- United States

- /

- Metals and Mining

- /

- NasdaqGS:HAYN

We Like These Underlying Return On Capital Trends At Haynes International (NASDAQ:HAYN)

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. Speaking of which, we noticed some great changes in Haynes International's (NASDAQ:HAYN) returns on capital, so let's have a look.

Return On Capital Employed (ROCE): What Is It?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Haynes International, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.093 = US$44m ÷ (US$615m - US$139m) (Based on the trailing twelve months to June 2022).

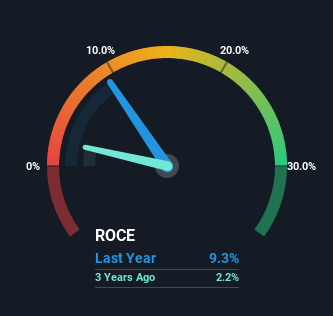

Therefore, Haynes International has an ROCE of 9.3%. In absolute terms, that's a low return and it also under-performs the Metals and Mining industry average of 19%.

View our latest analysis for Haynes International

Above you can see how the current ROCE for Haynes International compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Haynes International.

What Can We Tell From Haynes International's ROCE Trend?

Haynes International has broken into the black (profitability) and we're sure it's a sight for sore eyes. While the business was unprofitable in the past, it's now turned things around and is earning 9.3% on its capital. Interestingly, the capital employed by the business has remained relatively flat, so these higher returns are either from prior investments paying off or increased efficiencies. With no noticeable increase in capital employed, it's worth knowing what the company plans on doing going forward in regards to reinvesting and growing the business. Because in the end, a business can only get so efficient.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Essentially the business now has suppliers or short-term creditors funding about 23% of its operations, which isn't ideal. It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

The Key Takeaway

To bring it all together, Haynes International has done well to increase the returns it's generating from its capital employed. Since the stock has only returned 38% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 2 warning signs for Haynes International (of which 1 is potentially serious!) that you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

Valuation is complex, but we're here to simplify it.

Discover if Haynes International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HAYN

Haynes International

Develops, manufactures, markets, and distributes nickel and cobalt-based alloys in sheet, coil, and plate forms in the United States, Europe, China, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives