- United States

- /

- Chemicals

- /

- NYSE:ALB

Albemarle (ALB): Assessing Valuation After Share Price Momentum and Updated Analyst Coverage in Lithium Sector

Reviewed by Kshitija Bhandaru

Albemarle (ALB) shares have picked up steam lately, catching investor attention as a leading lithium producer amid a wave of updated analyst forecasts. The company’s recent momentum aligns with intensified sector focus and changing market sentiment.

See our latest analysis for Albemarle.

After a slow start to the year, Albemarle’s share price has shown renewed strength in recent weeks as policy incentives and shifting lithium demand reignite investor interest. Still, even with its recent rally, the 12-month total shareholder return remains negative. This signals that while momentum may be building, long-term holders are yet to see gains recover.

If you’re curious where else momentum might be emerging, consider widening your search and explore fast growing stocks with high insider ownership.

With headlines swirling and analyst opinions divided, investors now face a key question: is Albemarle undervalued given its recent turnaround and sector prospects, or is the current price already factoring in future growth?

Most Popular Narrative: Fairly Valued

Albemarle's most widely followed narrative sees fair value nearly matching its last close, setting up a debate about whether the recent share price reflects all future growth drivers or misses hidden upside. Strong cost discipline and tailwinds from global policy are at the core of the consensus view.

Albemarle’s disciplined capital spending (60% CapEx reduction YoY and ongoing prioritization of highest-return projects) and improved cash conversion is enabling it to generate positive free cash flow, strengthen its balance sheet, and provide greater financial flexibility for future growth. This can bolster earnings as demand recovers and pricing normalizes.

Curious what ambitious forecasts underpin this razor-thin valuation margin? The narrative’s future hinges on bold shifts in profit margins and aggressive revenue expansion. The surprise is in the numbers. Can the company actually deliver these game-changing results?

Result: Fair Value of $86.65 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued lithium oversupply and regulatory changes could quickly undercut profit margin rebound, which could make the current valuation outlook harder to justify.

Find out about the key risks to this Albemarle narrative.

Another View: Discounted Cash Flow Perspective

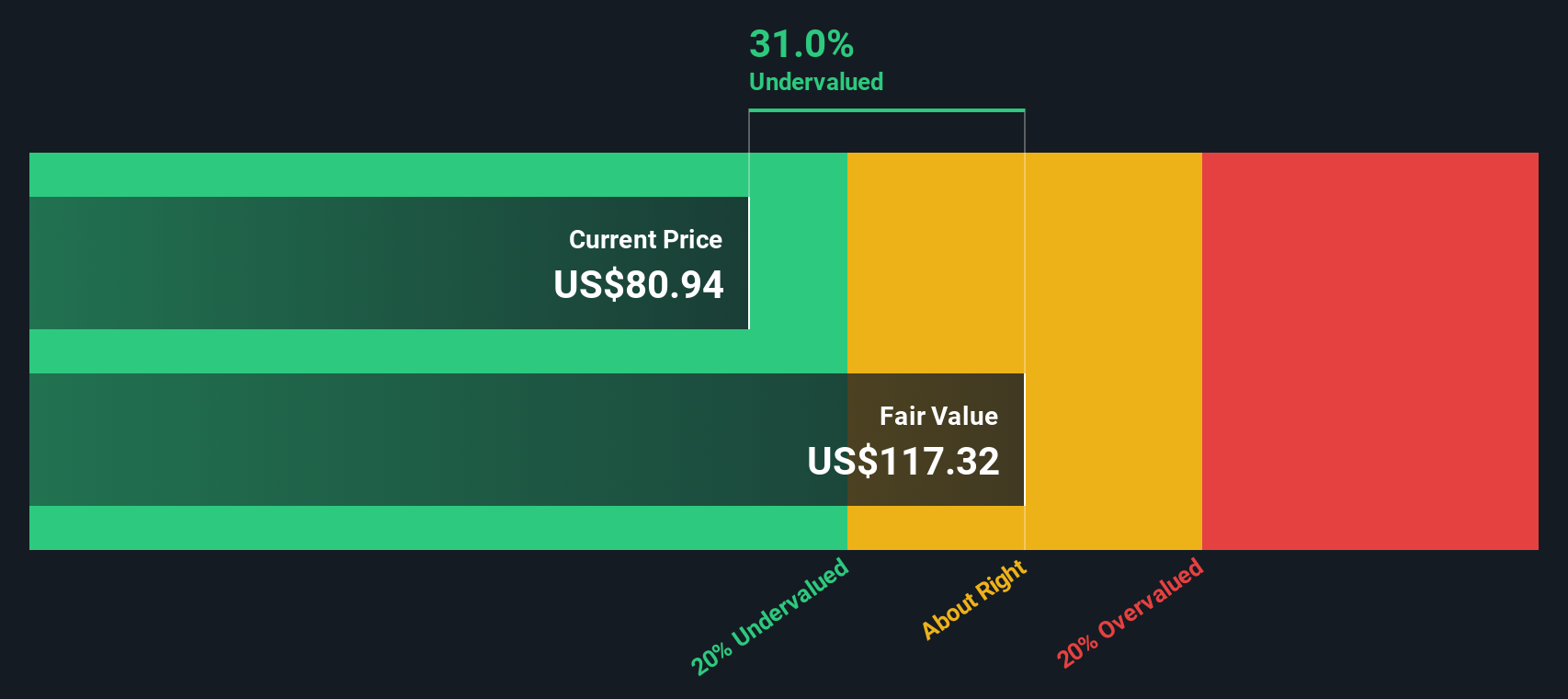

Looking beyond analyst price targets, our DCF model offers a different perspective. It suggests Albemarle is trading at a significant discount to its estimated fair value, with shares priced 25.8% below what the model calculates. Could the market be overlooking the company’s future cash flow potential, or is there a hidden risk analysts are including in their assessments?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Albemarle for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Albemarle Narrative

If you want to dig into the data yourself or see a different story than what’s presented here, you can build a personal view in just a few minutes with Do it your way.

A great starting point for your Albemarle research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Stock Picks You Don’t Want to Miss?

If you want to level up your strategy, don’t stop at Albemarle. The right tools can turn today’s opportunity into tomorrow’s big wins.

- Tap into high-yield opportunities by scanning these 19 dividend stocks with yields > 3% that are delivering income potential beyond traditional savings accounts.

- Jump ahead of the curve by seeking out innovation leaders among these 25 AI penny stocks who are driving breakthroughs across artificial intelligence sectors.

- Spot value before the crowd by targeting these 886 undervalued stocks based on cash flows with strong fundamentals and untapped growth prospects right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALB

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives