- United States

- /

- Metals and Mining

- /

- NasdaqGS:METC

Ramaco Resources (METC): Assessing Valuation Following $300M Financing and Strategic Minerals Expansion with Goldman Sachs

Reviewed by Simply Wall St

Ramaco Resources has just closed a $300 million fixed-income offering as it partners with Goldman Sachs on its Strategic Critical Minerals Terminal project. This move supports Ramaco’s ambitions to play a bigger role in the US critical minerals supply chain.

See our latest analysis for Ramaco Resources.

After surging earlier in the year, Ramaco Resources’ 1-year total shareholder return stands at an impressive 82.8%. This is despite a sharp 59.8% drop in the 1-month share price return. Investor sentiment has shifted as the company embarks on its critical minerals expansion, but its long-term gains still reflect substantial underlying momentum.

If you’re watching how capital raises can impact future growth stories, it’s worth exploring fast growing stocks with high insider ownership to spot other high-potential movers.

With Ramaco’s recent volatility and ambitious expansion plans, investors are left to wonder whether the stock is undervalued given its future growth prospects, or if the market has already priced in this next chapter.

Most Popular Narrative: 49% Undervalued

According to the most widely followed narrative, Ramaco Resources is being valued well below its fair value, with a last close price of $21.93 compared to the calculated fair value of $43. This significant gap stems from bullish expectations around rare earth mining expansion and domestic supply chain advantages.

Ramaco's advancement of the Brook Mine into America's first new rare earth mine in over 70 years, supported by extensive federal government collaboration and potential policy support amid rising U.S. demand for domestic critical minerals, positions the company to unlock new, high-margin revenue streams beyond metallurgical coal. Initial commercial oxide production is targeted as soon as 2027.

Curious how this narrative leans so heavily on future-facing growth? The core ingredients behind the headline valuation rely on ambitious profit margins and a profit turnaround scenario that is rare for coal miners. Find out what precise financial leap is expected to drive so much upside and see why analysts are betting on a transformation story rather than just raw materials.

Result: Fair Value of $43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still a risk that delays in government support or weaker rare earth demand could limit Ramaco’s growth and challenge these bullish forecasts.

Find out about the key risks to this Ramaco Resources narrative.

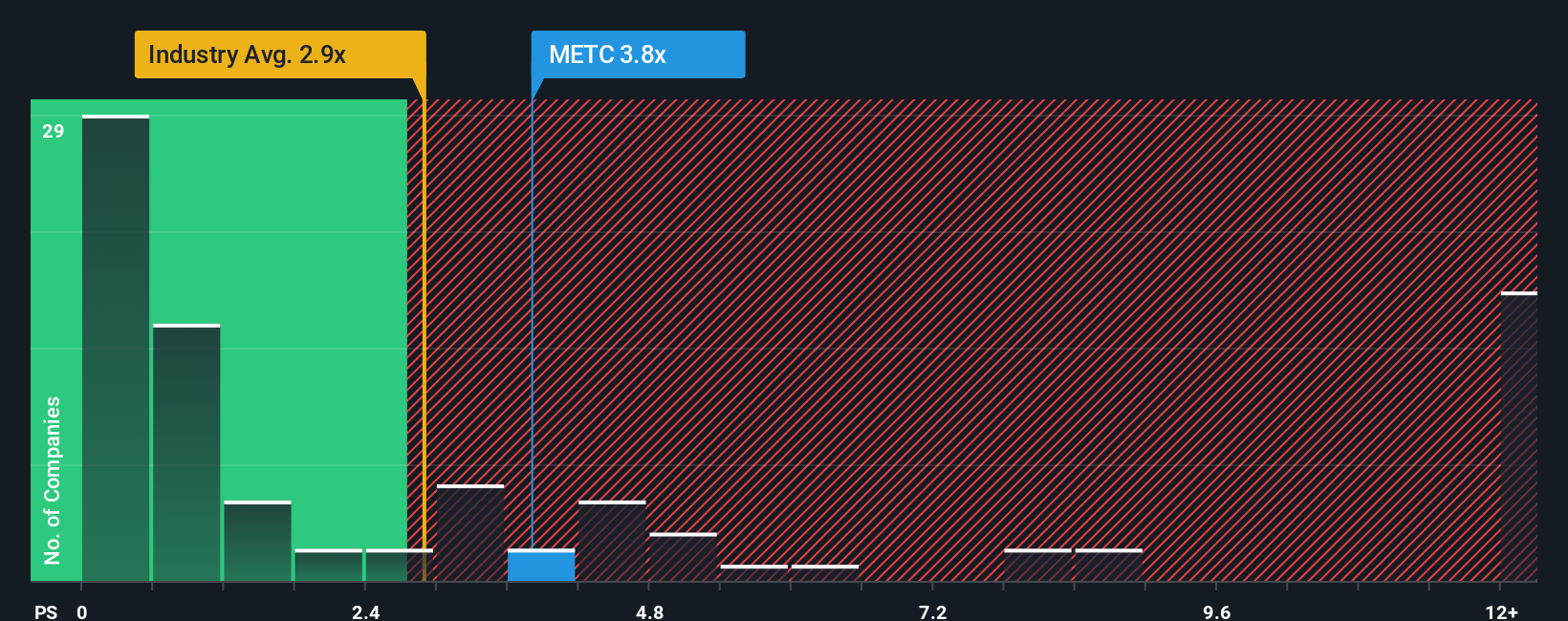

Another View: Valuing by Sales Ratio

While some believe Ramaco Resources is undervalued based on its strategic assets, its price-to-sales ratio is 2.5x, much higher than the peer average of 0.6x and notably above the fair ratio of 1.1x. This suggests the market is putting a premium price on the company now. Could this optimism persist if targets are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ramaco Resources Narrative

If you have a different perspective or want to dive deeper into the numbers, you can put together your own view in just a few minutes with Do it your way.

A great starting point for your Ramaco Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Get ahead of the crowd and put your capital to work where opportunity meets momentum. These unique stock lists could hold your next big winner, so don’t let strong ideas slip by.

- Capture rapid growth potential by targeting these 3585 penny stocks with strong financials, which combine small size with powerful financials and a history of resilience.

- Tap into megatrends and fuel your portfolio with the progress of these 31 healthcare AI stocks, accelerating advancements in life sciences and smart medical solutions.

- Maximize potential returns by zeroing in on these 870 undervalued stocks based on cash flows, which are priced below intrinsic value based on robust cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:METC

Ramaco Resources

Engages in the development, operation, and sale of metallurgical coal.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives