- United States

- /

- Metals and Mining

- /

- NasdaqCM:HLP

Hongli Group (NasdaqCM:HLP) Swings to Profit, Premium Valuation Fuels Market Skepticism

Reviewed by Simply Wall St

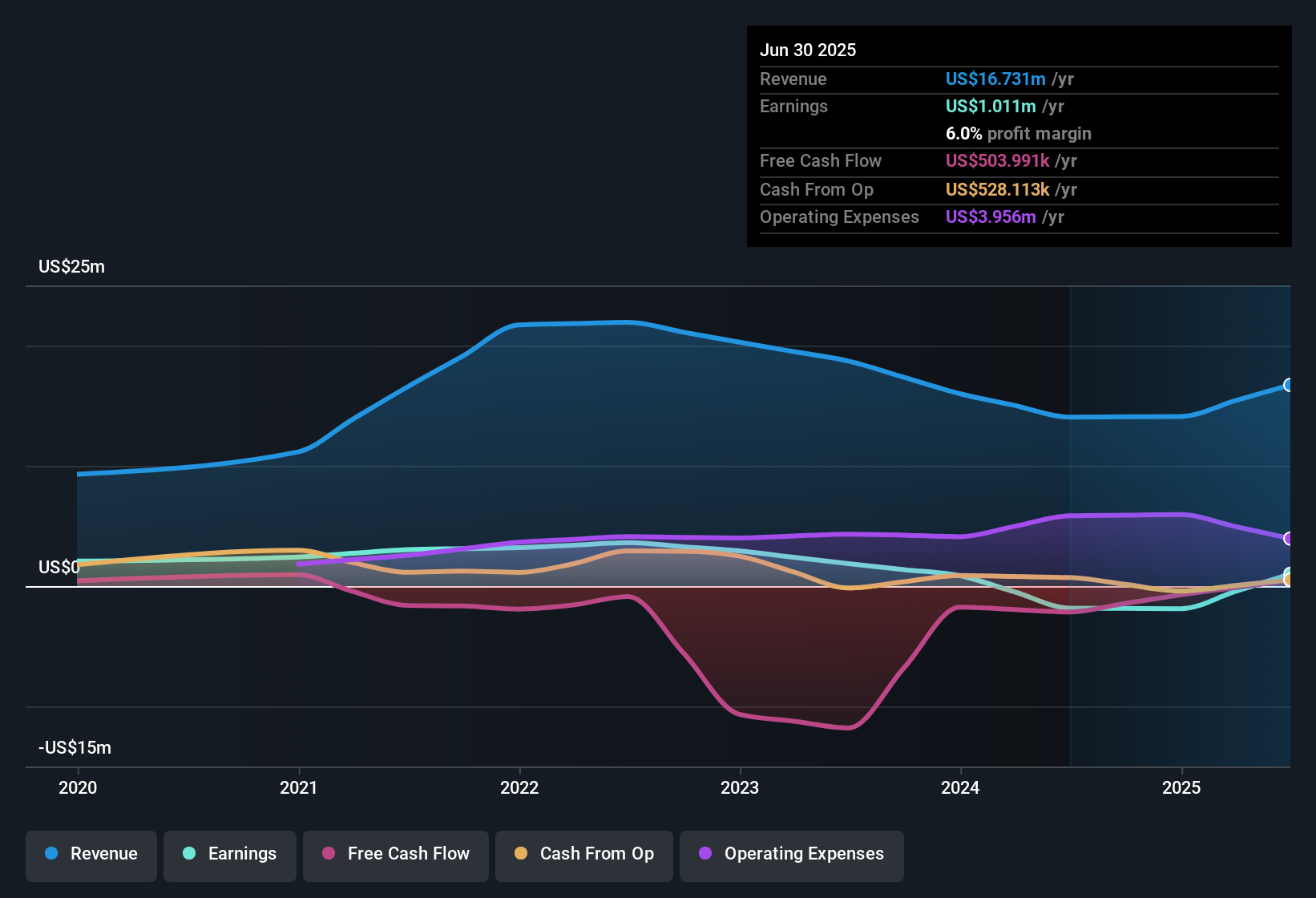

Hongli Group (NasdaqCM:HLP) has just swung to profitability, a notable shift given its challenging track record. Over the last five years, the company’s earnings have declined sharply at an average rate of 49.9% per year, and despite this new profit milestone, the historical headwinds remain evident for investors assessing future growth prospects.

See our full analysis for Hongli Group.The next section looks beyond the numbers, putting Hongli Group’s latest results in the context of how investors and analysts have been framing the story so far. Let’s see where the actual performance matches up with expectations and where it might unsettle the market’s outlook.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Turns Positive

- Hongli Group reported a positive profit margin this period, marking a shift from prior years where the company had not been profitable, even though its historical earnings declined by an average of 49.9% annually.

- The prevailing market view highlights that while turning a profit is a notable milestone for Hongli Group, these gains must be weighed against five years of steep declines and a lack of reliable trends. This means positive momentum could be fragile.

- There is no strong evidence yet of sustained profit or revenue growth to support this turnaround.

- Investors will need to see more consistent upward results to confirm the company’s ability to maintain profitability from this point.

Valuation Multiple Far Above Peers

- The company trades at a price-to-earnings ratio of 106.1x, significantly exceeding both the US Metals and Mining industry average of 24.4x and its peer group’s 15.2x.

- The current premium valuation creates tension with the lack of visible revenue or profit growth, putting pressure on future results to justify investor optimism.

- Hongli Group’s high-quality earnings are offset by concerns that, without an upward trend in profits or sales, the stock’s elevated valuation may not be sustainable.

- Bearish commentary draws attention to the gap between price and substantiated financial improvement, urging caution until the company delivers more robust growth.

Share Price Remains Unstable

- Over the past three months, Hongli Group’s share price has been notably unstable, underlining ongoing risk and uncertainty despite the recent profit milestone.

- The prevailing market view urges caution, as the lack of evident earnings or revenue growth trends means any recovery in the share price could be short-lived if results do not improve considerably.

- Volatile price action, when combined with valuation concerns, keeps the risk profile high for new investors.

- Consistent financial progress—not just a single profitable quarter—is needed to support a more positive long-term outlook.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Hongli Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Hongli Group’s unpredictable earnings history, lofty valuation, and lack of solid revenue momentum point to risks for investors seeking consistent growth and stability.

If volatile performance and high uncertainty are deal-breakers, use our stable growth stocks screener to find companies delivering the steady growth and reliability that this market environment rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hongli Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HLP

Hongli Group

Manufactures and sells customized metal profiles in the People's Republic of China and internationally.

Adequate balance sheet with low risk.

Market Insights

Community Narratives