- United States

- /

- Chemicals

- /

- NasdaqGS:BCPC

Is Balchem Corporation's (NASDAQ:BCPC) Latest Stock Performance Being Led By Its Strong Fundamentals?

Most readers would already know that Balchem's (NASDAQ:BCPC) stock increased by 5.5% over the past three months. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Balchem's ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

Check out our latest analysis for Balchem

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Balchem is:

10% = US$88m ÷ US$849m (Based on the trailing twelve months to March 2021).

The 'return' is the income the business earned over the last year. So, this means that for every $1 of its shareholder's investments, the company generates a profit of $0.10.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Balchem's Earnings Growth And 10% ROE

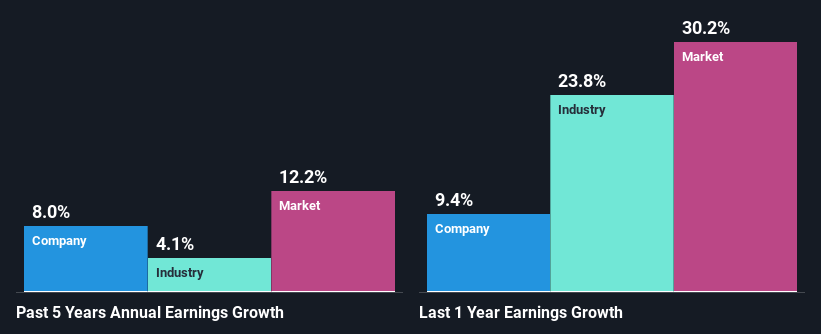

To start with, Balchem's ROE looks acceptable. Further, the company's ROE is similar to the industry average of 12%. This probably goes some way in explaining Balchem's moderate 8.0% growth over the past five years amongst other factors.

Next, on comparing with the industry net income growth, we found that Balchem's growth is quite high when compared to the industry average growth of 4.1% in the same period, which is great to see.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Balchem is trading on a high P/E or a low P/E, relative to its industry.

Is Balchem Using Its Retained Earnings Effectively?

Balchem's three-year median payout ratio to shareholders is 19% (implying that it retains 81% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

Moreover, Balchem is determined to keep sharing its profits with shareholders which we infer from its long history of paying a dividend for at least ten years. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 16% of its profits over the next three years. As a result, Balchem's ROE is not expected to change by much either, which we inferred from the analyst estimate of 10% for future ROE.

Conclusion

On the whole, we feel that Balchem's performance has been quite good. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see substantial growth in its earnings. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

When trading Balchem or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Balchem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:BCPC

Balchem

Develops, manufactures, and markets specialty performance ingredients and products for the nutritional, food, pharmaceutical, animal health, medical device sterilization, plant nutrition, and industrial markets worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives