- United States

- /

- Chemicals

- /

- NasdaqGM:NTIC

Northern Technologies International (NASDAQ:NTIC) Is Looking To Continue Growing Its Returns On Capital

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, we've noticed some promising trends at Northern Technologies International (NASDAQ:NTIC) so let's look a bit deeper.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Northern Technologies International is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

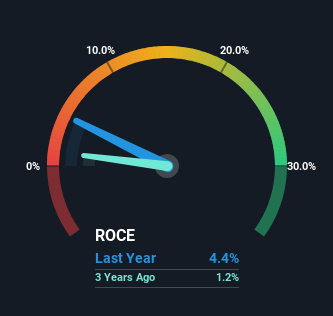

0.044 = US$3.3m ÷ (US$94m - US$18m) (Based on the trailing twelve months to November 2024).

Therefore, Northern Technologies International has an ROCE of 4.4%. In absolute terms, that's a low return and it also under-performs the Chemicals industry average of 8.8%.

View our latest analysis for Northern Technologies International

In the above chart we have measured Northern Technologies International's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Northern Technologies International .

So How Is Northern Technologies International's ROCE Trending?

The fact that Northern Technologies International is now generating some pre-tax profits from its prior investments is very encouraging. Shareholders would no doubt be pleased with this because the business was loss-making five years ago but is is now generating 4.4% on its capital. In addition to that, Northern Technologies International is employing 24% more capital than previously which is expected of a company that's trying to break into profitability. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

Our Take On Northern Technologies International's ROCE

To the delight of most shareholders, Northern Technologies International has now broken into profitability. Since the stock has only returned 25% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. Given that, we'd look further into this stock in case it has more traits that could make it multiply in the long term.

Northern Technologies International does have some risks though, and we've spotted 2 warning signs for Northern Technologies International that you might be interested in.

While Northern Technologies International may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

Valuation is complex, but we're here to simplify it.

Discover if Northern Technologies International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:NTIC

Northern Technologies International

Develops and markets rust and corrosion inhibiting solutions in North America, South America, Europe, the Middle East, China, Brazil, India, Rest of Asia, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives