- United States

- /

- Packaging

- /

- NasdaqGS:TRS

TriMas (TRS): Valuation Insights Following Strong Earnings Beat and Upgraded 2025 Guidance

Reviewed by Kshitija Bhandaru

TriMas (TRS) drew attention after announcing earnings that surpassed expectations. The company reported a 14% jump in quarterly revenue from last year and provided fresh guidance for fiscal 2025. The upbeat report has spurred new interest from institutional investors.

See our latest analysis for TriMas.

After a strong quarterly report and upbeat guidance, TriMas has seen renewed energy from investors, which is reflected in its share price return of 53.9% year-to-date. The 1-year total shareholder return stands at 30.9%, pointing to solid gains for those who stayed the course. The stock’s recent momentum continues to suggest growing optimism about its outlook.

If you’re curious to see what else investors are getting excited about after strong earnings seasons, now’s a great moment to discover fast growing stocks with high insider ownership

With TriMas trading about 23% below the average analyst target and showing robust earnings growth, investors are left to consider whether the stock remains undervalued or if current prices are already accounting for all of its future potential.

Most Popular Narrative: 18.5% Undervalued

TriMas closed at $36.68, notably below the most recent fair value estimate of $45. This gap has been fueled by sharply higher analyst expectations and hints at further upside if those projections hold true.

Ongoing strategic portfolio optimization, including the divestiture of non-core operations and reinvestment in higher-growth Packaging and Aerospace segments, positions TriMas to benefit from rising demand for recyclable, reusable, and innovative packaging solutions. This directly supports revenue growth.

What if the company's future success hinges on dramatic profit margin expansion and earnings leaps not seen in recent years? Discover which forecasts are propelling TriMas toward this striking valuation. You may be surprised by the scale of the projected improvement.

Result: Fair Value of $45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain challenges or regulatory shocks could undermine margin expansion and challenge TriMas’ ability to reach its ambitious growth targets.

Find out about the key risks to this TriMas narrative.

Another View: Testing Fair Value with a Different Lens

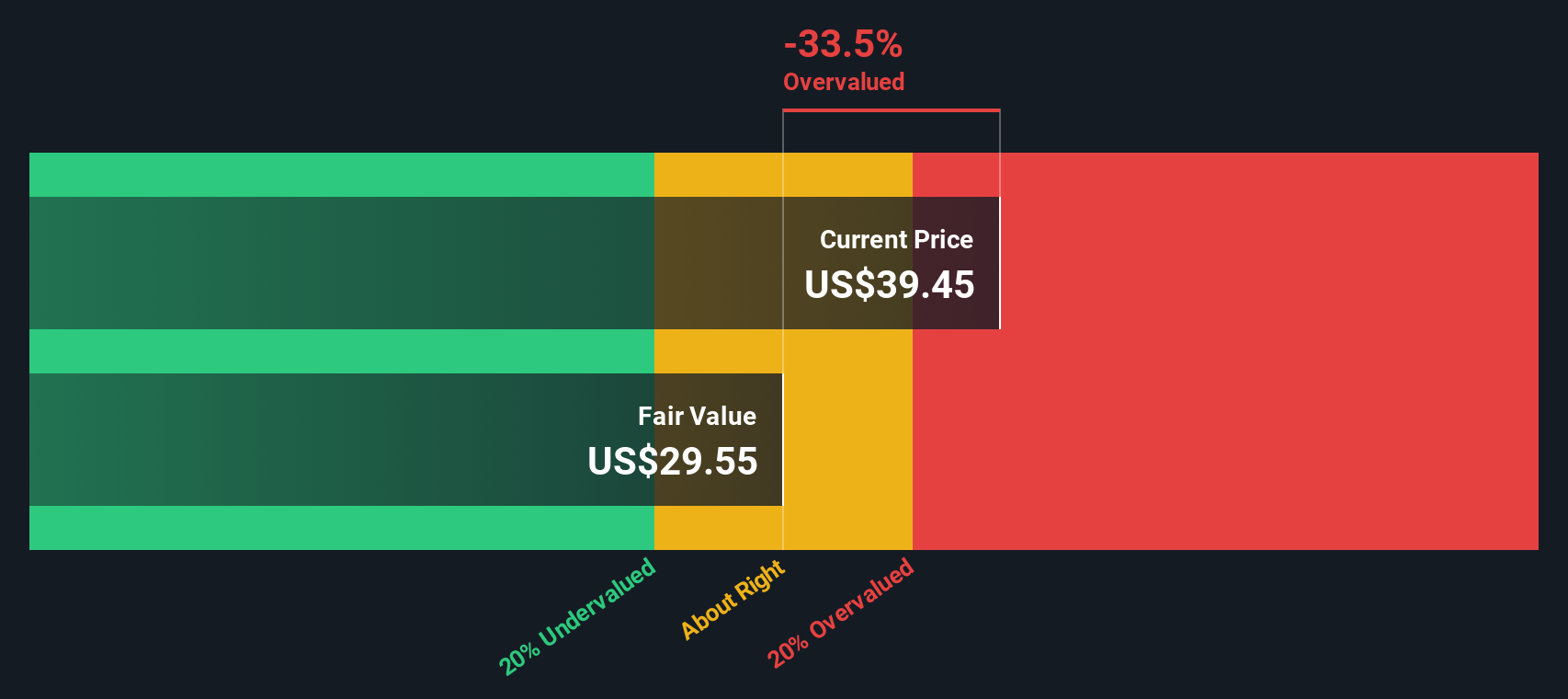

While analyst consensus suggests TriMas is undervalued, our SWS DCF model tells a different story. According to this approach, the shares are actually trading above our current estimate of fair value. This hints that the market may already be pricing in a significant amount of future growth. Which perspective aligns with your own expectations?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out TriMas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own TriMas Narrative

If you see things differently or want to dig into the numbers firsthand, crafting your own take is quick and straightforward. Do it your way

A great starting point for your TriMas research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for More Smart Stock Ideas?

Don’t settle for a narrow watchlist when innovative opportunities are just a click away. Unlock a new set of possibilities with these unique investment screens:

- Tap into the trend of groundbreaking artificial intelligence by checking out these 24 AI penny stocks, which are poised to benefit from the next wave of machine learning advancements.

- Maximize your search for value by targeting companies trading below intrinsic worth using these 875 undervalued stocks based on cash flows and see which businesses still offer upside potential.

- Boost your portfolio’s income potential by finding reliable yields over 3% with these 18 dividend stocks with yields > 3% and skip the guesswork on steady, cash-generating stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TriMas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRS

TriMas

Engages in the design, development, manufacture, and sale of products for consumer products, aerospace, and industrial markets worldwide.

Moderate growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives