- United States

- /

- Metals and Mining

- /

- NYSE:AA

Alcoa (AA) Is Up 9.6% After Q3 Results and Gallium Plant Expansion: What's Changed

Reviewed by Sasha Jovanovic

- Alcoa recently reported third-quarter 2025 results, including higher aluminum production, a surge in net income to US$232 million, and new capital investments at its U.S. Massena smelter, alongside a joint government-supported initiative to develop a gallium plant in Australia.

- This expansion into critical mineral supply chains, coupled with modernization of core North American assets, signals Alcoa's moves to strengthen its market position and operational resilience in response to shifting industry demands.

- We'll explore how Alcoa's gallium plant joint venture with multiple governments could reshape the company's long-range investment thesis.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Alcoa Investment Narrative Recap

To invest in Alcoa today, you'd need to believe in the durability of global aluminum demand, its ability to optimize U.S. production, and ongoing progress in critical minerals like gallium. While the latest quarterly results and new capital projects support operational momentum, risks from tariffs and mine approval delays remain central near-term issues. The positive results do not materially shift these dynamics; tariff-related costs and regulatory overhang are still in focus for both short-term performance and longer-term upside.

Of the recent developments, Alcoa's $60 million investment to modernize the Massena smelter in New York is particularly relevant. Paired with a decade-long renewable energy contract, this announcement underscores how Alcoa is working to sustain and upgrade domestic production, an action that ties directly to one of the company’s main catalysts: secure, cost-effective energy for future U.S. output and improved resiliency against volatility in global supply or pricing.

Yet, beneath the upbeat headlines, it’s essential for investors to understand the ongoing risks if mine approvals stall or tariffs remain stubbornly high, because...

Read the full narrative on Alcoa (it's free!)

Alcoa's outlook projects $13.6 billion in revenue and $592.1 million in earnings by 2028. This is based on a 2.0% annual revenue growth rate and a decrease in earnings of $396.9 million from the current earnings of $989.0 million.

Uncover how Alcoa's forecasts yield a $39.21 fair value, in line with its current price.

Exploring Other Perspectives

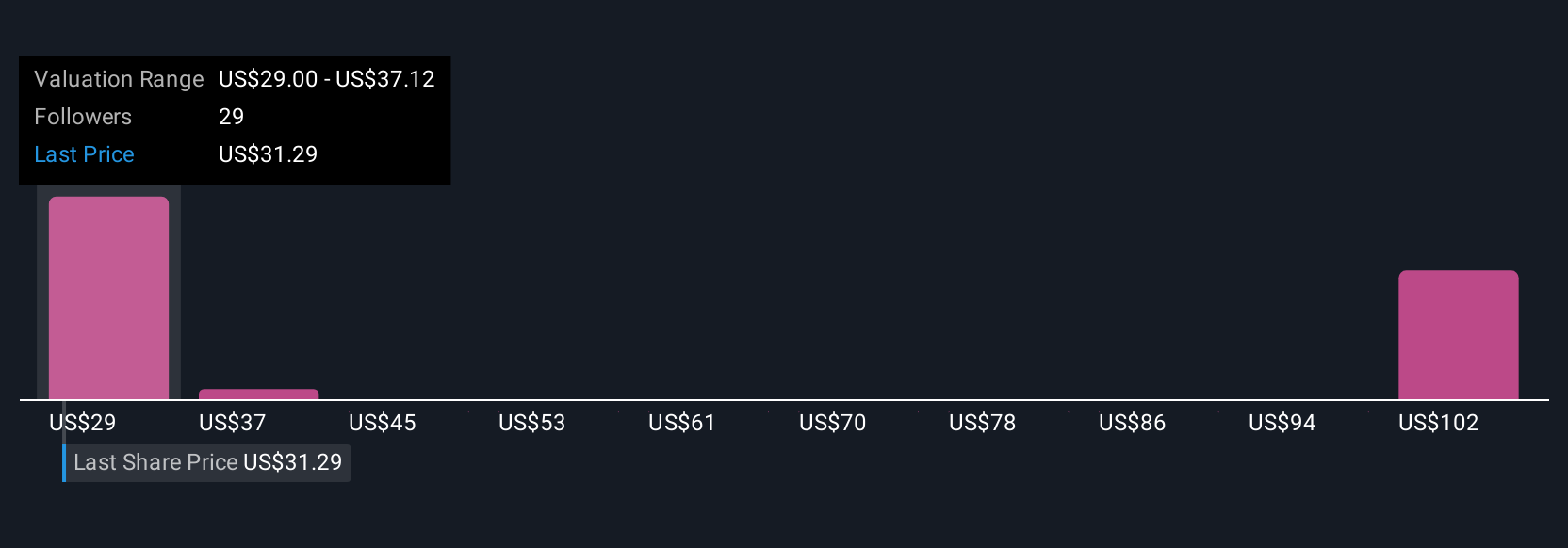

Six fair value estimates from the Simply Wall St Community span from US$23.86 to US$42 per share, reflecting a wide spectrum of conviction. While analyst estimates often center on operational risks like global supply pressures, the community’s diverse views show just how differently investors weigh aluminum price and regulatory uncertainty.

Explore 6 other fair value estimates on Alcoa - why the stock might be worth 39% less than the current price!

Build Your Own Alcoa Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alcoa research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alcoa's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives