- United States

- /

- Metals and Mining

- /

- NasdaqGM:USAR

USA Rare Earth (USAR) Is Up 15.6% After JPMorgan Podcast Fuels Hopes for Government Investment

Reviewed by Simply Wall St

- USA Rare Earth recently gained attention following optimistic remarks on a JPMorgan podcast suggesting the company could secure upcoming government investment linked to a high-profile industry deal.

- This optimism is fueled by the company's plans to begin producing rare-earth magnets in Oklahoma in 2026, supporting efforts to strengthen domestic supply chains for critical minerals.

- We'll explore how speculation about potential government support for USA Rare Earth's magnet production project shapes its investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is USA Rare Earth's Investment Narrative?

To be comfortable holding USA Rare Earth, you have to be confident in its vision to scale up rare-earth magnet production in the United States and reduce the country’s reliance on foreign supplies. The recent share price spike, triggered by JPMorgan’s suggestion of possible government support, draws new attention to the feasibility and timing of these plans. That optimism, however, sits alongside rising risks, competition from increased Chinese exports and supply deals by other companies have tempered investor sentiment and erased some recent gains. The most important catalysts remain the company’s push toward revenue generation in 2026 and potential government investment, now brought more into focus by the podcast remarks. Still, with a volatile share price, new management, an inexperienced board, and no current revenue, investors need to weigh whether the prospect of federal backing is enough to counterbalance operational and financial risks. For now, the news appears to amplify attention on these near-term catalysts rather than fundamentally shift the risk profile, although competitive pressures are visibly intensifying.

On the flipside, new competition could put added pressure on emerging domestic producers.

Exploring Other Perspectives

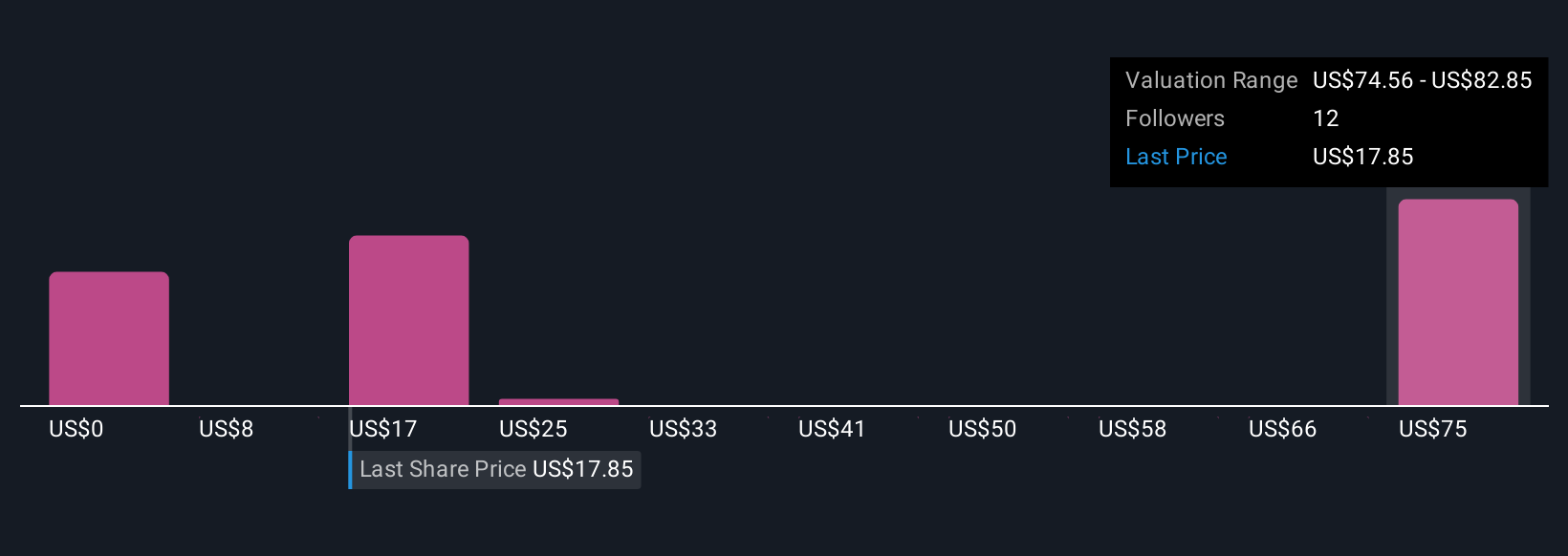

Explore 12 other fair value estimates on USA Rare Earth - why the stock might be worth 49% less than the current price!

Build Your Own USA Rare Earth Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your USA Rare Earth research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free USA Rare Earth research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate USA Rare Earth's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:USAR

USA Rare Earth

Engages in mining, processing, and supplying rare earths and other critical minerals in the United States.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives