- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (NYSE:ALB) Announces Quarterly Dividend of US$0.41 Per Share

Reviewed by Simply Wall St

Albemarle (NYSE:ALB) recently declared a dividend of $0.405 per share, affirming its intent to return value to shareholders, yet the stock recorded a 4.29% decline over the past week. This price movement may be contextualized by broader market trends, as the Dow and S&P 500 had been experiencing losses for February, with the Nasdaq falling 5.5% this month. Market volatility, driven by tech earnings reports and U.S. tariff concerns, likely impacted investor sentiment across sectors. Despite the Federal Reserve's inflation reading suggesting stabilization, overall market uncertainties affected share performances. Consequently, while Albemarle's dividend affirmation underscores its stable financial footing, wider economic and market-related pressures overshadowed this positive development. As the market continues to navigate these challenges, observers will closely monitor Albemarle’s strategic maneuvers to sustain shareholder confidence.

Click to explore a detailed breakdown of our findings on Albemarle.

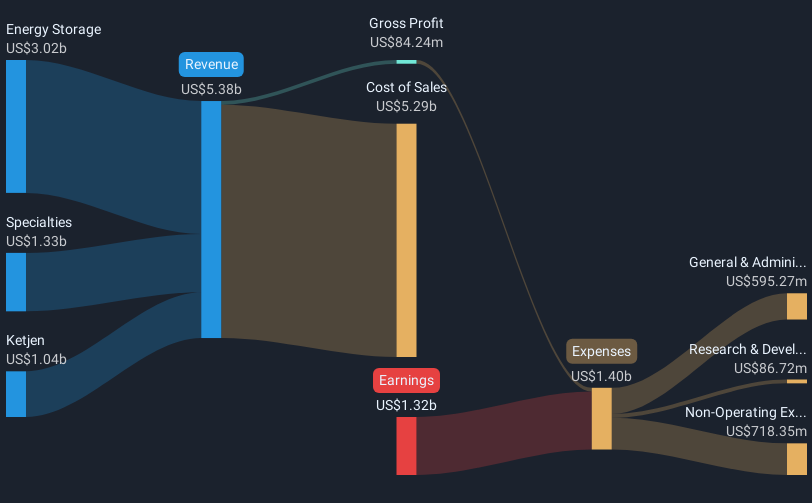

Over the last 5 years, Albemarle's total shareholder return, including share price and dividends, was a decline of 1.53%. Relative to the broader market, Albemarle underperformed, with the US market achieving growth over the past year. Several factors contributed to this performance. A significant earnings report in February 2025 showed a decrease in sales from a year earlier, although net income reversed from large losses, affecting overall investor perception. Furthermore, the M&A rumors, particularly around the potential sale of its stake in the Greenbushes lithium mine in 2024 due to falling lithium prices, likely influenced market sentiment adversely.

The company's price-to-sales ratio, at 1.7x, was higher than the US Chemicals industry average of 1.2x, suggesting it was trading at a premium, which might have affected investor attraction. Despite ongoing dividends, the payouts weren't well covered by earnings or free cash flows, raising sustainability concerns. This was compounded by Albemarle's announcement of no share buybacks in the latter part of 2024, showing restrained financial maneuvers to enhance shareholder returns.

- Analyze Albemarle's fair value against its market price in our detailed valuation report—access it here.

- Discover the key vulnerabilities in Albemarle's business with our detailed risk assessment.

- Hold shares in Albemarle? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Reasonable growth potential with adequate balance sheet.