- United States

- /

- Metals and Mining

- /

- NasdaqGS:RGLD

Royal Gold (RGLD): Evaluating Valuation After Strong Rally and Recent Pullback

Reviewed by Simply Wall St

See our latest analysis for Royal Gold.

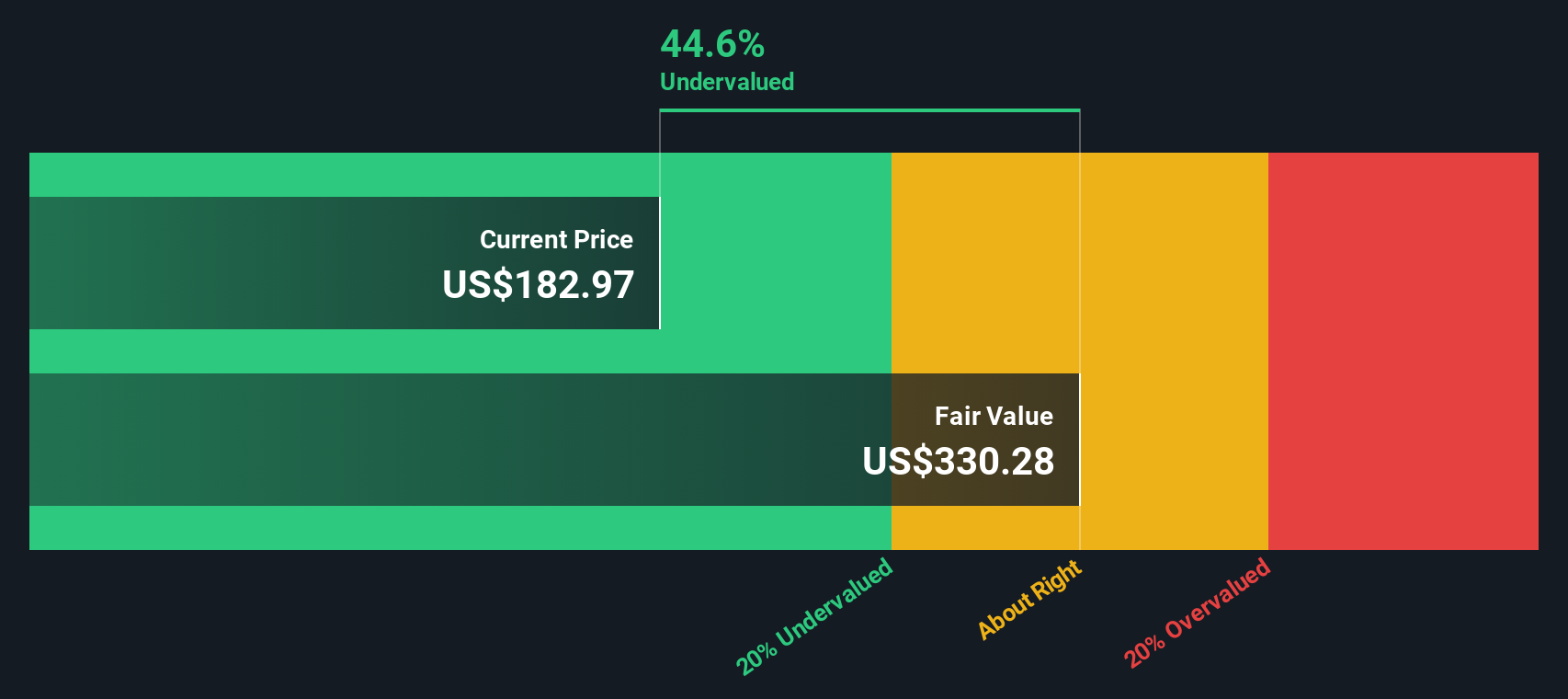

Royal Gold’s share price has charged higher this year, rallying more than 37% year-to-date, though it recently cooled off with a notable pullback. Even after this dip, the company’s longer-term record remains impressive, boasting a 21% total shareholder return over the last year and nearly doubling investors’ money over three years. This momentum suggests investor optimism about the gold market remains strong.

If you’re interested in what else is showing resilience lately, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With recent gains and robust financials, the key question is whether Royal Gold’s future growth is already reflected in its soaring share price or if there is still room for investors to capitalize on potential upside.

Most Popular Narrative: 22.6% Undervalued

Royal Gold’s fair value calculation points notably higher than the recent close, implying substantial upside if current analyst and investor consensus holds true. This estimate takes into account strategic initiatives and the impact of new projects, setting up an intriguing outlook for shareholders.

The strategic acquisitions of Sandstorm Gold and Horizon Copper will significantly diversify Royal Gold's asset base, reducing single-asset risk and increasing exposure to long-term growth projects. This is expected to drive more stable and growing revenue streams and improve net margins. Recent investments in projects such as the Kansanshi gold stream, with a multi-decade production profile, and the Warintza copper-gold-moly project, which has large-scale development potential in the early 2030s, position Royal Gold to benefit from increasing demand for gold as a hedge against inflation and geopolitical risk and for copper as electrification and renewable energy adoption accelerate. These factors support the potential for higher long-term revenue and earnings growth.

Want to understand the key factors behind this bullish fair value? The narrative rests on rapid growth assumptions for both revenue and profit margins, along with a bold vision for future dealmaking. Discover which ambitious forecasts are the foundation for this valuation and what could turn these projections into reality.

Result: Fair Value of $238.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing gold demand or operational setbacks at key mines could quickly undermine the growth expectations that drive Royal Gold’s current valuation.

Find out about the key risks to this Royal Gold narrative.

Another View: The SWS DCF Model

Taking a step back from multiples, our DCF model paints a picture of Royal Gold trading well below its estimated fair value of $295.71. This method signals far greater upside than the multiples approach suggests. This raises the question of whether the market is missing deeper growth potential or simply being cautious.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Royal Gold Narrative

If you want to dig deeper or reach your own conclusions, it only takes a few minutes to shape your own outlook and perspective. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Royal Gold.

Looking for More Investment Ideas?

Don’t wait for the next big winner to pass you by. Let the Simply Wall St Screener point you toward fresh opportunities and hidden gems that match your goals.

- Uncover potential in tomorrow’s market leaders by browsing these 881 undervalued stocks based on cash flows, which are poised for growth based on strong cash flows.

- Tap into income potential by reviewing these 17 dividend stocks with yields > 3%, offering attractive yields above 3% for investors seeking reliable returns.

- Seize the AI revolution and see which companies are powering the future by checking out these 24 AI penny stocks right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RGLD

Royal Gold

Acquires and manages precious metal streams, royalties, and related interests.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives