- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Royal Gold (RGLD): Evaluating Valuation Following 6% Dividend Increase and Renewed Investor Confidence

Reviewed by Simply Wall St

Royal Gold (RGLD) just approved a 6% increase to its annual dividend, raising it from $1.80 to $1.90 per share for 2026. The new quarterly rate begins in January, which signals management’s confidence in the company’s financial strength.

See our latest analysis for Royal Gold.

Investors responded enthusiastically to Royal Gold’s dividend boost, with the share price jumping 4.5% in a single day and momentum gathering pace. The year-to-date share price return now stands at a robust 49%. Combined with a strong 1-year total shareholder return of nearly 39%, Royal Gold’s track record suggests both ongoing investor optimism and long-term wealth creation potential.

Wondering what other companies are showing similar momentum? Now’s an ideal moment to discover fast growing stocks with high insider ownership.

With shares nearing all-time highs and trading at only a modest discount to analyst targets, the question is whether Royal Gold offers further upside from here or if the market has already priced in its promising growth story.

Most Popular Narrative: 19% Undervalued

Royal Gold’s widely tracked narrative signals a valuation nearly 20% below fair value, with analyst and investor models seeing room for further gains beyond the latest $201.05 close. This perspective weighs the impact of upcoming portfolio moves and sector dynamics, hinting at key catalysts not yet fully discounted by the market.

The combination with Sandstorm and Horizon portfolios will make Royal Gold more attractive to passive and generalist investors due to greater scale and diversification. This could drive a larger investor base and valuation re-rating, positively impacting share price and EPS growth.

Why are analysts betting that Royal Gold’s financial profile will look dramatically different in a few years? Behind this narrative is a bold assumption: rapid multi-year expansion in revenue and profit margins, built on a strategy of acquisitions and surging demand for key metals. Which numbers reveal the bullish case? You’ll want to see the full breakdown.

Result: Fair Value of $248.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a sharp drop in gold prices or setbacks integrating recent acquisitions could quickly challenge the current optimism around Royal Gold’s outlook.

Find out about the key risks to this Royal Gold narrative.

Another View: Looking at Earnings Multiples

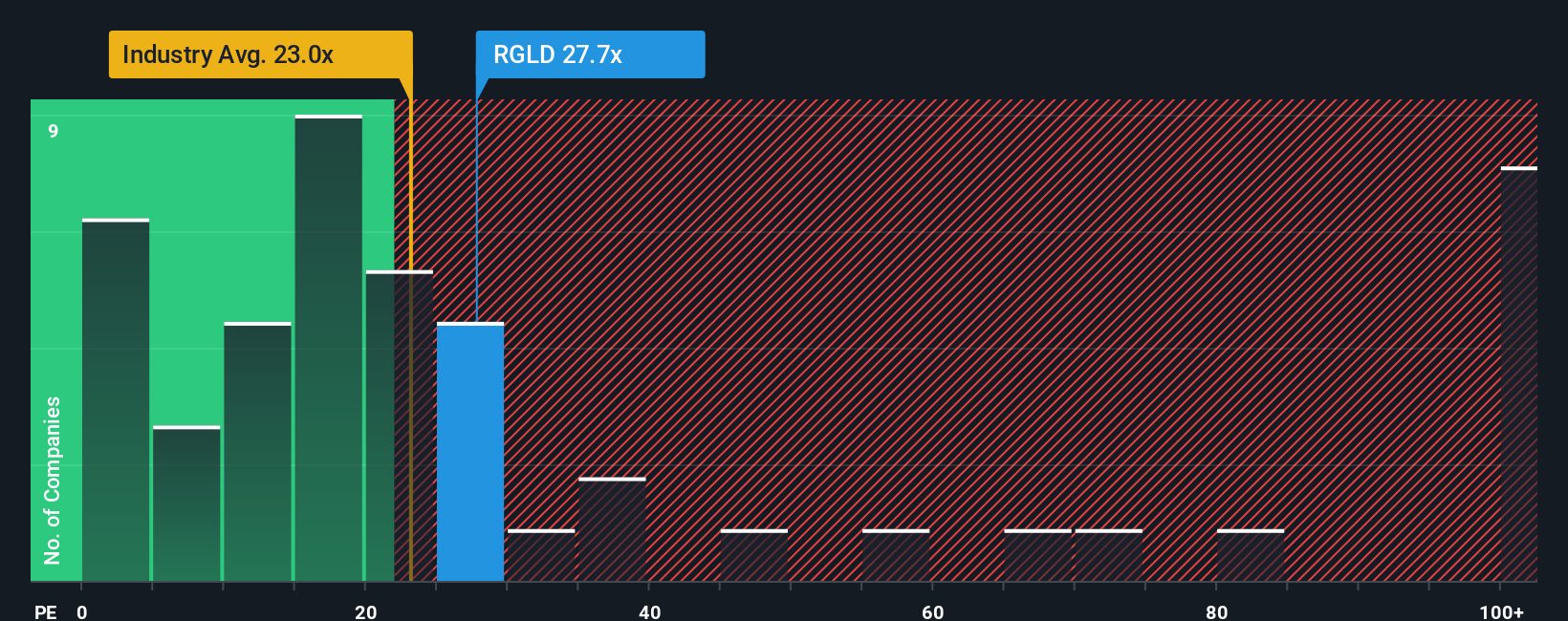

While discounted cash flow analysis points to Royal Gold being undervalued, a different picture emerges when we use the price-to-earnings approach. At 35.3 times earnings, Royal Gold trades at a premium compared to the industry average of 22.1x and its own fair ratio of 25.3x. This premium may signal investors are building in high growth hopes, but it does increase the risk of disappointment if the company does not deliver. Could the market be getting ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Gold Narrative

If you see things differently or want to dig deeper, you can quickly create your own perspective using the latest data in just a few minutes. Do it your way.

A great starting point for your Royal Gold research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why stop at just one stock? Broaden your opportunity set by tapping into other high-potential themes using the Simply Wall Street Screener. Smart investors know the best ideas don’t wait around.

- Tap into today's momentum and spot companies leading trends by uncovering these 922 undervalued stocks based on cash flows for undervalued opportunities based on strong cash flows.

- Accelerate your portfolio’s innovation edge when you research these 25 AI penny stocks making breakthroughs in artificial intelligence and automation.

- Secure reliable yield and boost your passive income by reviewing these 15 dividend stocks with yields > 3% with healthy dividend payouts above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.