- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (ALB) Declares Quarterly Dividend of US$0.41 Per Share

Reviewed by Simply Wall St

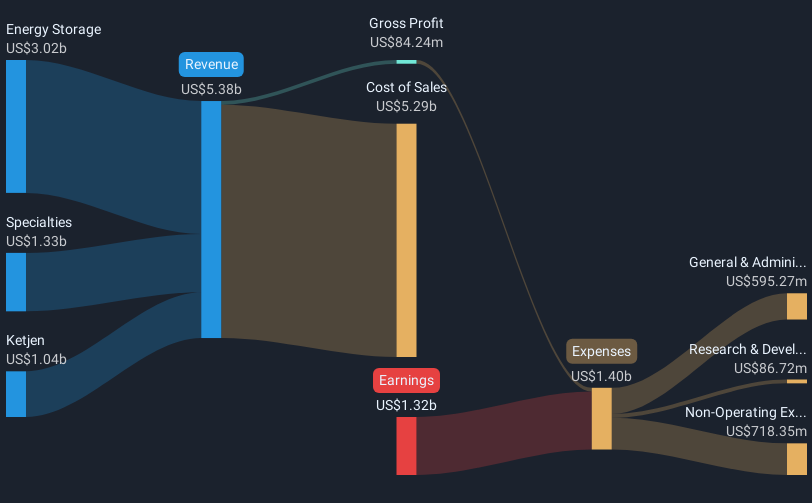

Albemarle (ALB) has affirmed its quarterly dividend of $0.405 per share, reflecting the company's ongoing commitment to returning value to shareholders. The stock price rose 50% in the last quarter, a substantial move possibly bolstered by its inclusion in the Russell 2500 and Value Indexes, which enhanced market visibility. Despite a year-over-year decline in sales, Albemarle's notable increase in net income highlights financial resilience. The broader market supported such gains, with the S&P 500 reaching record highs on trade deal optimism. Albemarle’s performance aligns closely with the market trend, although company-specific events likely provided additional momentum.

Albemarle has 1 weakness we think you should know about.

The recent affirmation of Albemarle’s quarterly dividend emphasizes its commitment to shareholder value, potentially stabilizing investor sentiment amidst volatile market dynamics. Over a longer-term perspective, Albemarle’s total shareholder return was 5.33% over the past five years, indicating modest growth. In stark contrast, the company's one-year performance lagged behind the broader US market where Albemarle's returns didn't match the market's 14.6% gain, highlighting current challenges in aligning with industry leaders.

The recent stock price surge of 50% likely provides a temporary uplift to Albemarle's market perception, though the longer-term revenue and earnings outlook remains under close scrutiny. Despite ongoing initiatives to optimize conversion networks and cut capital expenditures, the company's earnings remain susceptible to fluctuations in lithium market prices, and current leverage levels pose ongoing financial risks. The affirmation of the dividend and recent index inclusions may support market confidence, yet analysts maintain conservative revenue growth expectations, poised at 6.7% annually over the next few years. The stock is trading close to its price target of $83.38, suggesting limited immediate upside in market valuation, reflecting cautious market sentiment toward Albemarle’s future profit potential.

Evaluate Albemarle's historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives