- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (NYSE:ALB) Stock Slides 14% After Sales Dip US$1,124 Million

Reviewed by Simply Wall St

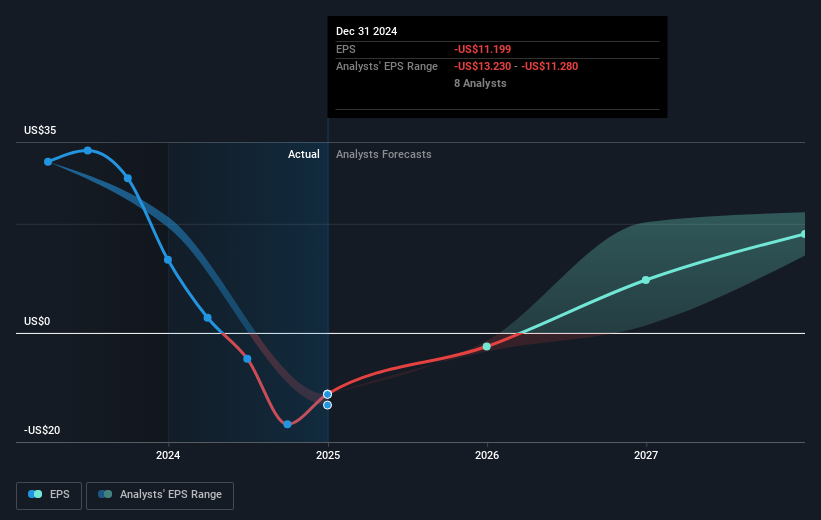

Albemarle (NYSE:ALB) experienced a price decline of 14% last week, a period marked by several significant developments. Investors might have processed the company's affirmation of a quarterly dividend of $0.405 per share, shortly after the announcement of its Q4 2024 earnings. Although Albemarle reported improved net income of $75 million compared to the previous year's net loss, sales decreased significantly to $1,232 million from $2,356 million. Meanwhile, there was turmoil in the broader market, as the S&P 500 saw a 2.5% weekly decline amidst concerns over new tariffs imposed by the U.S. on key trading partners. The market environment's impact on investor sentiment likely contributed to the downward pressure on ALB’s stock, aligning with a broader market sell-off that included other sectors like financial services and technology. Despite Albemarle's ongoing buyback commitments, their inactivity in recent quarters might have further influenced investor sentiment.

Unlock comprehensive insights into our analysis of Albemarle stock here.

Over the last five years, Albemarle Corporation's shares have achieved a total return of 1.34%, reflecting the company's challenges and opportunities. A significant moment was the announcement of Q4 2024 earnings, where sales fell to US$1.23 billion from the previous year's US$2.36 billion. Despite reduced sales, Albemarle moved toward profitability with a net income of US$75 million. Leadership changes, including Jim LaBauve’s appointment as Chief Accounting Officer, were made to navigate market uncertainties. Adding to the shifting landscape were rumors in 2024 regarding the sale of Albemarle's stake in the Greenbushes lithium mine, influenced by Chinese investment complexities.

Further impacting investor sentiment was Albemarle's collaboration with Caterpillar Inc., aimed at enhancing sustainable lithium mining technology. However, Albemarle's revised corporate guidance in November 2024, which lowered sales forecasts, may have further clouded long-term growth prospects. Additionally, without repurchasing shares during several quarters in 2024, Albemarle's buyback inactivity may have dampened confidence during broader market fluctuations.

- Understand the fair market value of Albemarle with insights from our valuation analysis—click here to learn more.

- Explore the potential challenges for Albemarle in our thorough risk analysis report.

- Already own Albemarle? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives