- United States

- /

- Chemicals

- /

- NasdaqGS:BIOX

Bioceres Crop Solutions Corp. (NASDAQ:BIOX) Not Doing Enough For Some Investors As Its Shares Slump 25%

The Bioceres Crop Solutions Corp. (NASDAQ:BIOX) share price has fared very poorly over the last month, falling by a substantial 25%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 68% loss during that time.

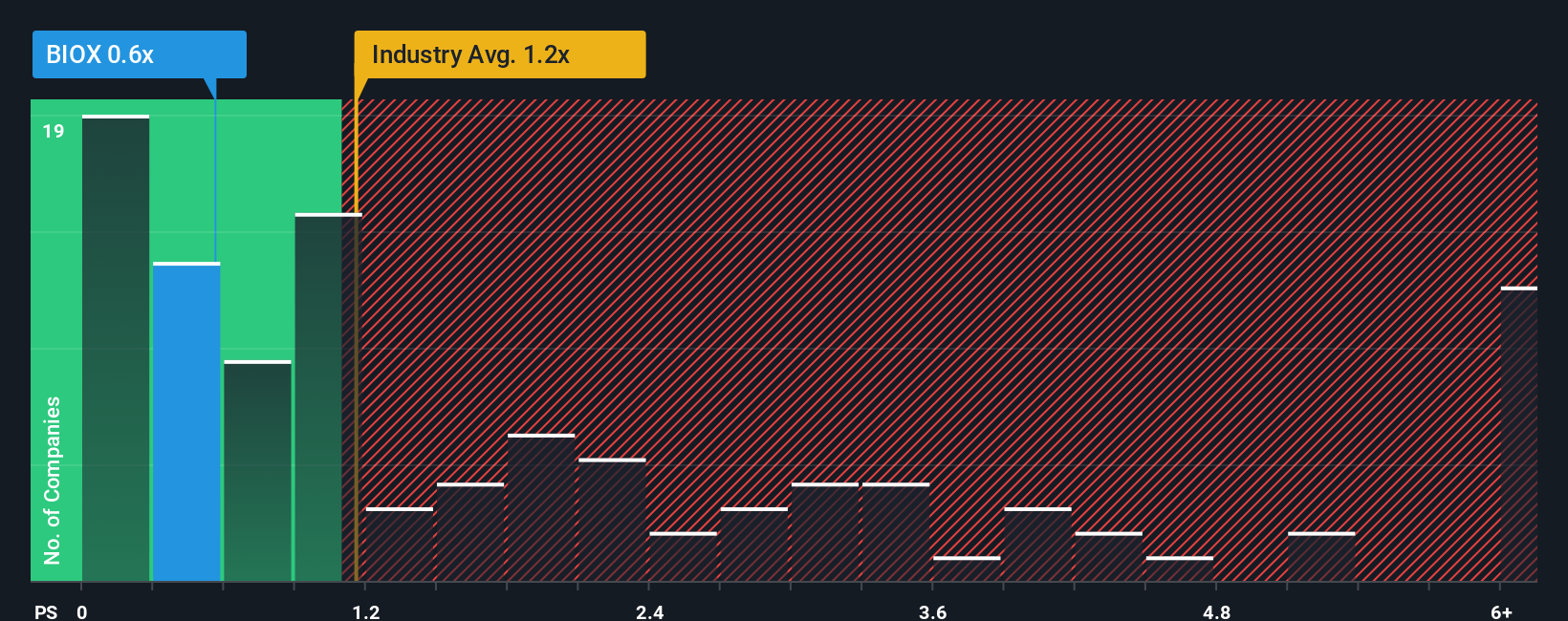

Following the heavy fall in price, given about half the companies operating in the United States' Chemicals industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider Bioceres Crop Solutions as an attractive investment with its 0.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Bioceres Crop Solutions

How Has Bioceres Crop Solutions Performed Recently?

While the industry has experienced revenue growth lately, Bioceres Crop Solutions' revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Bioceres Crop Solutions.Is There Any Revenue Growth Forecasted For Bioceres Crop Solutions?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Bioceres Crop Solutions' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. Regardless, revenue has managed to lift by a handy 24% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 9.3% each year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 22% per year growth forecast for the broader industry.

In light of this, it's understandable that Bioceres Crop Solutions' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Bioceres Crop Solutions' P/S?

Bioceres Crop Solutions' recently weak share price has pulled its P/S back below other Chemicals companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Bioceres Crop Solutions maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Bioceres Crop Solutions with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bioceres Crop Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:BIOX

Bioceres Crop Solutions

Develops and commercializes crop productivity solutions.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)