- United States

- /

- Metals and Mining

- /

- NYSE:AEM

Agnico Eagle Mines (NYSE:AEM) Declares US$0.40 Dividend

Reviewed by Simply Wall St

Agnico Eagle Mines (NYSE:AEM) experienced a remarkable price move, climbing 40% over the last quarter. This notable increase occurred despite the company reporting a decline in net income and earnings per share for 2024. The declaration of a $0.40 dividend and the confirmation of strong future production guidance possibly strengthened investor confidence. Additionally, the share buyback program, which saw the repurchase of 248,700 shares, may have contributed positively. The company's removal from an index could have countered these effects, yet overall, these events likely added significant weight to its strong quarterly performance compared to the broader market trend.

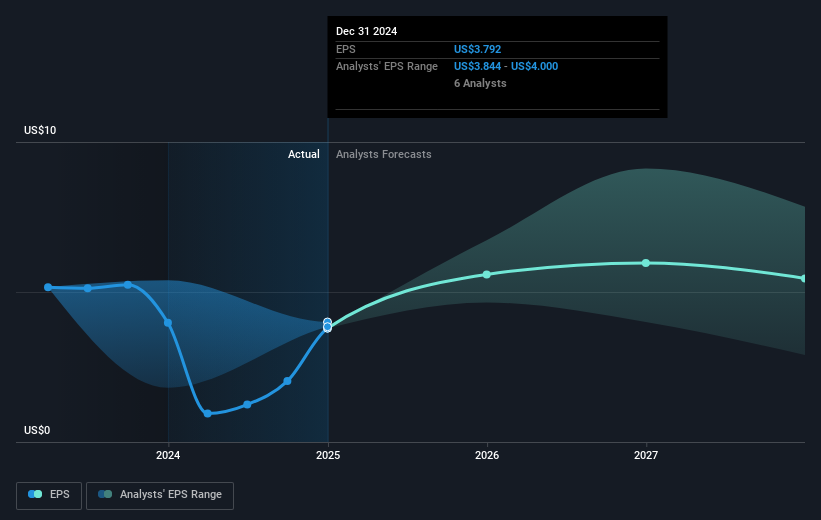

The recent developments surrounding Agnico Eagle Mines have contributed significantly to its narrative. The strong quarterly share price increase of 40% contrasts with the company's decline in net income and earnings per share for 2024. However, the declared dividend and active share buyback program have reinforced investor confidence. These moves, combined with confirmed production guidance, suggest a strategy focused on shareholder value, potentially bolstering future revenue and earnings forecasts.

Over a five-year period, Agnico Eagle Mines has delivered a total shareholder return of 148.21%, highlighting robust long-term performance. This surpasses the broader US market return of 3.6% over the past year. Despite the one-year challenges, such as a 2.9% drop in production guidance, Agnico Eagle's commitment to expansion projects like Hope Bay and Malartic could sustain revenue growth, though rising costs remain a concern.

While the stock's current price of US$100.13 remains below the consensus price target of US$114.69, indicating a potential upside of 12.7%, it reflects cautious investor sentiment amid varying analyst earnings projections. The consensus anticipates earnings reaching US$2.4 billion by April 2028, contingent on the company maintaining a Price-to-Earnings ratio of 30.0x. As such, the news from the introduction supports a cautiously optimistic outlook, balanced against revenue risks and cost escalation concerns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Agnico Eagle Mines, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AEM

Agnico Eagle Mines

A gold mining company, engages in the exploration, development, and production of precious metals.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives