- United States

- /

- Metals and Mining

- /

- NasdaqCM:HUDI

Take Care Before Jumping Onto Huadi International Group Co., Ltd. (NASDAQ:HUDI) Even Though It's 29% Cheaper

Huadi International Group Co., Ltd. (NASDAQ:HUDI) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

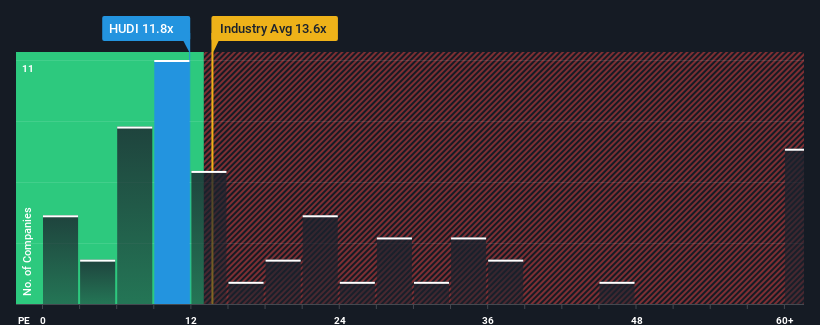

Following the heavy fall in price, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may consider Huadi International Group as an attractive investment with its 11.8x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Huadi International Group over the last year, which is not ideal at all. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Huadi International Group

Is There Any Growth For Huadi International Group?

There's an inherent assumption that a company should underperform the market for P/E ratios like Huadi International Group's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 25%. Even so, admirably EPS has lifted 49% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Comparing that to the market, which is predicted to deliver 15% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it odd that Huadi International Group is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Bottom Line On Huadi International Group's P/E

Huadi International Group's P/E has taken a tumble along with its share price. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Huadi International Group revealed its three-year earnings trends aren't contributing to its P/E as much as we would have predicted, given they look similar to current market expectations. There could be some unobserved threats to earnings preventing the P/E ratio from matching the company's performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Before you take the next step, you should know about the 3 warning signs for Huadi International Group (1 doesn't sit too well with us!) that we have uncovered.

If you're unsure about the strength of Huadi International Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Huadi International Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Huadi International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:HUDI

Huadi International Group

Through its subsidiaries, develops, manufactures, markets, and sells stainless steel seamless pipes, tubes, and bars in the People’s Republic of China.

Excellent balance sheet and good value.