- United States

- /

- Metals and Mining

- /

- NYSE:AA

A Fresh Look at Alcoa (AA) Valuation Following Debt Redemption and Financial Optimization

Reviewed by Simply Wall St

Alcoa (AA) has announced plans to redeem $141 million of its 5.500% notes due in 2027, using available cash for the early payoff. This move highlights the company’s proactive focus on managing capital and streamlining its balance sheet.

See our latest analysis for Alcoa.

Alcoa’s decision to pay down debt comes after a period of renewed market confidence, with the share price climbing 30% over the past 90 days. Despite this positive short-term momentum, the total shareholder return for the past year is still down 8%. This reminds investors that recent gains are helping to rebuild lost ground rather than demonstrate lasting outperformance over the longer term.

If Alcoa’s rebound has you watching for other opportunities, consider broadening your search and discover fast growing stocks with high insider ownership

But with shares still trailing last year's level and trading close to analyst price targets, investors are left wondering if Alcoa is truly undervalued or if the market has already accounted for any future upside.

Most Popular Narrative: 5.1% Overvalued

Alcoa’s current market price stands above the narrative’s fair value estimate, creating a gap that has investors and analysts questioning what is driving sentiment. Optimism about sustainability efforts and new partnerships is fueling projections, but industry challenges remain a focal point.

Ongoing tariff volatility, regulatory pressures, operational bottlenecks, and limited production flexibility could compress margins and elevate future costs.

Curious how hopeful forecasts stack up against shrinking profit margins and industry headwinds? The valuation here rides on shifting market forces and bold efficiency bets. Want to see which financial leap powers this price? Click to unlock the full story.

Result: Fair Value of $39.54 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, strong global decarbonization efforts and Alcoa's innovation in low-carbon aluminum products could propel demand and support higher long-term revenues.

Find out about the key risks to this Alcoa narrative.

Another View: Market Comparisons Paint a Different Picture

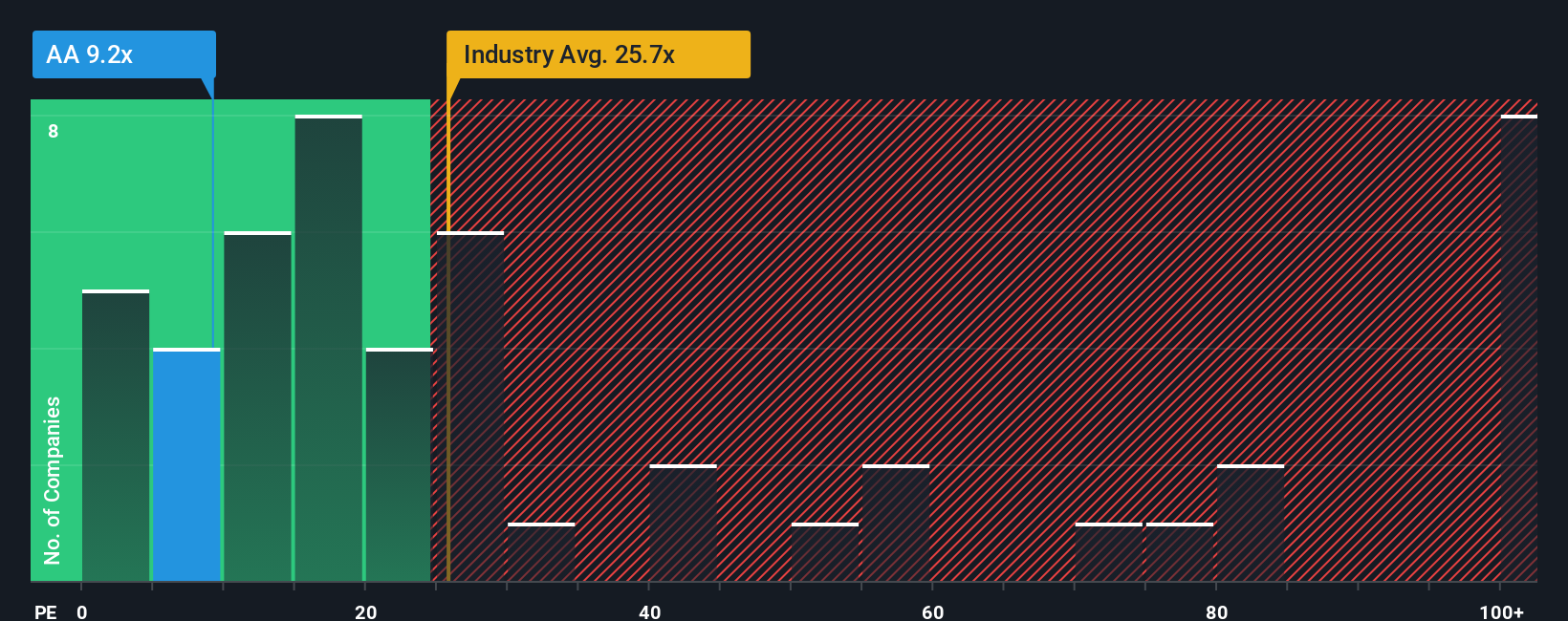

When we look at Alcoa's current price using a price-to-earnings ratio, it trades at 9.5x earnings. This is well below both its industry peers, who sit at 21.7x, and the peer group average at 47.1x. Even compared to the fair ratio of 15x, Alcoa seems discounted. Gaps like these can signal either an overlooked value or a warning sign. Are investors missing something, or is the risk understated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alcoa Narrative

If you have a different perspective or want to dig a little deeper, you can craft your own Alcoa narrative in just a few minutes. Do it your way

A great starting point for your Alcoa research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay one step ahead by acting on the newest trends before they go mainstream. Check out these hand-picked opportunities and make your next move count.

- Catch the momentum of fast-rising tech by targeting these 25 AI penny stocks, which are reshaping industries with artificial intelligence breakthroughs and real-world solutions.

- Explore high-yield potential when you browse these 15 dividend stocks with yields > 3%, which stand out with robust returns and proven income consistency.

- Uncover tomorrow’s market leaders by zeroing in on these 3580 penny stocks with strong financials, which are positioned for dramatic growth and new opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AA

Alcoa

Engages in the bauxite mining, alumina refining, aluminum production, and energy generation business in Australia, Brazil, Canada, Iceland, Norway, Spain, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.