- United States

- /

- Metals and Mining

- /

- NYSE:AA

The Bull Case For Alcoa (AA) Could Change Following Tariff Hit and Alumina Acquisition-Driven Sales Shift

Reviewed by Sasha Jovanovic

- Alcoa Corporation recently reported a substantial impact from increased US aluminum tariffs, reducing quarterly EBITDA by almost US$100 million, but has partially offset this by redirecting sales to Canada and Europe following its 2024 acquisition of Alumina Limited.

- The possibility of tariff removal could boost Alcoa’s annual earnings by nearly US$400 million, highlighting the company’s operational flexibility and supply chain strength amid challenging global trade conditions.

- We’ll explore how Alcoa’s efforts to counteract high US tariffs could reshape its future earnings outlook and investment appeal.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Alcoa Investment Narrative Recap

At a glance, investing in Alcoa hinges on expectations that global aluminum demand, sustainability trends, and operational efficiency will drive long-term returns. The recent impact of US aluminum tariffs is currently the most important short-term catalyst, as their removal could significantly boost annual earnings, while ongoing cost controls and supply chain shifts mitigate near-term risks. However, continued tariff pressures remain a key variable that could materially affect Alcoa’s earnings outlook. The most recent closure of Alcoa’s Kwinana alumina refinery in Western Australia, announced in late September 2025, underscores the company’s ongoing operational adjustments amid volatile global trade. This move, while not directly related to tariff impacts, spotlights Alcoa’s proactive approach to addressing cost headwinds and market shifts, tying into the near-term catalyst of earnings relief from potential tariff removals. Yet, investors should also keep in mind that unexpected developments in global supply, especially production trends from China and other regions, could present risks that...

Read the full narrative on Alcoa (it's free!)

Alcoa's outlook anticipates $13.6 billion in revenue and $592.1 million in earnings by 2028. This is based on an annual revenue growth rate of 2.0% and a $396.9 million decrease in earnings from the current $989.0 million.

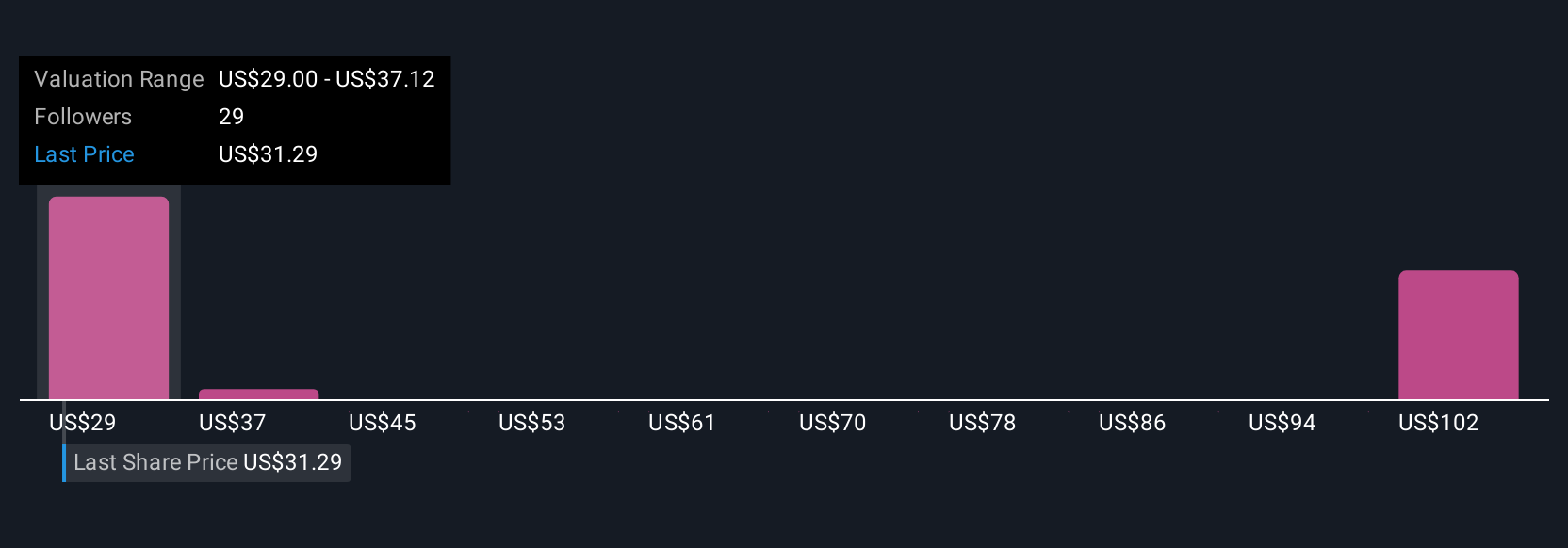

Uncover how Alcoa's forecasts yield a $36.64 fair value, in line with its current price.

Exploring Other Perspectives

Six community fair value estimates for Alcoa range from US$23.86 to an ambitious US$160.53. While views within the Simply Wall St Community are diverse, ongoing trade policy uncertainty shapes the earnings outlook and calls for examining a variety of expectations.

Explore 6 other fair value estimates on Alcoa - why the stock might be worth over 4x more than the current price!

Build Your Own Alcoa Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alcoa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alcoa's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion