- United States

- /

- Metals and Mining

- /

- NasdaqGS:CENX

Century Aluminum (CENX): Valuation in Focus After Mt. Holly Power Deal Unlocks Major Expansion

Reviewed by Kshitija Bhandaru

Century Aluminum (CENX) recently secured a long-term extension to its power agreement with Santee Cooper for the Mt. Holly facility. This clears a major hurdle and enables a $50 million investment to reactivate idle smelting capacity.

See our latest analysis for Century Aluminum.

The buzz around Century Aluminum has only grown as shares powered higher this year, helped along by bullish analyst calls, stronger aluminum pricing and the recent landmark power agreement at Mt. Holly. Century’s one-year total shareholder return of nearly 75% and its remarkable 426% gain over three years signal that momentum remains firmly in the company’s favor for now, with investors increasingly optimistic about its growth runway and profitability.

If you’re curious what other fast-moving companies are catching investors’ attention, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock climbing rapidly and new bullish analyst coverage, should investors consider Century Aluminum attractively valued at current levels, or is all the good news already priced in and future gains in doubt?

Most Popular Narrative: 4% Overvalued

With Century Aluminum closing at $30.29 and the most-followed narrative assigning a fair value of $29, the stock now trades slightly above the consensus estimate. Amid shifting market optimism, the narrative forecasts are anchored in bold assumptions about production, demand, and industry tailwinds.

The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production, capturing rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections. This supports future revenue growth and improved fixed cost absorption, thus enhancing net margins.

Curious what’s fueling this narrative’s upbeat valuation? The bullish vision hinges on aggressive top-line growth, ambitious margin expansion, and a projected earnings leap that could transform expectations. Is the market underestimating just how high profit forecasts reach? Find out which key numbers ignite this price target.

Result: Fair Value of $29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a drop in aluminum prices or changes to supportive tariffs could quickly challenge the outlook and test investors’ current optimism.

Find out about the key risks to this Century Aluminum narrative.

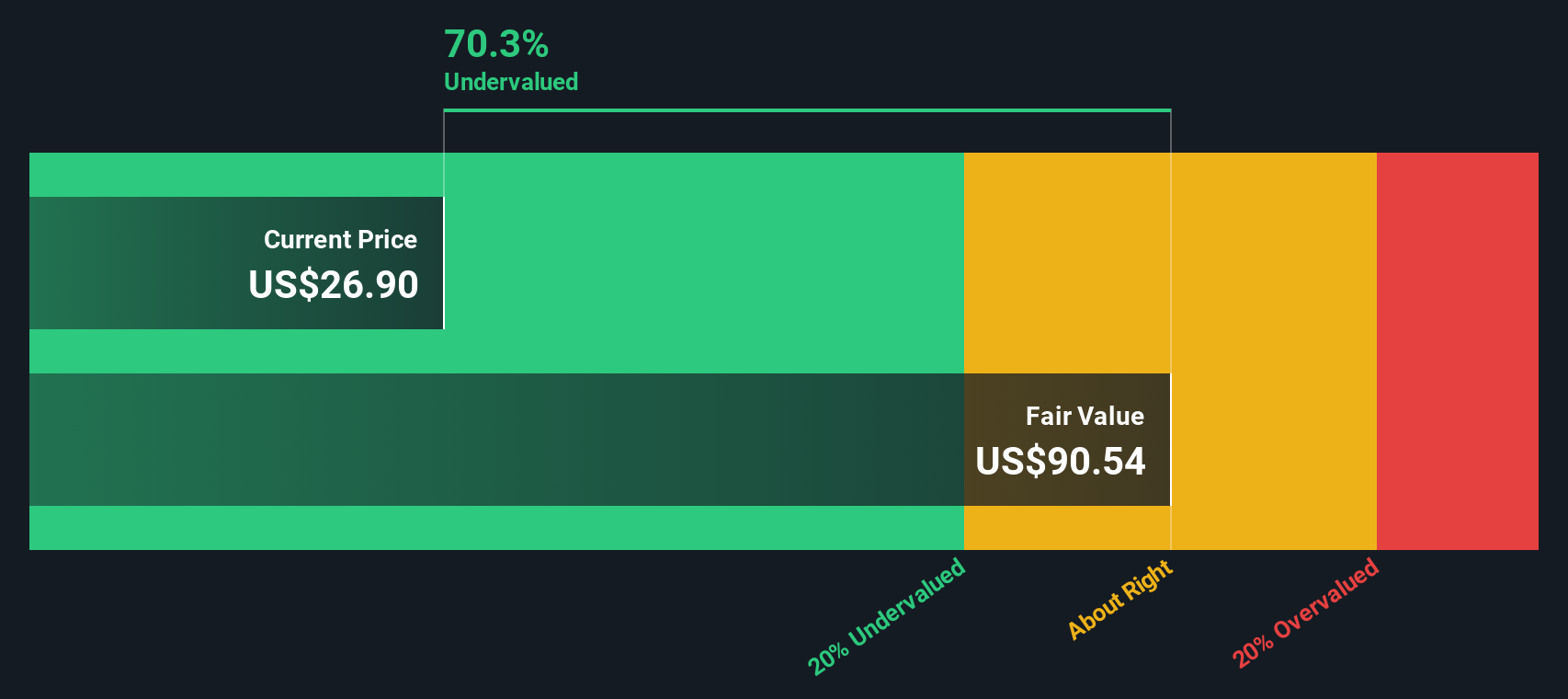

Another View: DCF Model Points to Deep Value

While consensus estimates suggest Century Aluminum is modestly overvalued, the SWS DCF model paints a sharply different picture. This approach finds the current share price of $30.29 is actually 57% below its calculated fair value of $70.73, which hints at significant upside if those assumptions hold true. Could the market be missing something big, or are DCF forecasts too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Aluminum Narrative

If you’d rather dig into the numbers yourself or prefer to challenge the consensus, it only takes a few minutes to build your own view and see where you land. Do it your way

A great starting point for your Century Aluminum research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Opportunity rarely knocks twice, so open the door to tomorrow’s winners by checking out these hand-picked stock ideas tailored to the future of investing.

- Capitalize on breakthroughs in medicine by searching for tomorrow’s leaders with these 33 healthcare AI stocks, combining artificial intelligence and healthcare innovation.

- Enhance your portfolio’s income with companies that pass the test for healthy yields and staying power. Tap into these 19 dividend stocks with yields > 3% for options with attractive returns.

- Ride the next big wave in financial technology by targeting these 79 cryptocurrency and blockchain stocks, offering exposure to those driving advancements in digital assets and blockchain.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CENX

Century Aluminum

Produces and sells standard-grade and value-added primary aluminum products in the United States and Iceland.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives