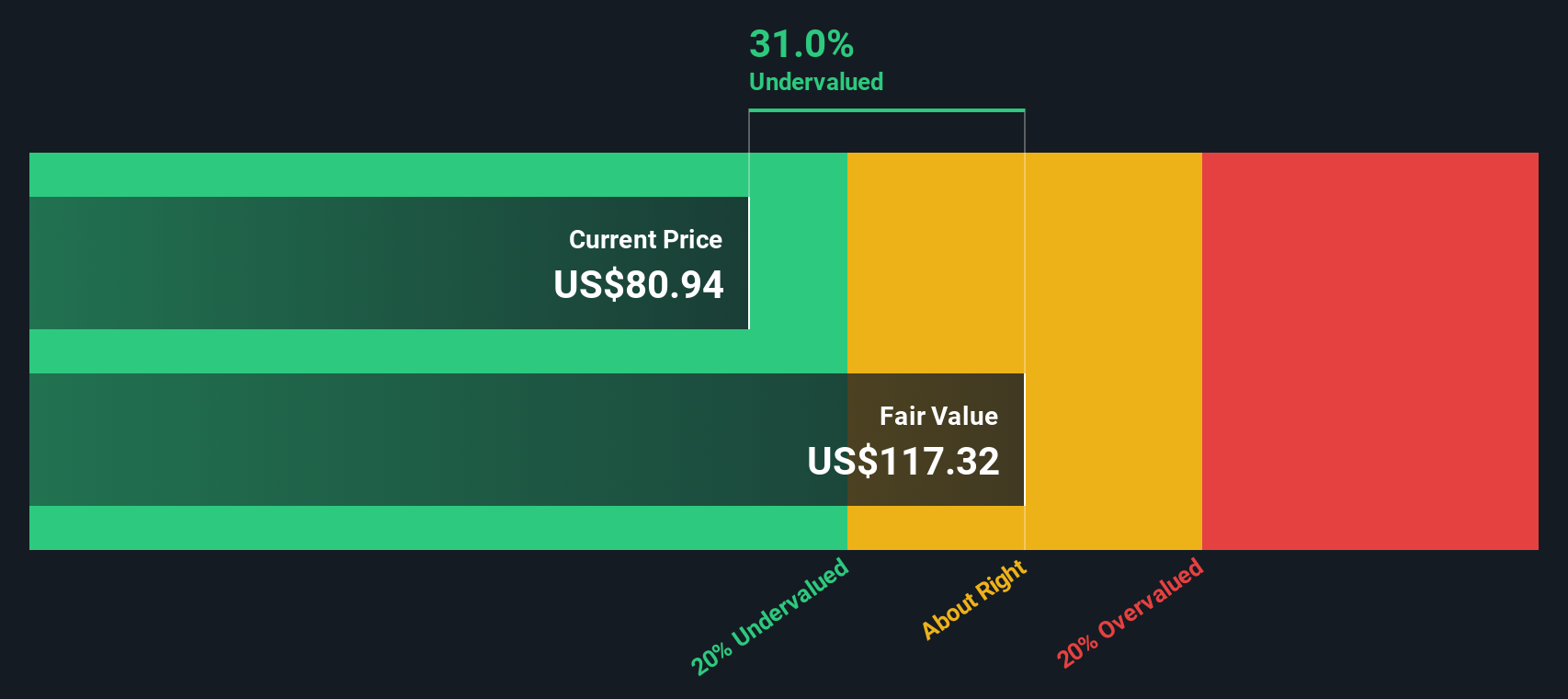

When all these projected cash flows are discounted back to present value, the fair value estimate for Albemarle lands at $154.82 per share. With the DCF accounting for a 36.6% intrinsic discount at recent prices, the model sees Albemarle stock as meaningfully undervalued compared to its underlying cash flow profile.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Albemarle is undervalued by 36.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Albemarle Price vs Sales

Price-to-Sales (P/S) is a favored valuation metric, especially for companies where profits can fluctuate widely from year to year. For cyclical or fast-changing industries like chemicals and lithium, the P/S ratio helps investors focus on revenue rather than volatile earnings. This can provide a clearer snapshot of market optimism or skepticism.

Growth expectations and risk are major drivers of what counts as a "normal" or "fair" P/S ratio. Companies with higher expected revenue growth or lower perceived risk typically command higher multiples. Slower-growing or riskier businesses tend to trade at a discount.

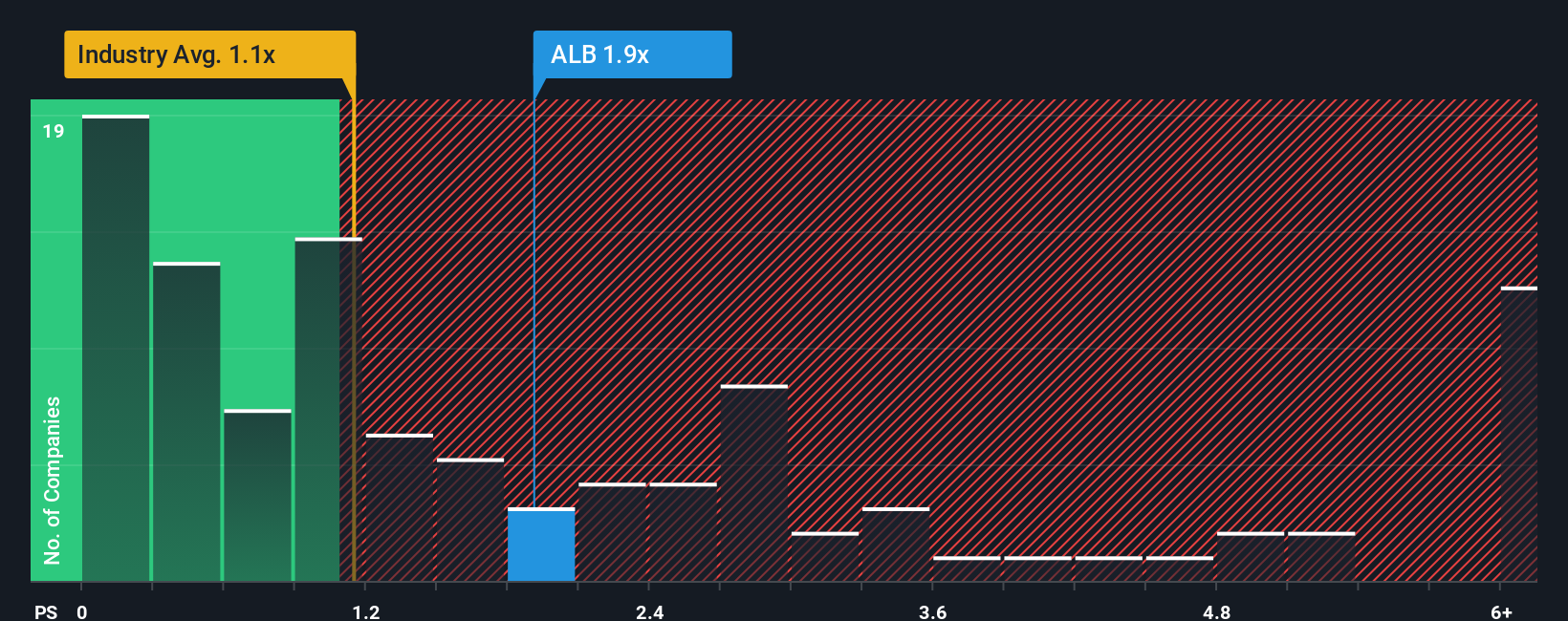

Currently, Albemarle trades at a P/S ratio of 2.31x. For context, the chemicals industry average stands at 1.17x, and its peer average is 1.69x. This means Albemarle is priced well above both industry and peer benchmarks based on sales alone.

However, Simply Wall St’s "Fair Ratio" for Albemarle is 1.25x. Unlike standard multiples, the Fair Ratio incorporates a holistic look at Albemarle’s sales growth, margins, industry conditions, market cap, and risk profile. This makes it a more accurate benchmark as it adjusts for realities that can skew peer or industry comparisons.

With Albemarle’s P/S at 2.31x, significantly above the Fair Ratio of 1.25x, the shares look overvalued by this measure despite positive sales momentum.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Albemarle Narrative

Earlier, we mentioned there is an even better way to assess valuation, so let’s introduce you to Narratives. Think of a Narrative as your investment story for Albemarle. It is the way you bring together your views on the company’s future and connect those to concrete forecasts for growth, profits, and margins. Narratives link Albemarle’s business outlook with the numbers, mapping your story to a financial forecast and, ultimately, a fair value that you can compare with the latest price.

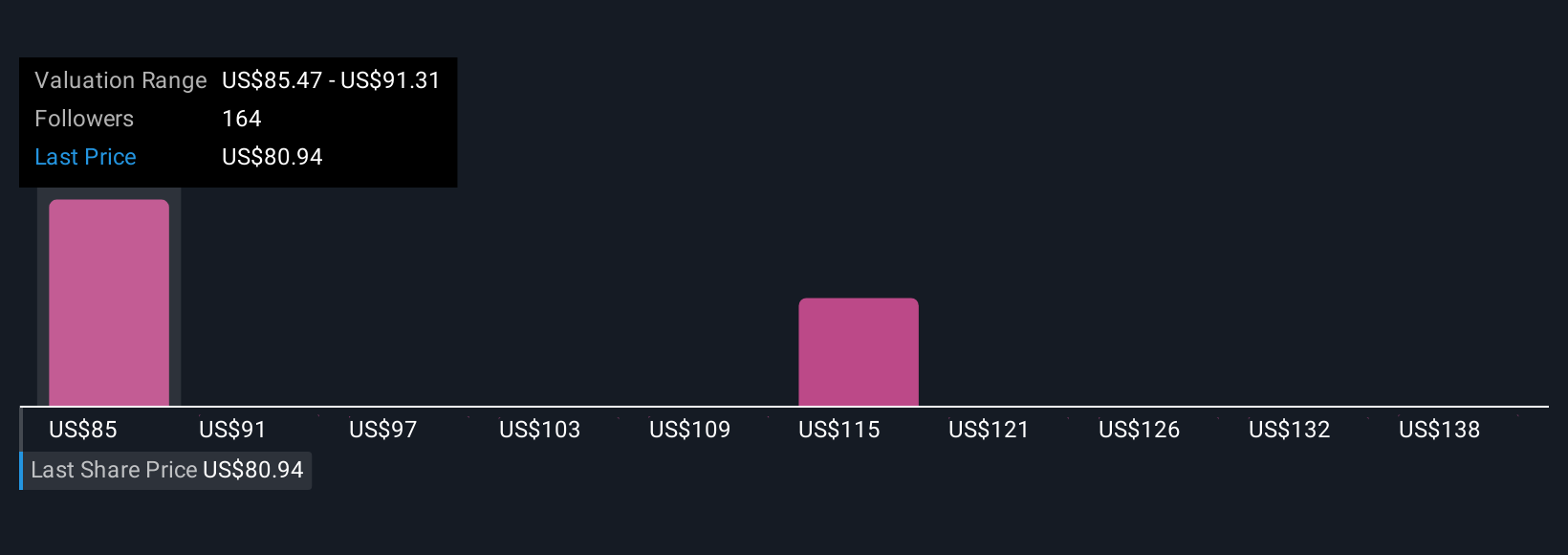

Narratives are simple and accessible. On Simply Wall St's Community page, millions of investors use them to articulate “why” they are bullish or bearish, and the platform automatically ties these stories to valuation models, updating dynamically as news or earnings roll in. They are especially useful for tricky situations. For instance, one Albemarle Narrative assumes lithium demand rebounds, cost cutting pays off, and a fair value of $200 is warranted. Another, more pessimistic Narrative factors in weak pricing and regulatory risks, placing fair value closer to $58. Narratives let you size up both perspectives at a glance so you can decide whether Albemarle is a buy, sell, or hold based on your outlook and risk tolerance.

Do you think there's more to the story for Albemarle? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives