- United States

- /

- Metals and Mining

- /

- NasdaqGS:STLD

Q2 Earnings Dip and Share Buybacks Could Be A Game Changer For Steel Dynamics (STLD)

Reviewed by Simply Wall St

- Steel Dynamics recently reported its second quarter 2025 results, with net income falling to US$298.73 million and sales reaching US$4.57 billion, both below prior-year levels; the update also detailed the repurchase of nearly 2 million shares under its active buyback program.

- This combination of softer earnings and ongoing capital returns highlights management's commitment to shareholder policies despite operational pressures.

- We’ll examine how the earnings decline and active share repurchase program could influence Steel Dynamics’ investment narrative going forward.

Steel Dynamics Investment Narrative Recap

To be a shareholder in Steel Dynamics, one typically needs to believe in the company's strategy of growing through value-added steel products, operational excellence and capital returns, even as near-term earnings can fluctuate with volatile input costs and shifting trade policies. The recent results, softer earnings and sales, but steady buybacks, do not appear to materially alter the biggest short-term catalyst, which remains the ramp-up of new coated steel and aluminum facilities; however, the main risk continues to be cost pressures if these assets encounter delays or market conditions shift unexpectedly.

The most relevant recent announcement is the update that nearly 2 million shares were repurchased for about US$254 million in the second quarter. This ongoing buyback, despite earnings pressure, signals consistency in capital allocation amid industry cyclicality and keeps shareholder returns in focus as the company seeks higher-margin growth from its new facilities.

By contrast, investors should be aware that execution risks from new facility integration could have an outsized impact if...

Read the full narrative on Steel Dynamics (it's free!)

Steel Dynamics' outlook forecasts $21.4 billion in revenue and $2.4 billion in earnings by 2028. This scenario assumes 7.4% annual revenue growth and a $1.2 billion increase in earnings from the current $1.2 billion level.

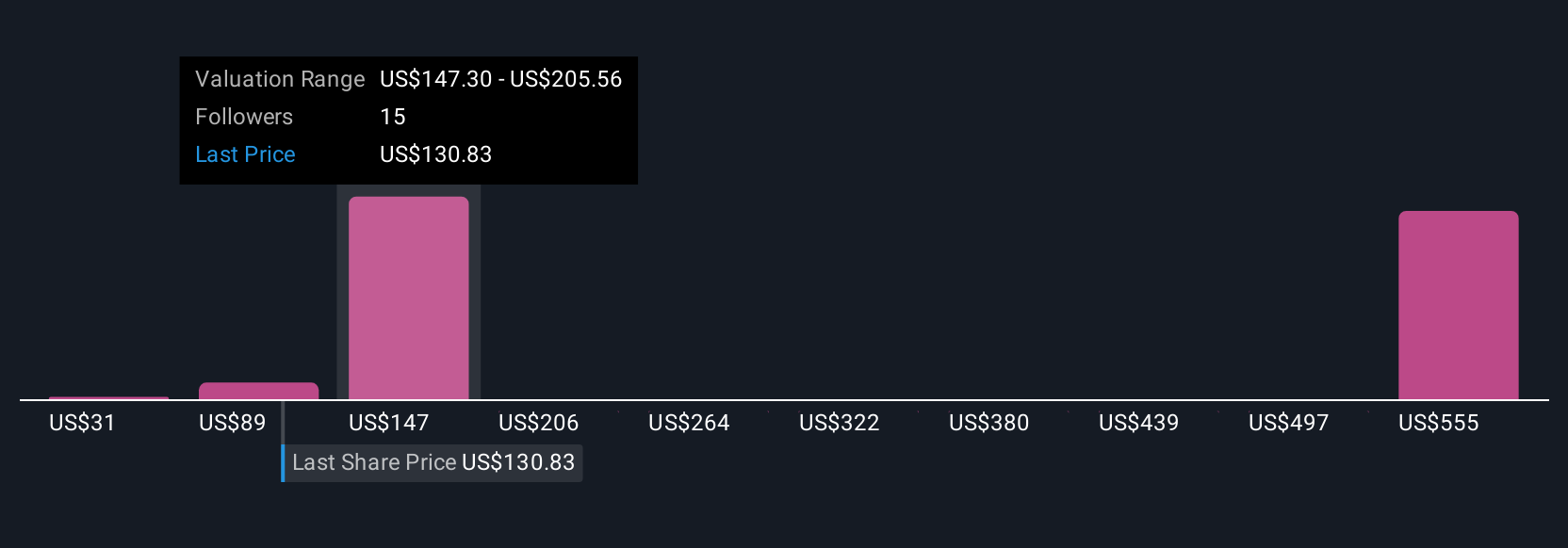

Uncover how Steel Dynamics' forecasts yield a $147.44 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Five different Simply Wall St Community fair value estimates for Steel Dynamics range from as low as US$30.80 to US$518.88 per share. While some point to major undervaluation, others focus on shorter-term risks around input costs and operational ramp-up, showing just how much opinions can differ on where the company is headed next.

Build Your Own Steel Dynamics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Steel Dynamics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Steel Dynamics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Steel Dynamics' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:STLD

Steel Dynamics

Operates as a steel producer and metal recycler in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives