- United States

- /

- Metals and Mining

- /

- NasdaqGS:KALU

Is Zacks’ Upgrade of Kaiser Aluminum (KALU) Reframing How Investors Value Its Earnings Power?

Reviewed by Sasha Jovanovic

- Recently, Zacks highlighted Kaiser Aluminum with a Strong Buy ranking, citing its attractive valuation metrics compared with industry peers and a strong earnings outlook.

- This fresh analyst attention puts the company’s value characteristics in sharper focus, potentially influencing how investors assess its longer-term prospects.

- With this backdrop and fresh emphasis on valuation metrics, we’ll explore how the Zacks upgrade shapes Kaiser Aluminum’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Kaiser Aluminum's Investment Narrative?

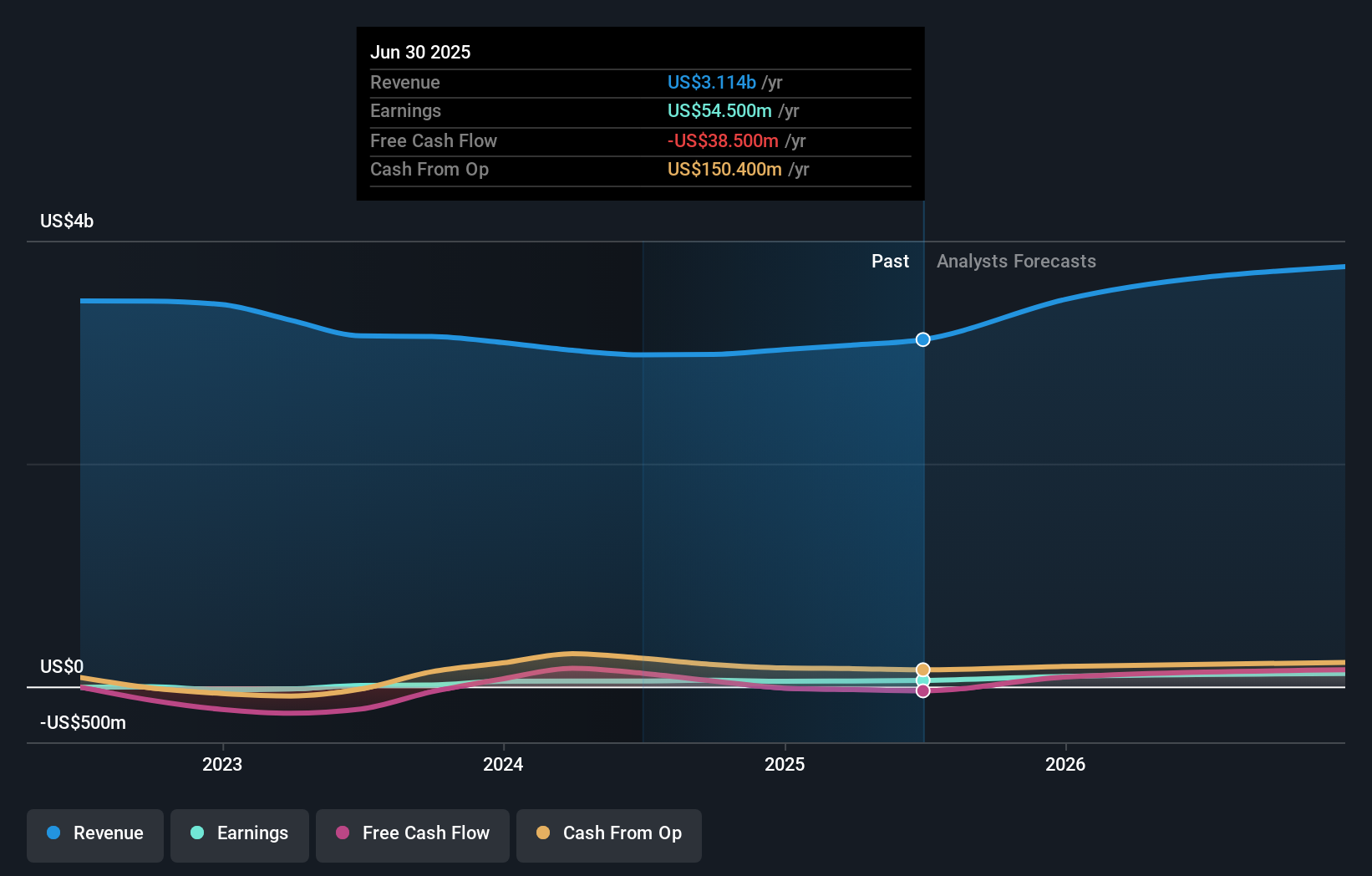

To own Kaiser Aluminum, you have to believe the company can keep converting its solid earnings rebound into durable cash generation, despite a capital intensive footprint and uneven demand across end markets. Recent quarters show improving profitability and a reaffirmed dividend, but leverage and weaker cash coverage of that payout remain front of mind. The Zacks Strong Buy call mainly reinforces what the numbers already suggest: relative value compared with peers and an earnings profile that screens well. On its own, that analyst upgrade is unlikely to change the core short term catalysts, which still hinge on execution, pricing, and how refinancing plans affect interest costs. It may, however, draw in more attention after a strong share price run, which can amplify both upside and disappointment if expectations move too far ahead of cash flows.

However, investors should not overlook how thin free cash flow coverage of the dividend currently is.Kaiser Aluminum's shares have been on the rise but are still potentially undervalued by 19%. Find out what it's worth.

Exploring Other Perspectives

Simply Wall St Community members see Kaiser Aluminum’s fair value spanning about US$106.50 to roughly US$130.56 across 2 views, underscoring how far opinions can stretch. Set against the recent analyst optimism around earnings quality and refinancing progress, this dispersion invites you to weigh how much balance sheet risk you are personally comfortable with as you think about the company’s future performance.

Explore 2 other fair value estimates on Kaiser Aluminum - why the stock might be worth just $106.50!

Build Your Own Kaiser Aluminum Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kaiser Aluminum research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kaiser Aluminum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kaiser Aluminum's overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaiser Aluminum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KALU

Kaiser Aluminum

Manufactures and sells semi-fabricated specialty aluminum mill products.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026