- United States

- /

- Metals and Mining

- /

- NasdaqGS:HAYN

It Looks Like Shareholders Would Probably Approve Haynes International, Inc.'s (NASDAQ:HAYN) CEO Compensation Package

The performance at Haynes International, Inc. (NASDAQ:HAYN) has been quite strong recently and CEO Michael Shor has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 22 February 2023. It is likely that the focus will be on company strategy going forward as shareholders hear from the board and cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Haynes International

Comparing Haynes International, Inc.'s CEO Compensation With The Industry

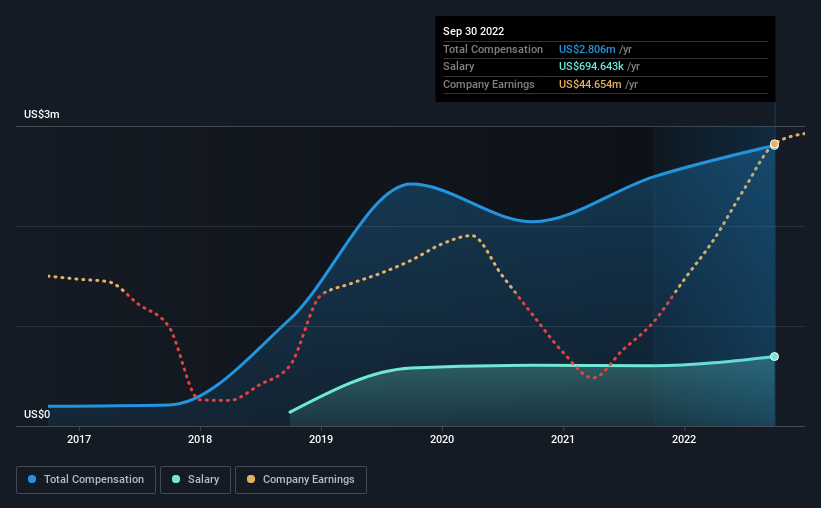

According to our data, Haynes International, Inc. has a market capitalization of US$676m, and paid its CEO total annual compensation worth US$2.8m over the year to September 2022. Notably, that's an increase of 13% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$695k.

On examining similar-sized companies in the American Metals and Mining industry with market capitalizations between US$400m and US$1.6b, we discovered that the median CEO total compensation of that group was US$3.7m. This suggests that Haynes International remunerates its CEO largely in line with the industry average. What's more, Michael Shor holds US$4.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$695k | US$604k | 25% |

| Other | US$2.1m | US$1.9m | 75% |

| Total Compensation | US$2.8m | US$2.5m | 100% |

Speaking on an industry level, nearly 21% of total compensation represents salary, while the remainder of 79% is other remuneration. Haynes International pays out 25% of remuneration in the form of a salary, significantly higher than the industry average. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Haynes International, Inc.'s Growth

Haynes International, Inc. has seen its earnings per share (EPS) increase by 48% a year over the past three years. It achieved revenue growth of 44% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Haynes International, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Haynes International, Inc. for providing a total return of 111% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 3 warning signs for Haynes International you should be aware of, and 1 of them is a bit concerning.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Haynes International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HAYN

Haynes International

Develops, manufactures, markets, and distributes nickel and cobalt-based alloys in sheet, coil, and plate forms in the United States, Europe, China, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives