- United States

- /

- Metals and Mining

- /

- NasdaqCM:ZKIN

What Is ZK International Group's (NASDAQ:ZKIN) P/E Ratio After Its Share Price Rocketed?

It's really great to see that even after a strong run, ZK International Group (NASDAQ:ZKIN) shares have been powering on, with a gain of 40% in the last thirty days. The full year gain of 23% is pretty reasonable, too.

Assuming no other changes, a sharply higher share price makes a stock less attractive to potential buyers. While the market sentiment towards a stock is very changeable, in the long run, the share price will tend to move in the same direction as earnings per share. The implication here is that deep value investors might steer clear when expectations of a company are too high. One way to gauge market expectations of a stock is to look at its Price to Earnings Ratio (PE Ratio). A high P/E ratio means that investors have a high expectation about future growth, while a low P/E ratio means they have low expectations about future growth.

View our latest analysis for ZK International Group

Does ZK International Group Have A Relatively High Or Low P/E For Its Industry?

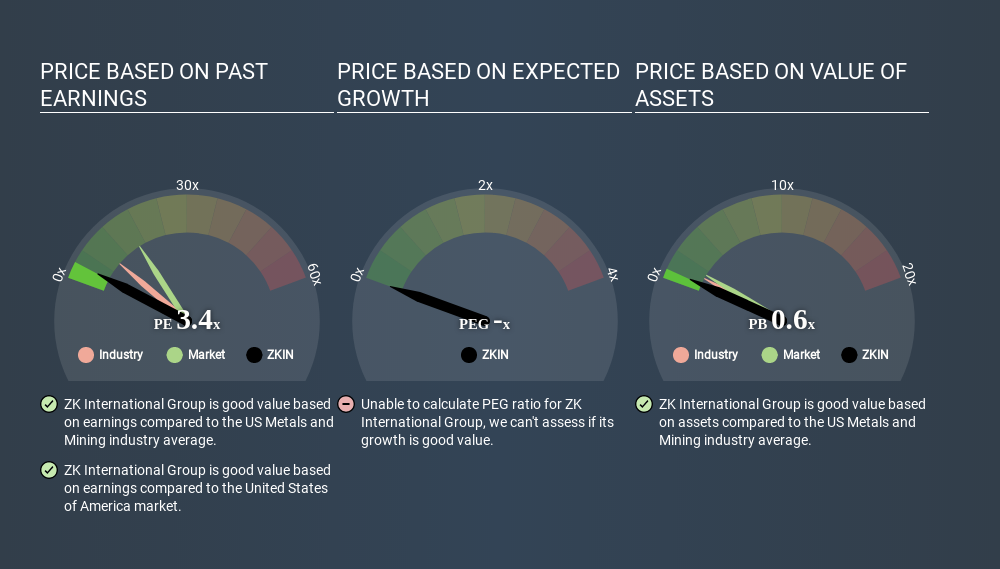

We can tell from its P/E ratio of 3.37 that sentiment around ZK International Group isn't particularly high. If you look at the image below, you can see ZK International Group has a lower P/E than the average (8.8) in the metals and mining industry classification.

This suggests that market participants think ZK International Group will underperform other companies in its industry. Many investors like to buy stocks when the market is pessimistic about their prospects. It is arguably worth checking if insiders are buying shares, because that might imply they believe the stock is undervalued.

How Growth Rates Impact P/E Ratios

If earnings fall then in the future the 'E' will be lower. That means even if the current P/E is low, it will increase over time if the share price stays flat. So while a stock may look cheap based on past earnings, it could be expensive based on future earnings.

ZK International Group's earnings per share fell by 5.0% in the last twelve months. And EPS is down 2.5% a year, over the last 5 years. So you wouldn't expect a very high P/E.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. Thus, the metric does not reflect cash or debt held by the company. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

Is Debt Impacting ZK International Group's P/E?

ZK International Group's net debt is 51% of its market cap. This is enough debt that you'd have to make some adjustments before using the P/E ratio to compare it to a company with net cash.

The Bottom Line On ZK International Group's P/E Ratio

ZK International Group has a P/E of 3.4. That's below the average in the US market, which is 16.1. The P/E reflects market pessimism that probably arises from the lack of recent EPS growth, paired with significant leverage. What is very clear is that the market has become less pessimistic about ZK International Group over the last month, with the P/E ratio rising from 2.4 back then to 3.4 today. For those who like to invest in turnarounds, that might mean it's time to put the stock on a watchlist, or research it. But others might consider the opportunity to have passed.

Investors have an opportunity when market expectations about a stock are wrong. If the reality for a company is not as bad as the P/E ratio indicates, then the share price should increase as the market realizes this. Although we don't have analyst forecasts you might want to assess this data-rich visualization of earnings, revenue and cash flow.

You might be able to find a better buy than ZK International Group. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqCM:ZKIN

ZK International Group

Engages in the designing, producing, and selling pipes and fitting products in the People’s Republic of China.

Slight risk and slightly overvalued.

Market Insights

Community Narratives