- United States

- /

- Chemicals

- /

- NasdaqGS:BCPC

All You Need To Know About Balchem Corporation's (NASDAQ:BCPC) Financial Health

Small and large cap stocks are widely popular for a variety of reasons, however, mid-cap companies such as Balchem Corporation (NASDAQ:BCPC), with a market cap of US$3.0b, often get neglected by retail investors. However, history shows that overlooked mid-cap companies have performed better on a risk-adjusted manner than the smaller and larger segment of the market. Today we will look at BCPC’s financial liquidity and debt levels, which are strong indicators for whether the company can weather economic downturns or fund strategic acquisitions for future growth. Note that this commentary is very high-level and solely focused on financial health, so I suggest you dig deeper yourself into BCPC here.

Check out our latest analysis for Balchem

BCPC’s Debt (And Cash Flows)

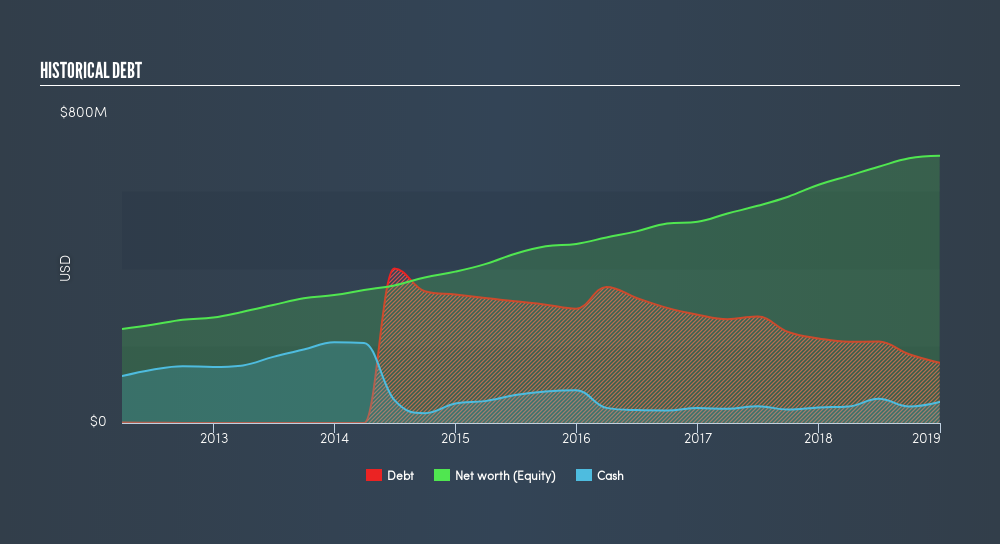

BCPC has shrunk its total debt levels in the last twelve months, from US$219m to US$156m , which also accounts for long term debt. With this debt repayment, BCPC's cash and short-term investments stands at US$54m , ready to be used for running the business. Moreover, BCPC has generated US$119m in operating cash flow during the same period of time, resulting in an operating cash to total debt ratio of 76%, signalling that BCPC’s operating cash is sufficient to cover its debt.

Does BCPC’s liquid assets cover its short-term commitments?

With current liabilities at US$82m, it seems that the business has been able to meet these obligations given the level of current assets of US$226m, with a current ratio of 2.76x. The current ratio is calculated by dividing current assets by current liabilities. Generally, for Chemicals companies, this is a reasonable ratio since there's a sufficient cash cushion without leaving too much capital idle or in low-earning investments.

Is BCPC’s debt level acceptable?

BCPC’s level of debt is appropriate relative to its total equity, at 23%. BCPC is not taking on too much debt commitment, which may be constraining for future growth. We can check to see whether BCPC is able to meet its debt obligations by looking at the net interest coverage ratio. A company generating earnings before interest and tax (EBIT) at least three times its net interest payments is considered financially sound. In BCPC's, case, the ratio of 14.39x suggests that interest is comfortably covered, which means that lenders may be less hesitant to lend out more funding as BCPC’s high interest coverage is seen as responsible and safe practice.

Next Steps:

BCPC has demonstrated its ability to generate sufficient levels of cash flow, while its debt hovers at an appropriate level. Furthermore, the company exhibits proper management of current assets and upcoming liabilities. This is only a rough assessment of financial health, and I'm sure BCPC has company-specific issues impacting its capital structure decisions. I recommend you continue to research Balchem to get a more holistic view of the stock by looking at:

- Future Outlook: What are well-informed industry analysts predicting for BCPC’s future growth? Take a look at our free research report of analyst consensus for BCPC’s outlook.

- Valuation: What is BCPC worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether BCPC is currently mispriced by the market.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:BCPC

Balchem

Develops, manufactures, and markets specialty performance ingredients and products for the nutritional, food, pharmaceutical, animal health, medical device sterilization, plant nutrition, and industrial markets worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives